For the first time that I can remember, my co-blogger and I have what I think is a real difference of opinion. As I understand his argument, he believes that, as of now, Brexit’s impact on the U.S. economy will be at worst minimal and that the pound to a large extent already made a post-Brexit bottom. I’ll provide a rebuttal to the small contagion possibility in another article.

Here, I would like to offer a counter-opinion to his thoughts on the pound, which appears to be based on the efficient market hypothesis:

…… an investment theory that states it is impossible to "beat the market" because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information. According to the EMH, stocks always trade at their fair value on stock exchanges, making it impossible for investors to either purchase undervalued stocks or sell stocks for inflated prices. As such, it should be impossible to outperform the overall market through expert stock selection or market timing, and that the only way an investor can possibly obtain higher returns is by purchasing riskier investments

His analysis is found at this link, and is best summarized by this passage:

Suppose you *know* the Pound will decline against the Dollar. Why would you wait a month or two or six before acting on that insight, missing that much of the down move? You'd make you investment decision *right now* to try to capture all of the move, wouldn't you?

But everybody else has that same insight. And everybody else also makes their decision right away. The result is that the move that you thought was going to take 3 or 6 or 12 months takes place today.

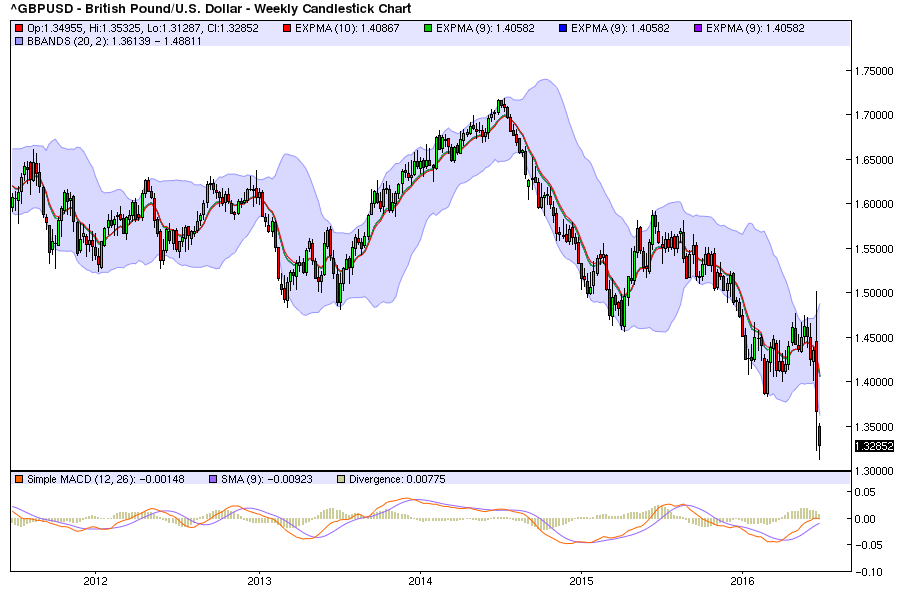

He then notes various cross-currency movements that occurred in relation to the Brexit move. However, he does not offer a long-term view (a 5-year chart) of the pound versus the dollar and euro, both of which show a clear pound negative trend. Let’s start with the pound/dollar:

With the exception of the rally from the beginning of 2013 to mid-2014, the overall trend is lower. As for the pound/euro, we get a different picture:

The pound formed a double top versus the euro in mid-2015. Since then, it has wiped out a large percentage of its gains achieved over the preceding 4 years.

The longer trend shows a clear downside move for the pound versus the dollar while a shorter trend is in place for the pound/euro. The primary reason for the pound’s long-term bearishness relative to the dollar is that traders believed the Fed would raise interest rates before the Bank of England. Post Brexit we have a different dynamic but a similar result. Brexit has probably put the Fed on hold but placed the BOE into a position where they’ll have to lower rates. From BOE head Carney’s speech Thursday:

As a result of increased uncertainty and tighter financial conditions, UK households could defer consumption and firms delay investment, lowering labour demand and causing unemployment to rise. Through financial market and confidence channels, there are also risks of adverse spillovers to the global economy.

At the same time, supply growth is likely to be lower over the next three years, reflecting slower capital accumulation and the need to reallocate resources across sectors of the economy. Both of these forces may be exacerbated by higher uncertainty and tighter financial conditions.

Finally, as expected, sterling has depreciated sharply. For given foreign demand, this will mean support to net trade, though this may well be dampened by uncertainty around future trading relationships. A lower exchange rate will also entail higher prices for imported consumer goods, energy and capital goods, and consequently lower real incomes.

As the MPC said prior to the referendum, the combination of these influences on demand, supply and the exchange rate could lead to a materially lower path for growth and a notably higher path for inflation than set out in the May Inflation Report. In such circumstances, the MPC will face a trade-off between stabilizing inflation on the one hand and avoiding undue volatility in output and employment on the other. The implications for monetary policy will depend on the relative magnitudes of these effects.

In my view, and I am not pre-judging the views of the other independent MPC members, the economic outlook has deteriorated and some monetary policy easing will likely be required over the summer

To paraphrase: increasing uncertainty will lower spending and investment, which will increase unemployment. Overall GDP growth, which 2.1% in the latest report, will slow. While the sterling’s depreciation will increase inflationary pressures, these will be less severe than the growth slowdown. The BOE will probably have to lower rates to limit the downside economic impact.

A lower growth environment plus lower interest rates will make the pound less attractive vis-à-vis the dollar, sending the pound lower.