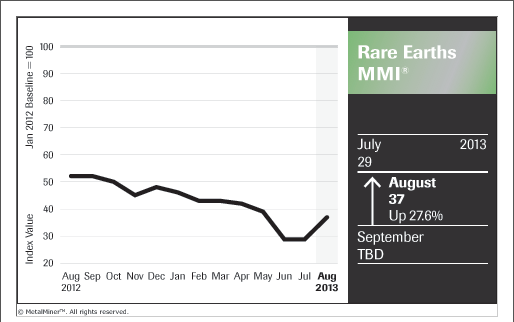

The monthly Rare Earths MMI® took the biggest jump of any of the index readings, moving from a paltry 29 in July to 37 in August, on the back of big upward price movements for all 14 metals and oxides that comprise rare earth metals index – see the breakdown of metal price movements below.

Dudley Kingsnorth, a noted rare earth metals analyst, attributes the improved rare earth price levels to several factors including: rising demand for automation technology (and the rare earth metals that support it, such as: neodymium, dysprosium, europium and cerium), as well as China’s stop to new mining exploration within China and a curb on mining licenses.

The other big issue with rare earth prices relates to the fact that other global producers outside of China have a greater ability to impact pricing.

Companies like Molycorp and Lynas Corp. supply many of these metals as well. Whether or not the rare earth metals sector will place itself fully on an upward price trend remains to be seen.

Which REEs Rose The Most?

The price of dysprosium oxide rose 72.4 percent over the past month. The price of yttria rose 47.6 percent after falling the previous month.

The price of terbium oxide finished the month 37.9 percent higher. This was the second straight month of declines. The price of neodymium oxide climbed 29.4 percent. The price of praseodymium oxide rose 26.7 percent over the past month, the second straight month of gains. The price of praseodymium neodymium oxide increased 23.6 percent.

For the second month in a row, the price of europium oxide increased, rising 21.1 percent over the past month. After dropping the previous month, the price of neodymium prices rose 20.9 percent. The price of yttrium closed the month up 3.9 percent. The price of lanthanum oxide rose 3.7 percent after falling the previous month. After dropping the previous month, the price of cerium oxide prices rose 3.6 percent.

The Rare Earths MMI® collects and weights 14 global rare earth metal price points to provide a unique view into rare earth metal price trends over a 30-day period. For more information on the Rare Earths MMI®, how it’s calculated or how your company can use the index, please drop us a note at: info (at) agmetalminer (dot) com.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why The Rare Earths Price Index Spiked

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.