We issued an updated research report on independent petroleum refiner, HollyFrontier Corporation (NYSE:HFC) on Aug 24. We believe that the company’s holding of fee-based assets through its partnership company, Holly Energy Partners, with limited commodity price exposure is a positive. However, increasing operating expense is a concern.

The company currently carries a Zacks Rank #3 (Hold), implying that the stock will perform in line with the broader U.S. equity market over the next one to three months.

HollyFrontier is one of the largest independent oil refiners in the United States with a combined crude oil processing capacity of approximately 457,000 barrels per day. A major advantage for the company is the high complexity index or the capability to process a wide mix of crude. It will also gain access to some of the fastest growing domestic markets afforded by its portfolio of five refineries.

Through its 36% interest in Holly Energy Partners, the company maintains fee-based assets with limited commodity price exposure. Moreover, the partnership boasts of durable long-term contracts with major refining clients.

Investors should know that the company has been returning cash to shareholders on a regular basis. The company has returned more than $4 billion to shareholders since the July 2011 merger between Holly Corp. and Frontier Oil - an extremely impressive track record. The downstream operator also pays a competitive dividend with a healthy yield of over 5%.

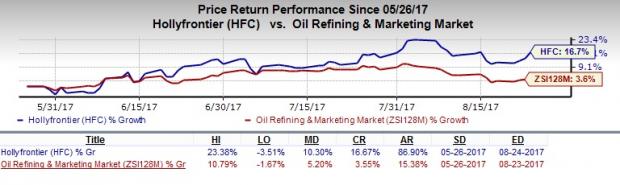

The company managed to surpass the Zacks Consensus Estimate in three of the prior four quarters with an average positive earnings surprise of 2.41%. Also, HollyFrontier’s price performance looks lucrative as reflected by its 16.7% gain over the last three months as compared with the 3.6% improvement of the industry.

However, HollyFrontier and other refiners have been pegged back by margins that remain significantly lower than 5-year averages. Increasing operating costs per barrel have further narrowed the spread.

Moreover, we are concerned about the company’s escalating expenses over the first six months of 2017. Increase in direct cost associated with unplanned outages and the heavy turnaround schedule continue to plague HollyFrontier. High maintenance levels during the most recent quarter also led to lower refinery segment production and sales volumes.

Stocks to Consider

A few better-ranked players in the energy sector include TransCanada Corporation (TO:TRP) , Transmontaigne Partners LP (NYSE:TLP) and Range Resources Corporation (NYSE:RRC) . All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Headquartered in Calgary, Canada, TransCanada is a midstream energy firm in North America. The company posted an average positive earnings surprise of 4.06% over the last four quarters.

Transmontaigne, headquartered in Denver, CO, involves in transporting and storing refined petroleum products. The firm posted an average positive earnings surprise of 6.60% over the last four quarters.

Based in Fort Worth, TX, Range Resources is an independent oil and gas company, engaged in the exploration, development and acquisition of U.S. oil and gas resources. The company’s 2017 earnings are estimated to grow 1587.17%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

See Stocks Now>>

HollyFrontier Corporation (HFC): Free Stock Analysis Report

TransMontaigne Partners L.P. (TLP): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research