Shares of United Natural Foods, Inc. (NASDAQ:UNFI) have declined almost 14% since the company reported disappointing third-quarter fiscal 2017 results on Jun 6. Though earnings came ahead of the Zacks Consensus Estimate but revenues missed the same by 2.1%. Consequently, management slashed its sales guidance for fiscal 2017.

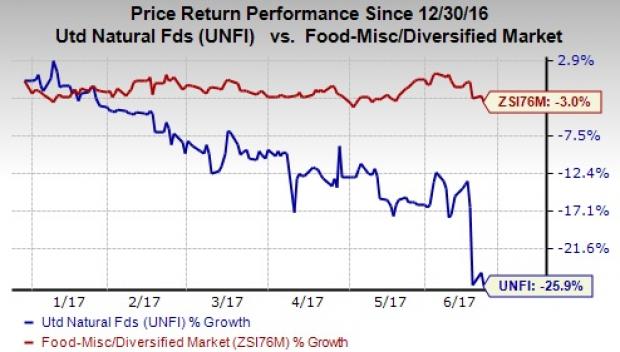

Moreover, shares of United Natural have underperformed both the Zacks categorized Food – Miscellaneous/Diversified industry and the broader sector year to date. The stock was down 25.9% in comparison to the industry’s decline of 3%. In fact, the industry is currently placed at bottom 34% of the Zacks Classified industries (168 out of 256). Meanwhile, the Zacks categorized Consumer Staples sector that is currently placed at bottom 31% of the Zacks Classified sectors (11 out of 16) gained 10.5%.

Let’s discover the factors currently weighing upon the stock.

Dismal Q3 Results; Guidance Cut

While United Natural’s earnings came ahead of the Zacks Consensus Estimate by a penny, it remained flat with the prior-year quarter earnings, as higher top line was offset by elevated operating expenses. Net sales lagged the Zacks Consensus Estimate by 2.1% and also came in below management’s expectations, primarily due to overall soft retail sales, margin expansion initiatives and reduced inflation. We note that United Natural’s top line has missed the Zacks Consensus Estimate in 10 consecutive quarters, including the recently reported quarter. Management expects that lack of inflation would continue to remain a concern for sales growth and margins expansions, going ahead.

Consequently, United Natural has cut down its sales guidance for fiscal 2017, which is now expected to be in the range of $9.29–$9.34 billion compared with $9.38–$9.46 billion, guided previously. However, it maintained the earnings projection in the band of $2.49–$2.54 per share. The Zacks Consensus Estimate for fiscal 2017 is currently pegged at the higher end of the company’s guided range. Over the last 30 days, the Zacks Consensus Estimate of 69 cents for the fiscal fourth quarter has decreased by a penny.

Ongoing Industry Challenges

The company has been facing the ongoing industry challenges like heightened competition, food deflation and little to no meaningful improvement in inflation. Meanwhile, the grocery/supermarket business is grappling with food deflation for quite some time now, and the same continues to remain a headwind for the company. Deflation was 17 basis points (bps) in the fiscal third quarter compared with 30 bps in the preceding quarter.

Notably, United Natural has been striving hard to spark a turnaround in its performance. In fact, the company has been carrying out various acquisitions over the years to grow its distribution network, customer base and drive growth. Furthermore, it has announced the expansion of its restructuring program in order to improve its operational efficiencies and is taking different measures to expand its market share in the specialty products industry. However, competition and deflationary pressure will continue to remain headwinds in the near term.

United Natural currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Better-ranked stocks in the same industry include SunOpta Inc. (NASDAQ:STKL) , Aramark (NYSE:ARMK) and B&G Foods, Inc. (NYSE:BGS) .

SunOpta has a long-term earnings growth rate of 15% and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Aramark carries a Zacks Rank #2 (Buy) and has posted an average earnings beat of 4.5% in the last four quarters. Also, it has a long-term earnings growth rate of 12%.

B&G Foods is also a Zacks Rank #2 stock. It has posted an average earnings beat of 2% in the last four quarters. Also, it has a long-term earnings growth rate of 10%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

SunOpta, Inc. (STKL): Free Stock Analysis Report

Aramark (ARMK): Free Stock Analysis Report

Original post

Zacks Investment Research