Investing.com’s stocks of the week

I spent a few minutes with my friends at Fox 26 Houston yesterday discussing the FOMC's recent two day meeting and why the Fed will not raise interest rates this year.

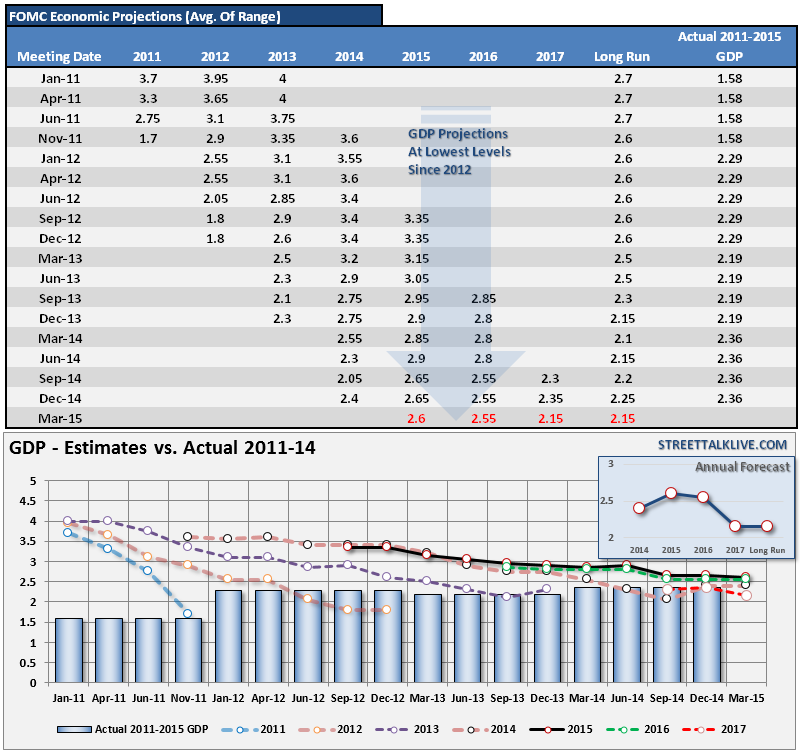

As I wrote yesterday, the track record of the Fed's economic forecasting has been abysmal as shown in the attendant chart of their projections versus reality.

As I state in the interview, I think the Fed has gotten itself caught in a trap.

It is my expectation, unless these deflationary trends reverse course in very short order, that if the Fed raises rates it will invoke a fairly negative response from both the markets and economy. However, I also believe that the Fed understands that we are closer to the next economic recession than not. For the Federal Reserve, the worst case scenario is being caught with rates at the "zero bound" when that occurs. For this reason, while raising rates will likely spark a potential recession and market correction, from the Fed's perspective this might be the 'lesser of two evils.