The US dollar had a strong run higher in 2014. At one point it had strengthened by about 25%. There was quite a buzz then. And then it stopped rising. By April the dollar had stopped improving against other currencies and just became stable.

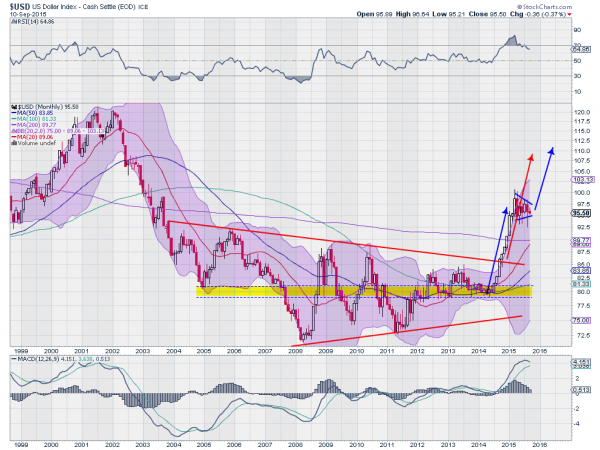

The chart below shows this action within the context of 17 years of monthly data. First note, it has been stronger. A lot a stronger. It also started that move higher out of a very long 11 year symmetrical triangle consolidation. The longer the base the higher into space, the saying goes. And when it did go higher that seemed to be the true.

But the technicals suggest it has some unfinished business to attend to. The break of that symmetrical triangle suggest a target to the upside of about 108. There is also a target to about 110 from a measure of the move higher into consolidation repeated to the upside. The US dollar may not move higher this month or next month even. In fact the momentum indicators suggest there is still some momentum to work off. But if they do turn to the upside get ready for another strong ride.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.