Despite this being a low-volume holiday week, crude oil continues to plunge. West Texas Intermediate (WTI) crude oil is down $3.69 or 6.75% and Brent crude oil is down $3.60 or 5.75% today alone, which further confirms the concerns I had when when I wrote the article “Is A Crude Oil Liquidation Event Ahead?” on November 6th. In that piece, I warned that WTI crude oil’s technical breakdown below its key $65 level would likely lead to even more bearish action, which could then cause speculators or the “dumb money” to violently liquidate their large bullish position of nearly 500,000 net futures contracts. In today’s update, I will show the next key technical levels to watch and discuss the economic implications of crude oil’s crash of the past two months.

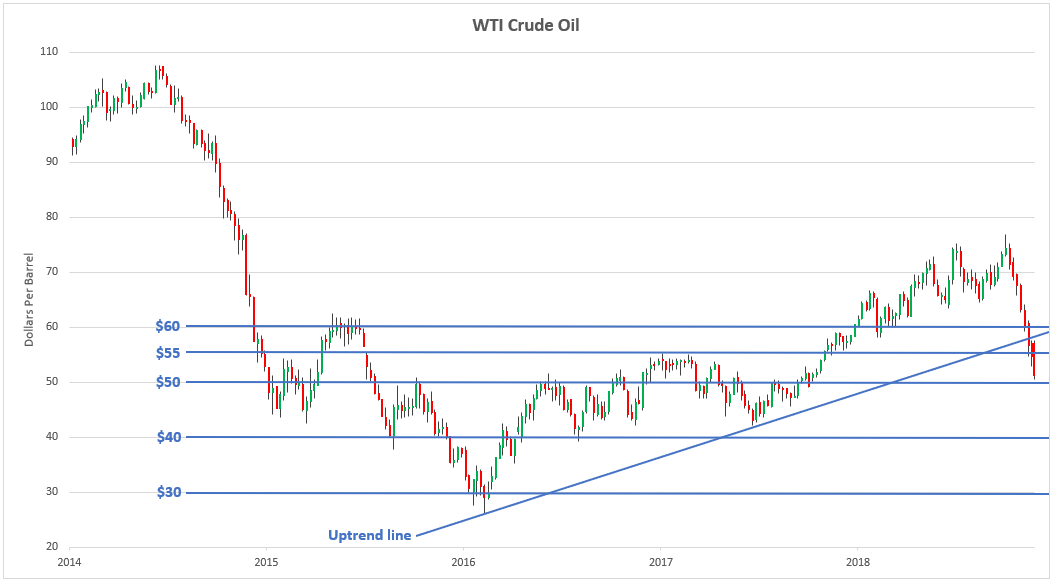

The daily chart shows how WTI crude oil fell by over $26 per barrel or 34% since early October:

