Over the last few years, public debate over Britain’s role within the European Union has intensified as it largely became a political wedge between the respective parties and their constituents. In fact, David Cameron’s refusal to sign the EU’s Fiscal Stability Treaty in 2011, along with the failure to implement the European justice system, largely predisposed the country to a future referendum. Although much of the political rhetoric focuses upon a strong sense of UK nationalism, little unbiased research has been undertaken to assess the macroeconomic impact of an exit from the common market. Subsequently, this report seeks to explore the case for remaining within the Eurozone.

Trade and Investment

The historical record of trade has been one of growth and success since the breakdown of the Bretton Woods system. The past 35 years have seen global trade largely triple at a time when economic output has been highly variable.

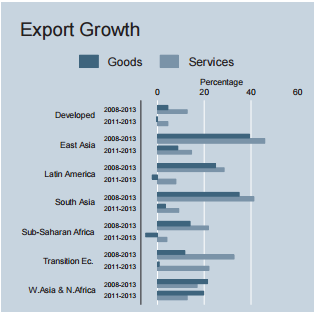

Globalisation has chiefly been responsible for the growth in international trade, which has seen significant growth, between the developed world and the emerging markets. In particular, Eastern and Southern Asia have experienced sharp levels of export growth which has fuelled much of the consumption within the developed world.

Figure 1.0 – Export Growth 2014

Source: United Nations Key Statistics in International Trade 2014

Subsequently, there is an argument to be made that increasing levels of global trade between the developed and emerging world implies that Britain’s continued membership within the Eurozone is less critical today compared to the past. Given that both China and India are experiencing significant levels of GDP growth amounting to 7.3%1 between 2011, and 2015, the argument for an exit implies that the European common market provides declining value to the UK.

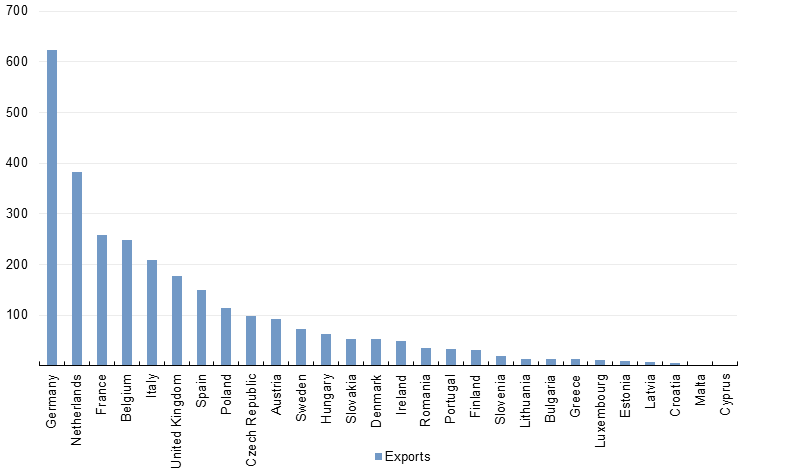

However, this theory largely omits the fact that trade growth has also grown steadily between developed countries and still represents the highest value of trade2. In fact, it is clear that Europe has become a regional trading hub when you consider the mix of exports between the various EU member states. The statistics are clear on the issue that over three-fifths of EU trade is conducted between member states3.

Figure 2.0 – Export to Other Member States 2013 – Source: Eurostat

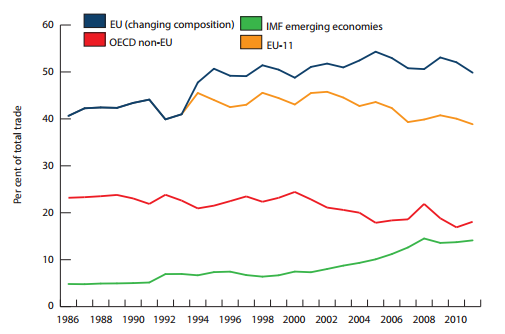

Despite evidence on growing intra-member trade, there are those that advocate for an exit by suggesting that membership in the trade bloc restrains the UK’s ability to seek greater trade within the emerging markets. There may be some tangential evidence in support of this assertion given that trade external to the single market is often riddled with EU regulatory requirements, tariffs, and quotas. However, economic data points to the fact that trade with Non-EU EM partners has actually been increasing according to the IMF4.

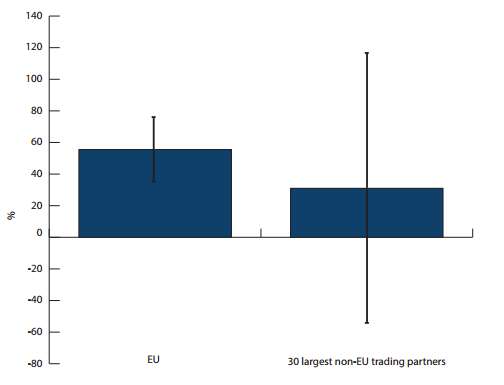

In fact, the CER Commission recently constructed a gravity model which attempted to measure the impact of the European Union on UK Trade, whilst controlling for a variety of macroeconomic variables. The model took into account the trade roles of Britain and her thirty largest trading partners, including Non-EU economies.

Figure 4.0 – Goods Trade Created and Diverted by the UK’s Membership in the EU

Source: www.cer.org.uk - Gravity Model

The results are stark in that the model demonstrates, whilst allowing for a range of factors and exchange rate effects, that the UK’s trade with other EU members is 55 per cent higher than would be expected given the respective size of the various economies. In fact, Britain’s bilateral trade amounted to £364 Billion in 20135, of which 130 Billion that the gravity model might attribute to membership within the single market.

