Investing.com’s stocks of the week

With so much of the attention focused on Greece, Portugal, Ireland and, more recently, Spain, the markets have had little time to pay much attention to France. Yet, France also faces significant economic challenges. These challenges are made all the more daunting because of the increasing socio-political divisions within the country, which will be highlighted by the upcoming Presidential election. As a result, it will become increasingly difficult for France to muster the political will needed to deal with its economic challenges and to obtain the public support needed to stabilize Europe’s financial situation.

The Socialist Party Candidate François Hollande appears to be in the driver’s seat. With less than a few days to go before the first round, polls placed him a few points ahead of President Nicolas Sarkozy, leader of the Union pour un Mouvement Populaire (UMP). But in the second and final round on May 6th, Hollande’s lead may widen to double-digit levels.

It should come as no surprise that the odds are stacked against Sarkozy. Under his watch, unemployment has risen substantially, the country has seen its industrial competitiveness erode and public debt levels have increased, which prompted S&P to strip France of its coveted triple A credit rating last January. A recent poll found that 64% of the French disapprove of him. The European debt crisis has already forced out leaders in Greece, Portugal, Ireland, Spain, Italy, Slovakia and Slovenia.

Regardless of the outcome of the Presidential elections, the Franco-German alliance, which has been the pillar of the EU and later the eurozone since they were founded, is going to come under increasing stress as well.

This report focuses on the key issues challenging France:

Unemployment hit a 12-year high of 9.3% in the third quarter of 2011, and since then has risen to just under 10% (worse than Italy’s 8.6%). The OECD projects it will reach 10.7% by the end of 2012. Indeed, since Sarkozy took office five years ago, a million people have lost their jobs. As is the case with so many European countries, unemployment rate for youth aged 18-24 is much higher, at 23%. Even for those fortunate enough to find employment, they must usually have to make do with temporary contracts. In fact, almost 90% of the job openings for this demographic is in the form of short-term contracts. This creates a dual labour market with a young generation largely unable to secure a permanent job and an older generation protected by strict labour laws.

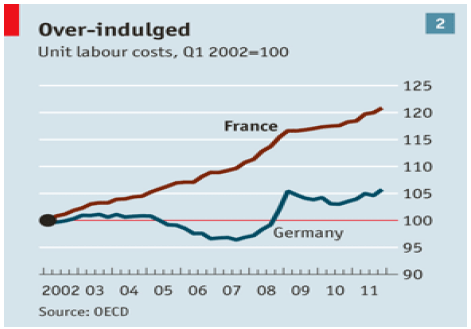

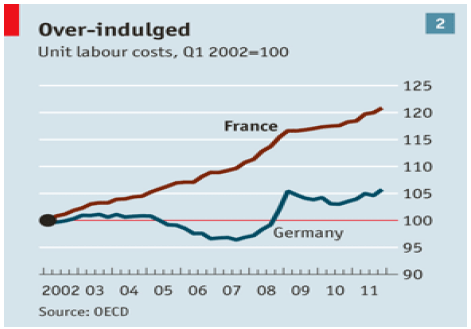

One significant factor weighing upon France’s economy is its eroding competitiveness, especially when compared to Germany, its largest trading partner.

