One of the defining debates of our time is what to do about income disparity. Nobody disputes that the wealthy have become much wealthier, particularly over the last five years. At the same time, the poor have become impoverished (e.g., 50 million on food stamps, etc.); meanwhile, middle class families are barely treading water. Yet American leaders have very different ideas about how to bridge the gap.

In the left corner, liberal-minded folk see the solution as a simple exercise in dollar redistribution. Confiscate more money from the highest end through taxation and provide more services to the needy. A “Robin Hood” mentality may appeal to the have-nots and to the political class seeking their votes, but punishing successful producers typically leads to less production in an economy. This does not even account for another reality where the richest 1% pay nearly 40% of federal tax revenue and half the citizens contribute no revenue to the federal government. Most importantly, redistributing wealth does not create more of it.

In the right corner, conservative-minded individuals believe that the answer resides in unleashing entrepreneurship and encouraging businesses, rather than let the U.S. government interfere. The assumption here is that everyone wants to work equally hard for a better life. Where is the evidence that each and every one of us pursues the best grades in our respective educational environments, or willingly logs 60-hour work weeks to climb a financial ladder? We’re different. That said, most people covet an equal slice of the American pie. Conservatives often fail to recognize that collectivism often appeals to the masses as much as the virtues of individual liberty.

Perhaps ironically, far too many are ignoring the primary reason for the rich getting richer and the poor getting poorer. The Federal Reserve’s ultra-low interest rate policies combined with quantitative easing (QE) to pump up stocks and real estate have primarily benefited those who hold these investment assets. It is the central bank of the United States that has made it possible for the wealthiest businessmen and businesswomen to acquire more stock and more property over the last decade. (I certainly have.)

Interestingly enough, stock prices and home prices will not be able to endlessly thrive on Fed stimulus alone. If the labor force continues to shrink at its torrid pace, stagnant wage growth and tepid employment growth will hinder consumption as well as the economy. Perhaps the best ingredients for minimizing the adverse effects of income disparity are genuine job growth and real wage increases. Unfortunately, the Fed’s hopes for the “wealth effect” to translate into substantial employment gains have yet to materialize.

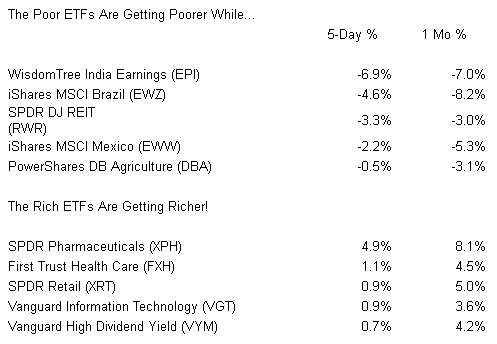

What the Fed has achieved in 2013 is a remarkable level of complacency. Already, zero-interest rates have pushed investors to do things they normally wouldn’t do — take more risk in stocks. And while one might be able to find better “value” in Brazilian, Mexican or Indian equities, poor ETFs will get poorer due to tax-loss harvesting; similarly, since few investors wish to realize capital gains on their winners, the rich ETFs will keep getting richer through year-end.

Throughout the entire year, I have recommended over-weighting the tech and health care sectors. There is no reason to alter that weighting in 2013 when there are few headwinds for ETFs with impressive relative strength. Many of my clients own funds like PowerShares Pharmaceuticals(PJP), SPDR Select Health Care (XLV), Vanguard Information Technology (VGT) and/or First Trust NASDAQ Technology Dividend (TDIV). Nearly of all my clients have maintained an allocation to “steady Eddie,” Vanguard High Dividend Yield (VYM).

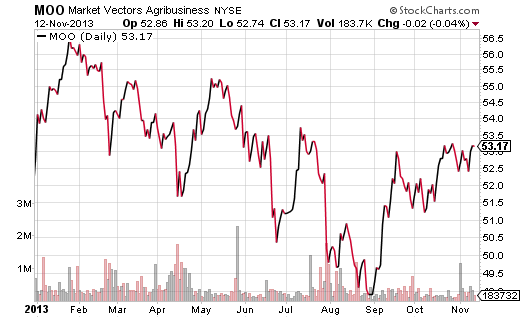

Keep in mind, I do not “buy-n-hold” any market-based security. If a stop-limit loss order or trendline breach occurs, I sell the asset or hedge against price depreciation. Additionally, I am already looking at many of 2013’s losers as potential winners in 2014. Agricultural commodities via PowerShares DB Agriculture (DBA) fared poorly in 2013; agriculture stocks also struggled. I expect Market Vectors Agribusiness (MOO) to be a snap-back success next year.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why The Rich ETFs Keep Getting Richer

Published 11/13/2013, 01:57 AM

Updated 03/09/2019, 08:30 AM

Why The Rich ETFs Keep Getting Richer

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.