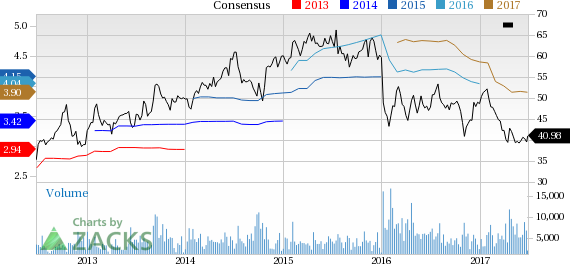

On Jun 27, Zacks Investment Research has downgraded AutoNation Inc. (NYSE:AN) to a Zacks Rank #5 (Strong Sell).

The company reported earnings of 97 cents per share in the first quarter of 2017, higher than 7 cents per share from the year-ago quarter. Earnings also topped the Zacks Consensus Estimate of 91 cents.

For the same period, revenues inched up 0.4% year over year to $5.14 billion, but missed the Zacks Consensus Estimate of $5.31 billion.

The financial position of AutoNation is deteriorating. With brand expansion plans, its capital expenditure is expected to increase by $500 million, over the next few years. In the last reported quarter, the same expenditure rose to $86.8 million compared with $50.7 million in the year-ago period.

AutoNation is also facing pressure in its used vehicles segment. For the last reported quarter, this segment’s revenue was almost flat year over year at $1.24 million. The used vehicles margin is in stress due to inventory that was previously on sales hold.

The company had roughly 7% of its used vehicle units on hold at the end of 2016, due to the Takata airbag recall. The burden is expected to continue with an improvement projected in the second quarter of 2017.

AutoNation has also underperformed the Zacks categorized Retail/Wholesale Auto/Truck industry in the last three months. Its shares have fallen 4.8% during the period, whereas the industry declined 3.4%.

Key Picks

AutoNation currently carries a Zacks Rank #5.

Better-ranked companies in the auto space are Cummins Inc. (NYSE:CMI) , Fox Factory Holding Corp. (NASDAQ:FOXF) and Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) . Cummins sports a Zacks Rank #1 (Strong Buy), while Volkswagen and Fox Factory Holding carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cummins has an expected long-term growth rate of 11.7%.

Fox Factory Holding has an expected long-term growth rate of 15.6%.

Volkswagen has an expected long-term growth of 17.5%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

AutoNation, Inc. (AN): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post