Let's take a closer look at the chart below and assess the likely crude oil price path ahead.

Chart courtesy of www.stooq.com

Yesterday, we wrote:

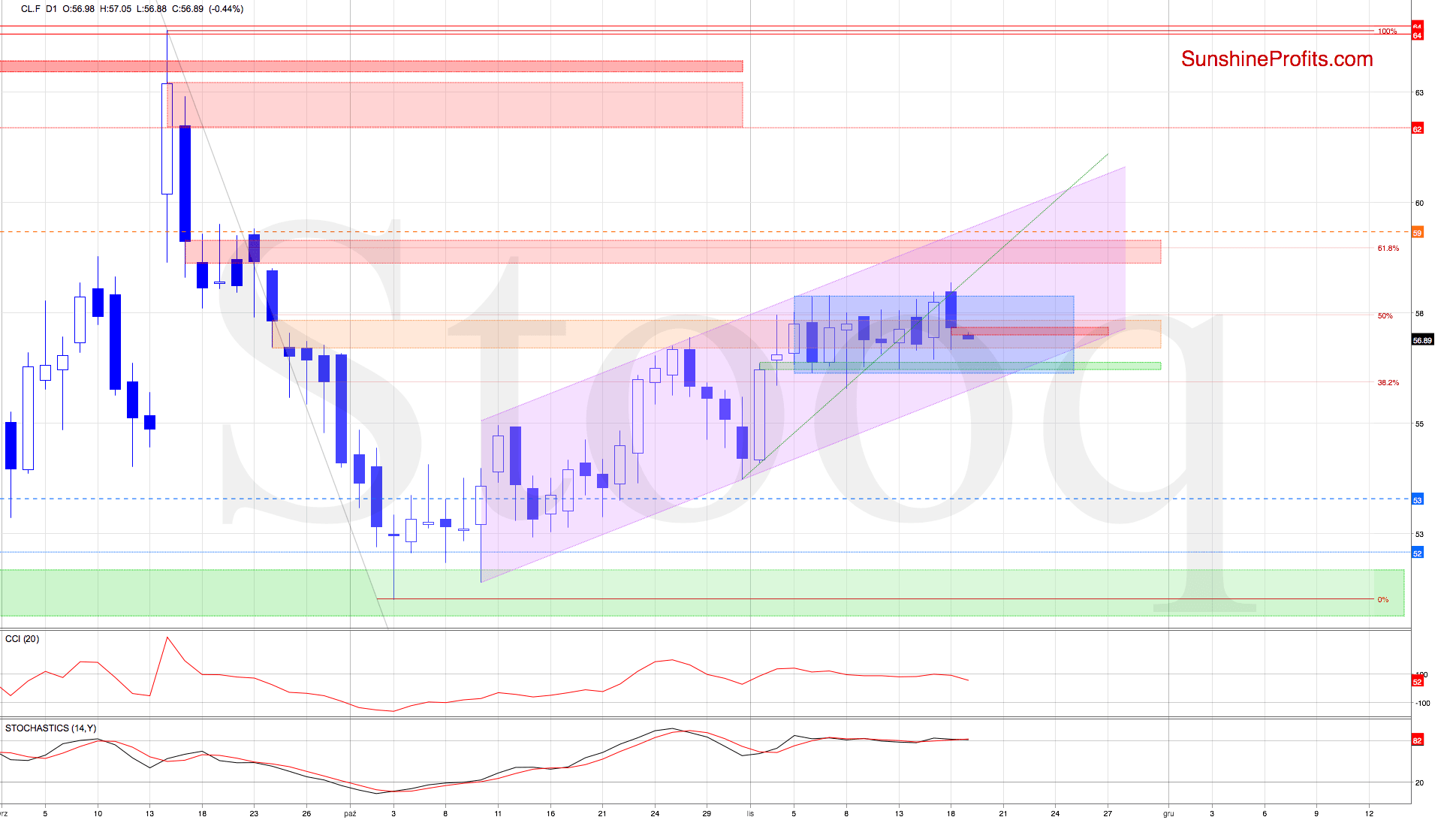

(…) On Friday, crude oil futures bounced off the green gap, which brought about quite a sharp move to the upside. The bulls had a reason to celebrate as it closed the orange gap – certainly a bullish development.

Earlier today, the bulls attempted to add to their gains, and broke above the blue consolidation. Their success proved only temporary, as the price reversed and declined to trade at around $57.35 currently. This means invalidation of the intraday breakout attempt.

Due to the extended position of the daily indicators, we have a reason to expect further decline from here.

The situation has indeed developed in tune with the above, and crude oil futures closed yesterday below the upper border of the orange gap. This is a positive development for the bears, hinting that Friday’s strength of the bulls was only temporary.

Earlier today, the futures opened the day with a bearish red gap, which serves as an additional resistance right now. Additionally, the CCI generated a sell signal while the Stochastic Oscillator is very close to doing the same.

All in all, these signs increase the likelihood of the above-described further decline in the very near future. And indeed, black gold is trading at around $56.00 as we speak.

How low could the bears aim? Let’s again quote our yesterday’s Alert:

(…) the first downside target for the sellers will be the green support gap and then the lower border of the rising purple trend channel.

Summing up, yesterday’s action shows a downside reversal. The bears opened today with a gap, and keep driving prices lower. The CCI flashed its sell signal, and the Stochastic Oscillator is on the verge of doing the same. Both support lower oil prices ahead, and the short position remains justified.