Source: “An Inconvenient Truth,” The Economist, March 31, 2012

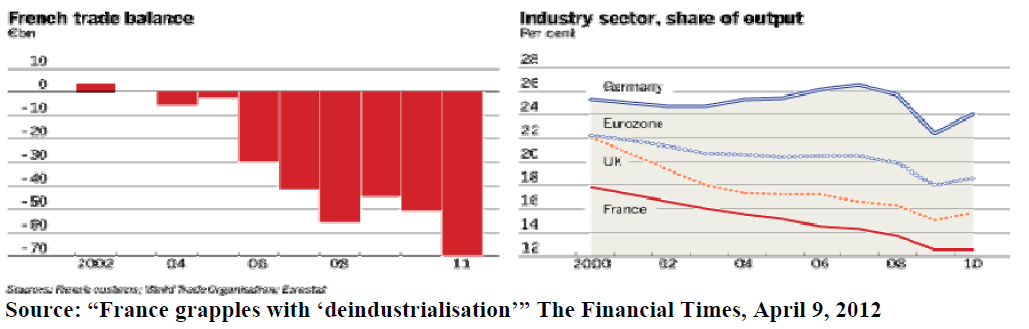

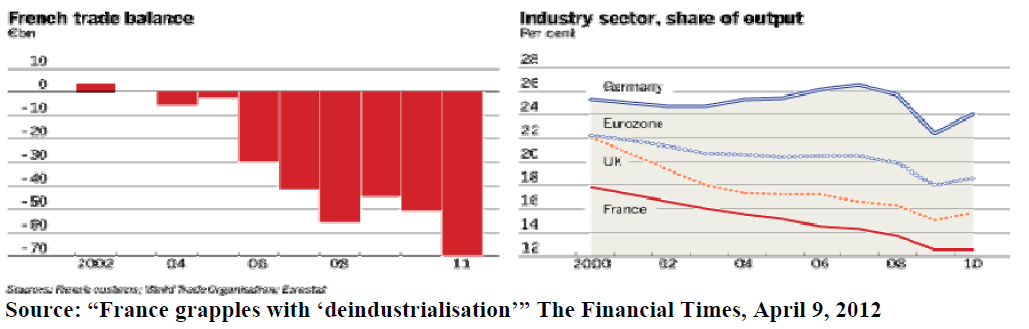

The impact of this eroding competitiveness can be seen firsthand in France’s industrial sector. Since Sarkozy came to power five years ago, France has lost 355,000 factory jobs. Indeed, France is now one of the least industrialized nations in Europe, ahead of only Luxembourg and Greece. Not surprisingly, this had a very negative impact on exports, with France posting a record trade deficit in 2011.

Source: “An Inconvenient Truth,” The Economist, March 31, 2012

Source: “An Inconvenient Truth,” The Economist, March 31, 2012

Indeed, strong public support of the current social welfare model explains why Sarkzoy’s tax cuts at the beginning of his mandate (which many described as being overly favourable to the rich) and his move to increase the minimum stage pensionable age to 62 from 60 provoked strong opposition. One could only imagine how the population would react if they were forced to implement harsh budget and policy measures, such as the mass sell-off of state enterprises, significant cuts to social programs and deregulation of the labour market, that are currently being forced upon Spain and Italy.

This also explains why, despite the fact both Hollande and Sarkozy have promised to balance the budget by 2017 and 2016, respectively, they have been reluctant to get into the specifics of how they plan to achieve this goal. It is also important to note that France has not had a balanced budget since 1974.

Indeed, Francois Bayrou, the Presidential contender who has most stressed the dangers of excessive debt, has seen his support fall during the campaign. As of this writing, he was polling about 10% in the polls, way down from the 19% he got in 2007.

As has been the case with many other countries in the past, the risk is that France will only implement major budget cuts and market reforms if dire circumstances leave it no choice, which, in the short term at least, would only worsen the economic situation.

On the far right of the political spectrum, the leader of Front National, Marine Le Pen, wants France to abandon the euro, reindustrialize the country behind a great wall of tariffs and oppose further immigration, in particular from Muslim countries. She is currently polling at around 14% to 16%. On the far left is the Front de Gauche led by Jean-Luc Mélenchon. He supports raising the minimum wage to $2,200 a month, capping salaries at $470,000 (360,000 euros) a year, banning profitable companies from laying off workers, retirement for all at age 60 and withdrawal from NATO. He is also currently polling at around 14% to 16%.

Although neither the Front National nor the Front de Gauche stand a chance of getting past the first round of the Presidential elections, these two parties, which share a deep scepticism of free markets and the EU, have already forced mainstream parties to adopt more extreme positions in order to attract more support for the second round of Presidential elections.

President Sarkozy, for instance, has recently adopted a much harder line on immigration and trade in order to attract Front National voters. He has pledged to cut France’s financial contribution to the EU budget, pull France out of the agreement allowing for passport-free travel in Europe unless the EU implements stricter controls on migrants and unilaterally erects trade barriers in defiance of EU regulations to exclude foreign firms whose home countries do not allow for reciprocal access to public contracts.

As for François Hollande, he has been pressured to move to the left to attract support from the Front de Gauche. He has pledged to implement a 75% tax rate on income over one million euros per year, raise taxes on large businesses, adopt laws that would make it harder for companies to lay off workers, raise the minimum wage, create 60,000 teaching jobs, lower the minimum retirement age to 60 for those who began work young, and freeze gasoline prices for three months.

