As David Cameron attempts to rally support to keep Britain firmly in the EU ahead of the June 23rd referendum, investors are eyeing up safe havens for the aftermath of a potential “out” vote. With latest polling data showing only 51% of Britons wish to remain a part of the EU, the result could go either way. With mounting uncertainty about the outcome, even the most bullish of GBP holders are looking for potential exit strategies. Some estimates put a potential depreciation of the GBP up to 20% if Britain leaves the EU, which would be a deathblow to long positions on the currency.

Ultimately, voter sentiment is likely to be crucial in determining market behavior in the lead up to the referendum. Any major shift in one particular camp’s popularity will likely result in increased speculation over the EUR/GBP pair, rather than interest in safe haven currencies. If a vote to stay looks likely, the EUR could soar, and therefore an increase in long positions on the EUR is likely to predominate. If the Brexit looks to be in mode, the EUR is likely to fall along with the GBP.

Long considered a safe haven for the world’s wealth, the Swiss are once again coming to the forefront to save the day. With its historically stable currency, economy, and political climate, the Swiss franc has been one of the traditional ports of call during stormy economic conditions. With the unprecedented effects that an economy as large as Britain’s leaving the EU might have, it’s no wonder that holders of GBP are looking for security. For those unwilling to gamble on the outcome of the referendum, there is a desire to identify alternative investments.

The CHF has already priced in a significant degree of Brexit risk, meaning there is very little in the way of risk premium to disappear. It’s worth noting that there has been some speculation around the role of the CHF as a safe currency for some time. However, when faced with economic uncertainty on this scale, investors are likely to flock back to the tried and true Franc.

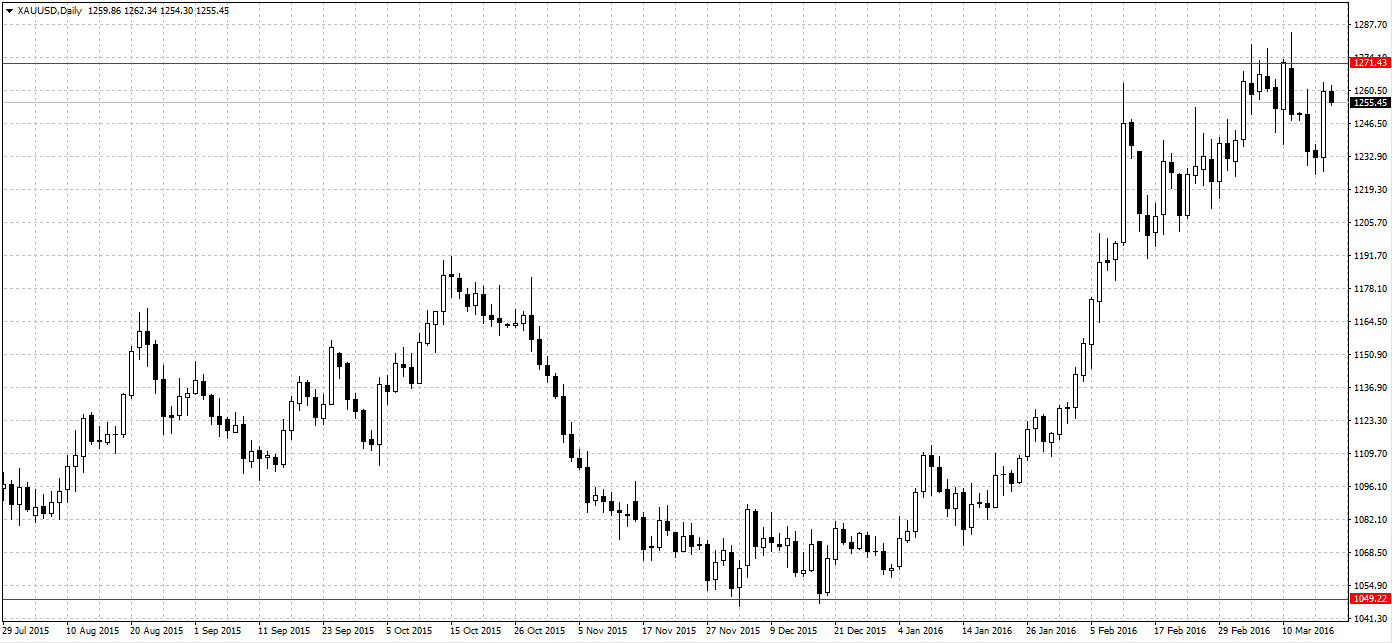

One might ask why gold won’t enjoy a similar status, as it is also considered a financial safe haven. Gold of course has been predominated by a bearish trend for some time. With recent uncertainty in the market, gold has been making an exceptional recovery, but is now meeting some strong resistance at the 1271.00 level. Unless gold drops to find support at the 1049.00 level, some investors may be unwilling to buy gold while it is so high compared with its recent performance.

In the end, no currency will be fully insulated from the widespread effect of the Brexit. The CHF does not represent a foolproof exit strategy. However, the CHF does provide an excellent option for those unwilling to gamble on the outcome of the referendum. Gauging voter sentiment is the key in formulating an appropriate response in the coming weeks.