The FOMC meets next week for the last time this year. The market sees a 73% chance of another increase in the Fed Funds Rate to a range of 2.25% to 2.50%, down from an 84 percent chance 2 weeks ago. This is still a bet that it will happen but after Chairman Powell’s recent comments about rates being close to where they need to be, it reflects the uncertainty and the longer term view that the Fed may be done for this cycle.

That alone might be enough for the Fed to pause. But market participants can’t get enough of parsing down to individual words to discern what Fed Chairmen are saying, so there is always two interpretations. Remember when your Dad used to tell you, “this is what we are gonna do” and you just believed him? But there is other data to support Powell’s comments. Have you looked at commodity based inflation?

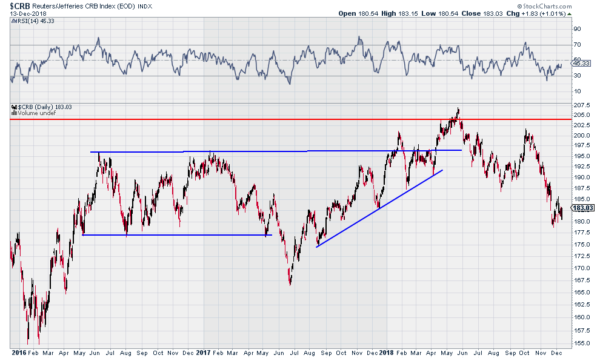

Stocks are not the only thing that have shed 10% of their value since the end of September. The CRB Index above, which measures commodity based inflation, is also off 10% during that span. And it is turning for another leg lower. Inflation is not building a head of steam that the Fed needs to throw cold water on, but rather dying off. Perhaps they have already done their job.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.