On the EU front, he has promised to renegotiate the fiscal compact France negotiated with Germany and other EU countries, which seeks to guarantee budgetary discipline. “This treaty is an illusion and it poses a risk ... It creates the conditions for lasting economic crisis which would only reproduce budgetary imbalances.” He also recently stated that the European Central Bank should have intervened “massively” by lending directly to eurozone countries in order to counter the sovereign debt crisis. This is a position that Germany is categorically against.

While it may be tempting to believe that both parties will return to the centre once the elections are over, the combined support of the Front National and Front de Gauche are too large to ignore. Indeed, based on the most recent polls, they represent close to a third of the electorate. These numbers will remain high as long as France’s economy continues to struggle.

In the event of a Hollande victory, a public display of unity will follow to show that Hollande and Merkel can work together. But arriving at future agreements will become even more difficult, especially if the French economy continues to struggle. If France and Germany are unable to agree on common measures to combat the debt crisis, Europe would be under significant additional stress.

the President to make significant concessions to either the far left or the far right. Even if the President wins a majority, the presence of the Front National and Front de Gauche in the National Assembly will be a strong platform to express their views.

It will also be politically difficult for the winner of the Presidential elections to explain to the electorate that economic circumstances are forcing him to renege on some of the promises made during the election. This is especially the case when one considers that, if current poll numbers hold, that almost a third of electorate will have voted against centrist policies.

Finally, it will be a lot more difficult for either Sarkozy or Hollande (the likely winner) to compromise on issues relating to the EU, after having taken such hard-line positions during the campaign. This could make it harder for France and Germany, the two largest economies in the eurozone, to arrive at compromises, which, in turn, would make it even more difficult for Europe to arrive at the solutions needed to overcome the debt crisis.

The Socialist Party Candidate François Hollande appears to be in the driver’s seat. With less than a few days to go before the first round, polls placed him a few points ahead of President Nicolas Sarkozy, leader of the Union pour un Mouvement Populaire (UMP). But in the second and final round on May 6th, Hollande’s lead may widen to double-digit levels.

It should come as no surprise that the odds are stacked against Sarkozy. Under his watch, unemployment has risen substantially, the country has seen its industrial competitiveness erode and public debt levels have increased, which prompted S&P to strip France of its coveted triple A credit rating last January. A recent poll found that 64% of the French disapprove of him. The European debt crisis has already forced out leaders in Greece, Portugal, Ireland, Spain, Italy, Slovakia and Slovenia.

Regardless of the outcome of the Presidential elections, the Franco-German alliance, which has been the pillar of the EU and later the eurozone since they were founded, is going to come under increasing stress as well.

This report focuses on the key issues challenging France:

- The serious economic situation confronting France

- The growing socio-political divisions, which are highlighted by the support for political parties on both the far left and far right of the political spectrum

- What the election of Francois Hollande, leader of the Socialist Party, would mean for France and the markets

- How France’s internal economic and socio-political divisions will affect its policies towards the eurozone debt crisis and relations with the EU in general

France’s Economy, The Second Largest In The Eurozone, Is Facing Severe Headwinds

France’s economy, the second largest in the eurozone, is facing severe headwinds. France’s economy is coming out of this election in a weakened state. After having expanded by only 0.2% in the last quarter of 2011, its economy posted no growth in the first three months of 2012. The French National Bureau of Statistics projects zero growth for the next year-and-a-half.Unemployment hit a 12-year high of 9.3% in the third quarter of 2011, and since then has risen to just under 10% (worse than Italy’s 8.6%). The OECD projects it will reach 10.7% by the end of 2012. Indeed, since Sarkozy took office five years ago, a million people have lost their jobs. As is the case with so many European countries, unemployment rate for youth aged 18-24 is much higher, at 23%. Even for those fortunate enough to find employment, they must usually have to make do with temporary contracts. In fact, almost 90% of the job openings for this demographic is in the form of short-term contracts. This creates a dual labour market with a young generation largely unable to secure a permanent job and an older generation protected by strict labour laws.

One significant factor weighing upon France’s economy is its eroding competitiveness, especially when compared to Germany, its largest trading partner.

