The unprecedented volatility to start the year has brought out nearly every type of expert opinion on the best way to ride out the storm. I have heard arguments ranging from “stay the course” to “this is just the start of the crash”.

Let me be clear by saying that absolutely no one knows what is going to happen over the next three to six months. We could be another 20% lower, 20% higher, or virtually anywhere in between. Anything can happen and to have 100% conviction in just one outcome is the sign of someone who is completely unhinged from reality.

The consensus seems to be that we are already in a bear market based on the average publicly traded U.S. stock having fallen more than 20% from its 52-week highs. The SPDR S&P 500 ETF (N:SPY) is only down about 12% from its all-time peak, but that is generally an anomaly based on the strength of a few large stocks in the market-cap weighted index.

So now that we are getting all kinds of expert advice on riding out a bear market, I felt it’s a perfect time to talk about how to avoid a dip in your portfolio. It’s simple really – you don’t invest in stocks, bonds, commodities, or any other investment short of a guaranteed money market, savings account, or CD.

The only risk in those instruments is that you aren’t going to be able to survive on the meager amount of income that they provide. But you will be safe from all but the most horrific meltdown of the modern financial system.

For those who are actually trying to grow their money to save for retirement, generate an income stream, or keep up with inflationary forces, you have to realize that there is a risk in every market. If you shift from stocks to bonds, then you are simply transferring the volatility to different forces – i.e. business risk to interest rate risk. There are risks in buying oil, gold, real estate, or virtually any other asset class.

If you take out all the risks by moving to cash, then you simply have shifted to the risk of lost opportunity in the event the investments you sold suddenly rise in value. That is the trade off to using stop losses or selling into a capitulation-style event that scares you out of the market.

One of my favorite proxies of the typical investor portfolio is the iShares Growth Allocation ETF (N:AOR). This fund holds a 60/40 allocation of stocks and bonds that is probably the most common asset distribution structure across the U.S. population. AOR is down 5% so far in 2016, which means that most investors have probably seen their accounts drop by a similar percentage.

If you think that a 5% drop is overly risky or you can’t seem to handle that type of volatility, then you have simply overestimated your risk tolerance. That isn’t a crash or a meltdown or a fiscal cliff or any other adjective that the media has cooked up – that’s just investing.

Many of you also love to think in terms of dollars rather than percentages. I’m down $50,000 on my $1,000,000 portfolio! Right, that’s 5%, and perfectly normal in the course of a market cycle. It’s a lot of money to be sure, but there will certainly be plenty of opportunity in the future to make that money back and then some. The key is keeping a balanced perspective and level-headed approach that realizes the market will go down and back up again.

The best form of risk management that I can advise is to not take an overly aggressive approach to begin with. If you can’t handle a 5% or 10% draw down in your portfolio, then don’t be 60-80% invested in stocks. Even if you are using stop losses, you won’t be able to move in and out of the market quick enough to time every little gyration. You’ll just find yourself constantly chasing your tail and likely doing more harm than good.

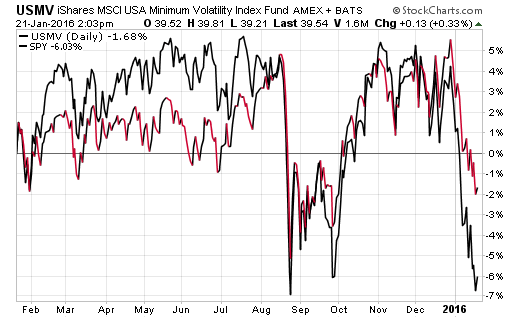

For my more conservative income clients, we have had a low exposure to stocks for quite some time now. By that I mean 25-35% of the entire portfolio. In addition, much of that exposure has been positioned in low volatility exchange-traded funds such as the iShares MSCI USA Minimum Volatility ETF (N:USMV). We recently shifted more of our stock holdings to this ETF in recent days as it has exhibited approximately 30% less downside price action than broad-based indices such as SPY. This still allows us to participate in a snap back rally, while also being more cautious with the equity sleeve of our portfolio.

Making adjustments in the midst of a correction can reduce your anxiety and ensure you come out the other side in a better position than when you entered. This should be accomplished in a multi-step approach that allows for incremental changes to reduce risk or capitalize on depressed prices.

I would caution against wide sweeping changes or “clearing the decks” at inopportune moments. This may leave you feeling momentarily protected only to find that you zigged when the market zagged, and now you are once again behind the curve as it makes another big move.

Hindsight is always 20/20 and there are going to be moments of doubt or regret over perceived missteps. However, a slow and steady approach is going to be kinder to you over the long-term than impulsive moves that jerk you in or out of investments at random intervals.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.