Improvement in the coal scenario is very encouraging for railroads and Union Pacific Corporation (NYSE:UNP) is no exception. In fact, the 17% rally in coal volumes aided the company’s results in the second quarter of 2017, where it reported better-than-expected earnings per share and revenues.

Moreover, the top and bottom lines expanded 23.93% and 10.1% respectively on a year-over-year basis on the back of growth in overall volumes. Union Pacific further expects an improving scenario regarding business volumes in the second half of the year.

The increase in operating ratio to 61.8% in the second quarter is encouraging. The company is on track to achieve its guidance of around 60% by 2019, while the operating ratio of 55% is targeted beyond that period. The company’s $3.1 billion capital plan announced this year is also commendable. The plan is in line with the company’s efforts to promote safety and enhance productivity. Union Pacific’s crossing accident rate improved to 2.27 in the first half of 2017 compared with 2.4 recorded in the same time frame, last year.

The company’s efforts to reward investors through share buybacks and dividend payouts are also appreciative. In November 2016, the company raised its quarterly dividend to 60.5 cents per share ($2.42 per share annualized), representing a jump of 10% over the previous payout. The company returned around $5 billion to its stockholders in 2016 through these investor-friendly measures. Of the same, approximately $3.1 billion were returned through share buybacks. During the first half of 2017, the company paid back around $2.6 billion to the stockholders via dividends/buybacks.

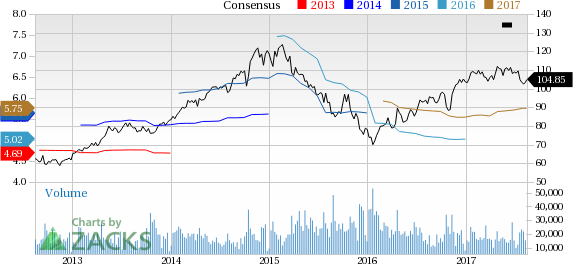

Keeping these positives in view, we believe the investors should hold on to Union Pacific stock for now.

Zacks Rank & Key Picks

Union Pacific currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the transportation sector are Canadian National Railway Company (NYSE:CNI) , Alstom (PA:ALSO) SA (OTC:ALSMY) and Canadian Pacific Railway Limited (NYSE:CP) . While Canadian National Railway sports a Zacks Rank #1 (Strong Buy), Alstom and Canadian Pacific Railway carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Canadian National Railway and Alstom have rallied over 6% in the last three months, while Canadian Pacific Railway shares have gained more than 8% on a year-to-date basis.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Union Pacific Corporation (UNP): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Canadian Pacific Railway Limited (CP): Free Stock Analysis Report

Alstom ADR (ALSMY): Free Stock Analysis Report

Original post

Zacks Investment Research