Source: “An Inconvenient Truth,” The Economist, March 31, 2012

The impact of this eroding competitiveness can be seen firsthand in France’s industrial sector. Since Sarkozy came to power five years ago, France has lost 355,000 factory jobs. Indeed, France is now one of the least industrialized nations in Europe, ahead of only Luxembourg and Greece. Not surprisingly, this had a very negative impact on exports, with France posting a record trade deficit in 2011.

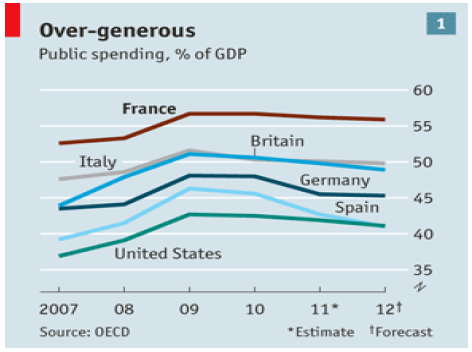

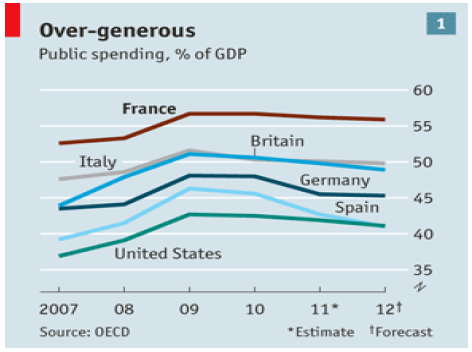

Too Much Government

France’s overreliance on the government to sustain its economy is another challenge. The public sector accounts for 56% of GDP, compared with an average of 43.3% for the OECD and 48% for the eurozone.This is not good news for a country that is facing a growing public debt problem.

Source: “An Inconvenient Truth,” The Economist, March 31, 2012

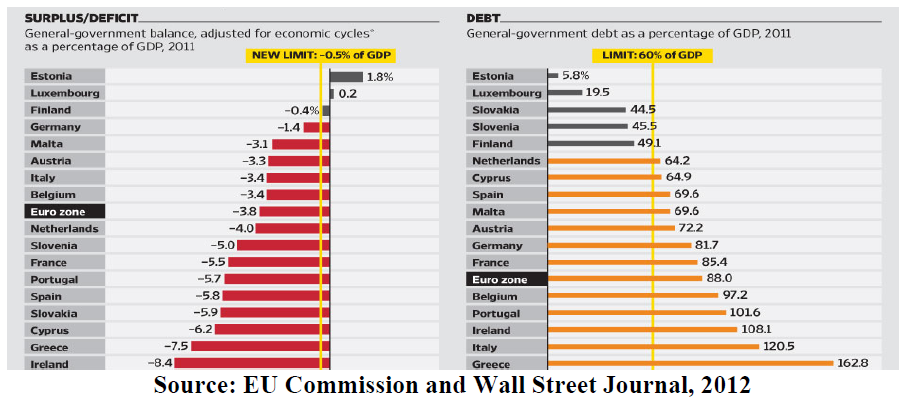

France’s Debt Problem

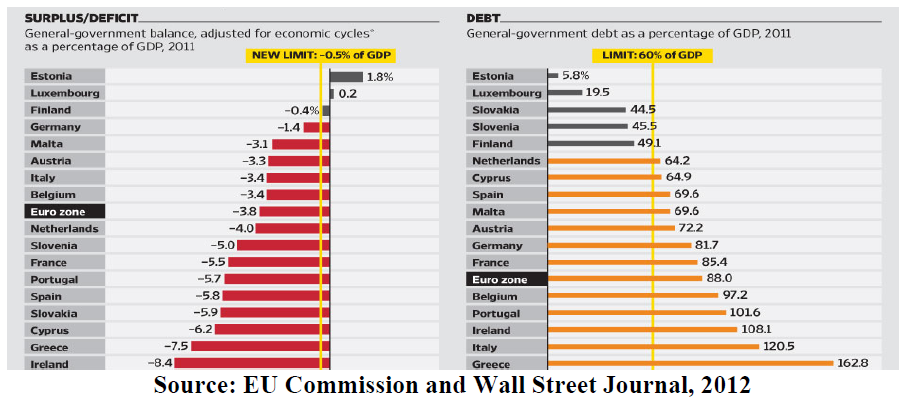

Getting France to become less reliant on public spending is made all the more urgent by its growing public debt, which stood at 88% of GDP at the end of 2011, up a third since 2007. Interest payments on the debt are the second largest item on the budget after education. France’s auditor warned last February that without significant changes, the country’s public debt levels could hit 100% of GDP by 2015 or 2016. The chart below illustrates France’s public debt and deficit levels compared to those of other European countries at the end of 2011.

