Last week, I discussed how patent expirations are affecting the biotech sector - particularly big names like Astrazeneca Plc (NYSE:AZN). I also explained why these larger pharmaceutical firms have been steadily gobbling up small companies left and right...

And, in the process, they’ve created sizable paydays for investors who got in at the right time.

Today we’re going to look at a few other factors driving biotech higher...

The Silver Tsunami

America’s population is getting older. All of those baby boomers are becoming grandparents, retiring and entering their golden years.

Roughly 10,000 boomers turn 65 every day. In 15 years, there will be 75 million Americans over the age of 65, including the youngest of the baby boomers. (That’s up from 44.7 million in 2013.)

And as people get older they tend to get sicker and require more healthcare. According to the Agency for Healthcare Research and Quality, 82% of Medicare beneficiaries have at least one chronic condition. The Congressional Budget Office projects that spending on healthcare will go from 4% of America’s GDP in 2007 to 7% in 2025. By 2050, that number should rise to 12%.

As Americans spend more on healthcare, an increasing percentage of those expenses will be on biotech drugs. Biologics already make up 24% of total drug sales, accounting for $221 billion in annual spending.

Furthermore, biologics are attractive to big pharma companies because they often carry a higher price point. Cancer-treating biologics often cost tens of thousands of dollars for a course of treatment. And drugs for rare diseases can cost six figures per year, with many patients dependent on therapy for the rest of their lives.

For example, Soliris, which is made by Alexion Pharmaceuticals (NASDAQ:ALXN), is the most expensive drug in the world. It treats a rare and sometimes fatal form of anemia. It costs around $440,000 per year.

These kinds of drugs will have an increasing role over the coming years. Tons of research is being conducted in immunotherapy and other new ways of fighting a wide variety of conditions, such as cancer and diabetes.

And with all of the upcoming patent expirations - which I talked about last week - there will be tremendous interest in the sector from large pharmaceutical companies looking to add to their research capabilities, pipelines and product offerings.

Why the Uptrend Should Continue

To top it all off, the fundamentals for this sector look great. And so do the technicals.

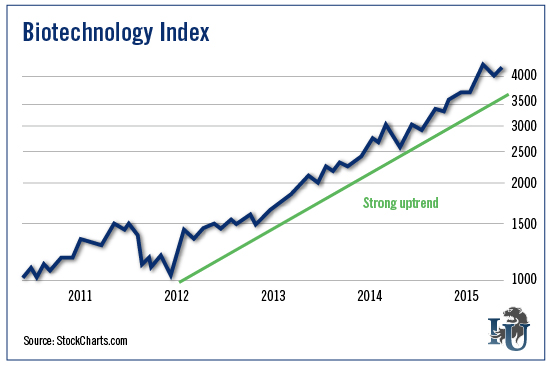

You can see from the chart above that the ARCA Biotechnology has been in a strong uptrend since 2012. It’s actually been rising since 2009, but the index has followed this uptrend line perfectly for the past three years.

There’s a saying in technical analysis that a trend in motion stays in motion. In other words, these types of trends tend to stay in effect until they break down meaningfully.

As shown above, we could even experience a 10% correction in the index and still be in the long-term uptrend.

In fact, if we did see the index pull back 10%, I’d be buying with both hands.

This is about as strong and perfect of a trend as you’ll see on a chart. And it suggests we should see higher prices for the foreseeable future.

The angle of the trend is not too steep, which means it’s sustainable. Sometimes when a stock or index rises too fast, even if it tracks along a trend line, it can’t maintain that momentum for very long. But this trend line is the kind that you’d find in a technical analysis textbook.

It’s reassuring when the technicals and fundamentals point in the same direction.

Biotech is a sector you have to be in over the coming decade. It has its risks. And it can be volatile. But over the years, it should generate extraordinary returns as new medicines come on the market and smaller companies get gobbled up by larger ones.

It’s my favorite sector in the market and I strongly encourage you to have some portion of your portfolio invested in biotech stocks.