Subsequently, an exit from the Eurozone could be relatively significant for the United Kingdom given the importance that EU centric trade poses to British exports. A key component of any BREXIT argument is the securing of a range of free trade agreements with the Eurozone. However, it is simplistic to suggest that these agreements would be obtained as a matter of course given that the UK is generally seen as lacking the economic clout to obtain the necessary trade treaties in a timely fashion.

In particular, as the UK is currently running a trade deficit, it is highly unlikely that they would be in any position to `dictate’ terms to the EU. In addition, nearly half of the EU’s trade surplus to the UK is due to Germany and the Netherlands, with the remaining members having little surplus with Britain. Subsequently, there is no reason to expect that the 27 EU members would come to the party to offer the UK a fast, fair, and equitable deal. It is patently clear that the UK would have very limited options and influence over trade with the EU if they do indeed choose to exit the trading bloc on the 23rd of June.

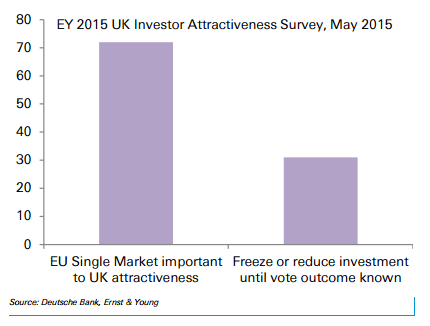

In addition, as the uncertainty over the UK’s future within the European Union continues, so too does its effect upon financial markets and investment. In fact, evidence from a recent investor sentiment survey shows the uncertainty factor currently in play with other 70%6 of respondents stating that the EU single market is an important aspect of their business investment decision. Currently, business investment is worth around 10% of UK GDP which implies that a 1% reduction in Foreign Direct Investment leads to an estimated 0.10 reduction in GDP growth. Given that access to the single market is a key component of UK FDI attractiveness, an exit vote could have a stark impact for UK economic growth over the medium term.

Figure 5.0 – UK Investor Attractiveness Survey, May 2015

In addition, the fallout from a BREXIT is likely to lead to materially weaker investment and a significant dent to consumer demand whilst any free trade agreements are negotiated. Ultimately, this is likely to lead to a period of falling employment intentions and moderating GDP growth. Asset prices will also feel the pinch as the risk to the UK economy of re-sourcing trade will lead to an outflow from a variety of asset classes.

Regulation

A significant component of the argument for a separation from the Eurozone revolves around the over regulation of markets by the European Union. A central theme of the highly adversarial relationship between the UK and EU is the view that a range of regulation has been foisted upon British businesses.

It is most certainly the case that the powers that be in Brussels are in the business of regulation and that this has had a measurable impact upon Britain. However, the UK currently has the ability to agitate for reform from within the current institutions whereas a BREXIT would remove this ability whilst also saddling these same UK businesses with further regulation. The reality is that the UK will continue to export to the EU but would now be required to accept a range of regulations (as a non-EU member) whilst having little say in their implementation.

In addition, there are legitimate reasons for EU regulation and in many cases the need to internalise a range of external costs and factors is valid, despite the additional cost to UK businesses. Subsequently, it is a simplistic argument to suggest that EU regulation is unsound, especially when the UK has a central role in forming and shaping the current legislation.

The Banking Industry

A significant component of the single market idea is the freedom of capital movement and in this form London has benefitted enormously as a world and European financial centre. The largest impact to the financial industry in the UK is likely to be on a wholesale basis as the barriers to capital flow across borders are ratcheted up. In short, the banking union and passporting rights have been a veritable boon for the City of London.

The UK has a relatively strong comparative advantage over other EU countries, in as far as the financial and banking industry, and possesses a strong trade surplus in this area. Although an exit may bring about some competitive gains for the sector as EU regulation drops away, ultimately, there is likely to be some tightening of capital flow restrictions between the EU and UK.

In fact, the EU is currently in the process of tightening their banking and financial regulations for third party institutions accessing the Eurozone. The new Markets in Financial Instruments Directive (MFID) is likely to require the establishment of a representative office for any third party actors. This clearly represents a level of complexity and cost that British financial players have not had to deal with in the past.

Although it is clear that the city would not collapse upon an exit from the Eurozone it would still likely face some significant operation changes that may erode its competitive advantage and access to European financial markets. Subsequently, the costs of an exit could end up outweighing any gains from the restored sovereignty in the short term.

Conclusion

Ultimately, quantifying the actual costs of an exit from the Eurozone is a difficult undertaking. However, it is clear from a short review that the complications to trade that an exit is likely to bring about will be costly indeed. There is also little evidence that the UK will be able to attain a free trade agreement with the EU quickly, or even at all. The impetus of members to act in this regard is limited given that only Germany and the Netherlands derive a trade surplus from Britain. Subsequently, the scope for ultimately securing an agreement from the remaining EU members is fraught with risk and open to disagreement.

In addition, the financial costs of a successful “Yes” vote could be stark considering the impact that an exit could have on inward foreign direct investment. Weaker investment could prove to be a significant drag on British GDP growth to the tune of 0.10 points, per 1% drop in FDI. Subsequently, regardless of the outcome of the pending referendum, there is likely to be a sharp impact on investment and, by extension GDP, until some certainty is finally regained.

1 World Bank GDP Growth Database 2011-2015

2 “The CER Commission on the UK and EU Single Market” – Centre for European Reform

3 The CER Commission on the UK and EU Single Market” p21 – Centre for European Reform

4 “Direction of Trade Statistics” – International Monetary Fund

5 HM Revenue and Customs, UK Tradeinfo data

6 Deutsche Bank (DE:DBKGn), Ernst & Young Report

7 Special Report: The UK & EU: Exit Emergency – Deutsche Bank