A Strong Public Opposition To Budget Cuts And Market Reforms

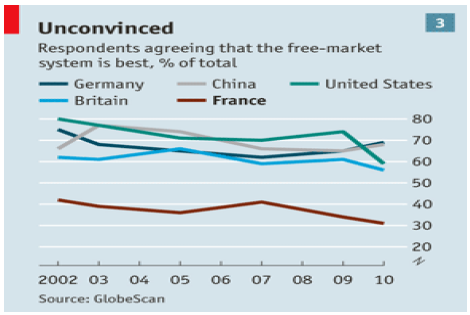

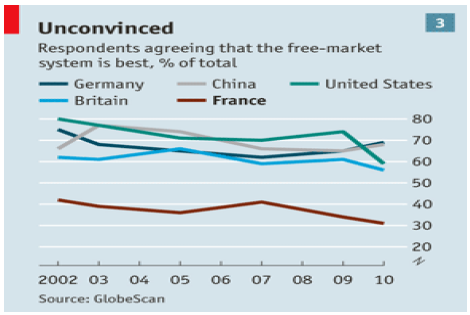

Despite the seriousness of France’s economic predicament, its politicians have hesitated to announce major cuts and free market reforms due to fears of sparking a major public backlash. In fact, the free market system is perceived more negatively in France than in many other countries, including China.

Source: “An Inconvenient Truth,” The Economist, March 31, 2012

Indeed, strong public support of the current social welfare model explains why Sarkzoy’s tax cuts at the beginning of his mandate (which many described as being overly favourable to the rich) and his move to increase the minimum stage pensionable age to 62 from 60 provoked strong opposition. One could only imagine how the population would react if they were forced to implement harsh budget and policy measures, such as the mass sell-off of state enterprises, significant cuts to social programs and deregulation of the labour market, that are currently being forced upon Spain and Italy.

This also explains why, despite the fact both Hollande and Sarkozy have promised to balance the budget by 2017 and 2016, respectively, they have been reluctant to get into the specifics of how they plan to achieve this goal. It is also important to note that France has not had a balanced budget since 1974.

Indeed, Francois Bayrou, the Presidential contender who has most stressed the dangers of excessive debt, has seen his support fall during the campaign. As of this writing, he was polling about 10% in the polls, way down from the 19% he got in 2007.

As has been the case with many other countries in the past, the risk is that France will only implement major budget cuts and market reforms if dire circumstances leave it no choice, which, in the short term at least, would only worsen the economic situation.

The Rise In Popularity Of Parties On Both The Far Right And Left Of The Political Spectrum Forces

In addition to its economic challenges, France must deal with growing support for right and left parties, which is forcing mainstream parties to take a harder line on issues ranging from economic policy to the eurozone.On the far right of the political spectrum, the leader of Front National, Marine Le Pen, wants France to abandon the euro, reindustrialize the country behind a great wall of tariffs and oppose further immigration, in particular from Muslim countries. She is currently polling at around 14% to 16%. On the far left is the Front de Gauche led by Jean-Luc Mélenchon. He supports raising the minimum wage to $2,200 a month, capping salaries at $470,000 (360,000 euros) a year, banning profitable companies from laying off workers, retirement for all at age 60 and withdrawal from NATO. He is also currently polling at around 14% to 16%.

Although neither the Front National nor the Front de Gauche stand a chance of getting past the first round of the Presidential elections, these two parties, which share a deep scepticism of free markets and the EU, have already forced mainstream parties to adopt more extreme positions in order to attract more support for the second round of Presidential elections.

President Sarkozy, for instance, has recently adopted a much harder line on immigration and trade in order to attract Front National voters. He has pledged to cut France’s financial contribution to the EU budget, pull France out of the agreement allowing for passport-free travel in Europe unless the EU implements stricter controls on migrants and unilaterally erects trade barriers in defiance of EU regulations to exclude foreign firms whose home countries do not allow for reciprocal access to public contracts.

As for François Hollande, he has been pressured to move to the left to attract support from the Front de Gauche. He has pledged to implement a 75% tax rate on income over one million euros per year, raise taxes on large businesses, adopt laws that would make it harder for companies to lay off workers, raise the minimum wage, create 60,000 teaching jobs, lower the minimum retirement age to 60 for those who began work young, and freeze gasoline prices for three months.

On the EU front, he has promised to renegotiate the fiscal compact France negotiated with Germany and other EU countries, which seeks to guarantee budgetary discipline. “This treaty is an illusion and it poses a risk ... It creates the conditions for lasting economic crisis which would only reproduce budgetary imbalances.” He also recently stated that the European Central Bank should have intervened “massively” by lending directly to eurozone countries in order to counter the sovereign debt crisis. This is a position that Germany is categorically against.

While it may be tempting to believe that both parties will return to the centre once the elections are over, the combined support of the Front National and Front de Gauche are too large to ignore. Indeed, based on the most recent polls, they represent close to a third of the electorate. These numbers will remain high as long as France’s economy continues to struggle.

An Increasingly Strained French/German Alliance

No surprisingly, the anti-EU rhetoric coming from both Hollande and Sarkozy has alarmed the German chancellor Merkel, especially since many of the positions taken are in direct opposition to those of Germany. But Chancellor Merkel does feel that Sarkozy is the lesser of the two evils. Indeed, she is so worried about the prospect of a Hollande victory that at one point she planned to campaign for Sarkozy. The idea was quietly shelved when polls revealed that French citizens did not want a German Chancellor telling them how to vote. The level of her concern was further highlighted when Chancellor Merkel was overheard at a Brussels summit last March saying that Nicolas Sarkozy was difficult enough to deal with, but Mr Hollande would be impossible.In the event of a Hollande victory, a public display of unity will follow to show that Hollande and Merkel can work together. But arriving at future agreements will become even more difficult, especially if the French economy continues to struggle. If France and Germany are unable to agree on common measures to combat the debt crisis, Europe would be under significant additional stress.

France’s Disillusioned Youth Abandoning Traditional Parties

Another disturbing trend is the growing alienation of youth from the mainstream parties and their increasing support for parties on the far right and far left. To date, the biggest benefactor of this trend has been the far right. A recent poll published in Le Monde newspaper showed that 26% of people aged 18 to 24 intended to vote for Marine Le Pen in the first round of the Presidential election. Hollande ranked second among young voters with 25% support, followed by Sarkozy and Mélenchon with 17% and 16%, respectively. Le Pen’s support from youth has doubled since the end of 2011. Jean-Luc Melenchon, leader of Front de Gauche, has seen his support from this demographic surge over the same period from 5% to 16%.Parliamentary Elections In June

Whoever wins on May 6th will then try to win a majority in the National Assembly, where elections are scheduled for June 10 and 17. Given the electrical strength of the Front National and Front de Gauche, the possibility of the President’s party not winning an outright majority cannot be excluded. This would requirethe President to make significant concessions to either the far left or the far right. Even if the President wins a majority, the presence of the Front National and Front de Gauche in the National Assembly will be a strong platform to express their views.

Conclusion

France is caught between a rock and a hard place. Without market reforms and budget cuts, it will not be able to regain its competitiveness and puts its economy back on a path towards long-term growth. But, if implemented, these very same measures, which usually take a few years to have a noticeable positive economic impact, would, in the shorter term, spark a major backlash from the public which is largely against across-the-board cuts and major free market reforms. Returning to growth is even further complicated by the fact that many of its European neighbours are struggling with high debt loads and austerity measures, which in turn is dragging down the European economy.It will also be politically difficult for the winner of the Presidential elections to explain to the electorate that economic circumstances are forcing him to renege on some of the promises made during the election. This is especially the case when one considers that, if current poll numbers hold, that almost a third of electorate will have voted against centrist policies.

Finally, it will be a lot more difficult for either Sarkozy or Hollande (the likely winner) to compromise on issues relating to the EU, after having taken such hard-line positions during the campaign. This could make it harder for France and Germany, the two largest economies in the eurozone, to arrive at compromises, which, in turn, would make it even more difficult for Europe to arrive at the solutions needed to overcome the debt crisis.