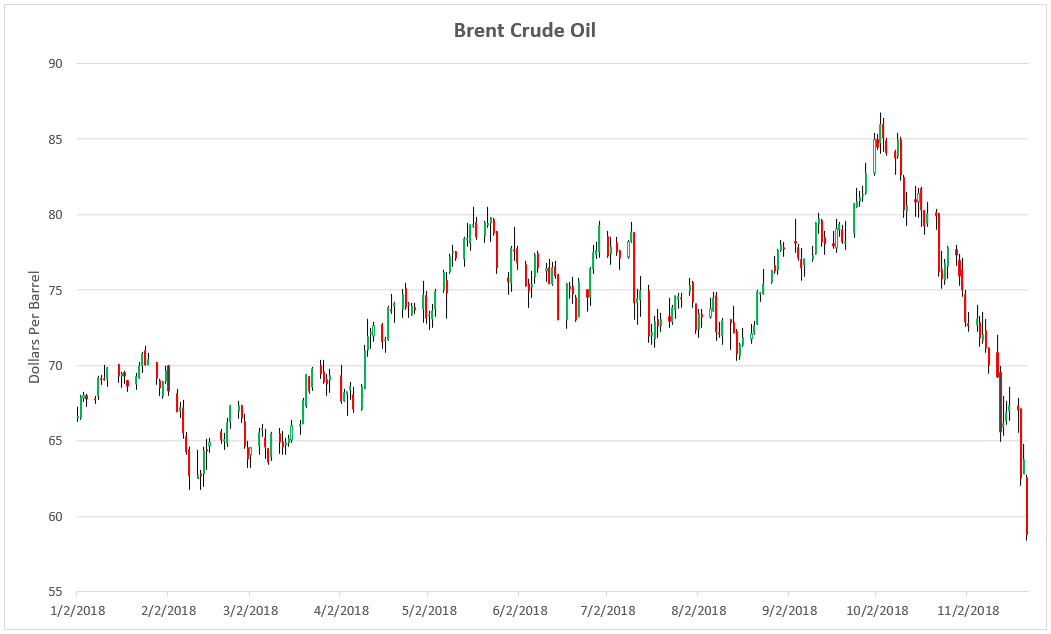

Brent crude oil fell by over $28 per barrel or 33% since early October:

WTI crude oil keeps slicing below important technical levels: $60, $55, and the uptrend line that began in early-2016, which represents a very important and concerning technical breakdown. The next major support level to watch is $50; if WTI crude oil breaks below $50 in a convincing manner, it will likely try to gun for $40, then $30, and so on.

Brent crude oil sliced below its $70 and $60 support levels along with the uptrend line that started in early-2016, which is a very bad omen that increases the probability of further bearish action provided it isn’t negated by a close back above this level.

As I’ve been pointing out since the start of this year, crude oil futures speculators or the “dumb money” (the red line under the chart) have built a massive long position in WTI crude oil of just under 500,000 net futures contracts. There is a very real risk that these speculators will be forced to liquidate if the sell-off continues, which would greatly exacerbate the sell-off.

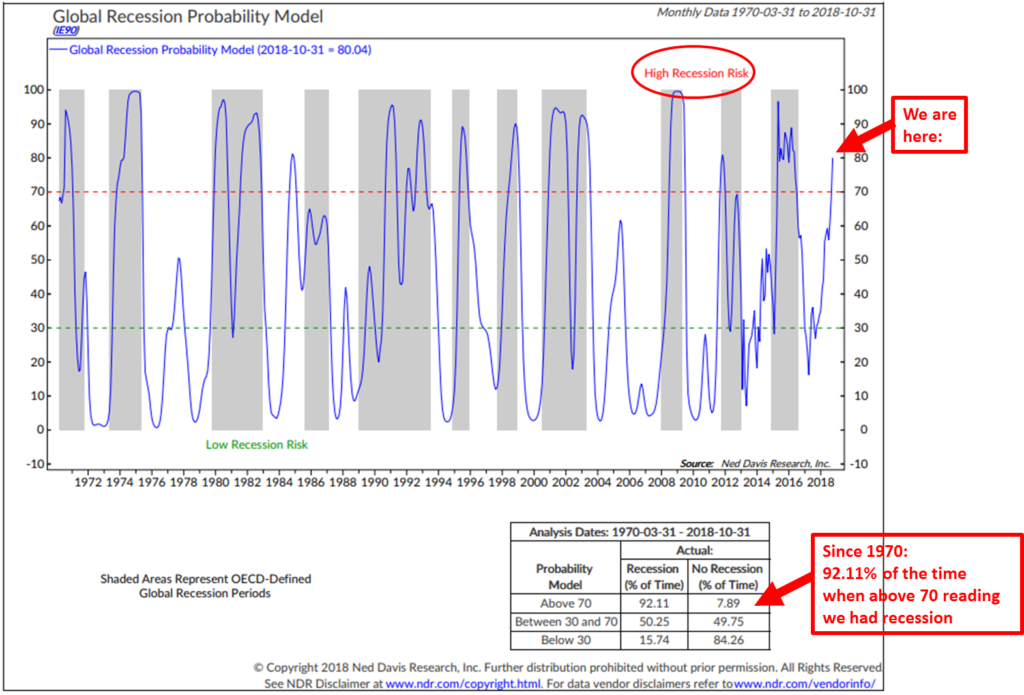

Why is crude oil selling off so sharply? There are a number of reasons, but the core reason is that global recession risk is rising (which is why the stock market is selling off along with oil). According to the Ned Davis Research chart below, global recession risk is now above 70.

What does that mean?

“Readings above 70 have found us in recession 92.11% of the time (1970 to present). Several months ago, the model score stood at 61.3. It has just moved to 80.04. Expect a global recession. It either has begun or will begin shortly. Though no guarantee, as 7.89% of the time since 1970 when the global economic indicators that make up this model were above 70, a recession did not occur.” – Stephen Blumenthal

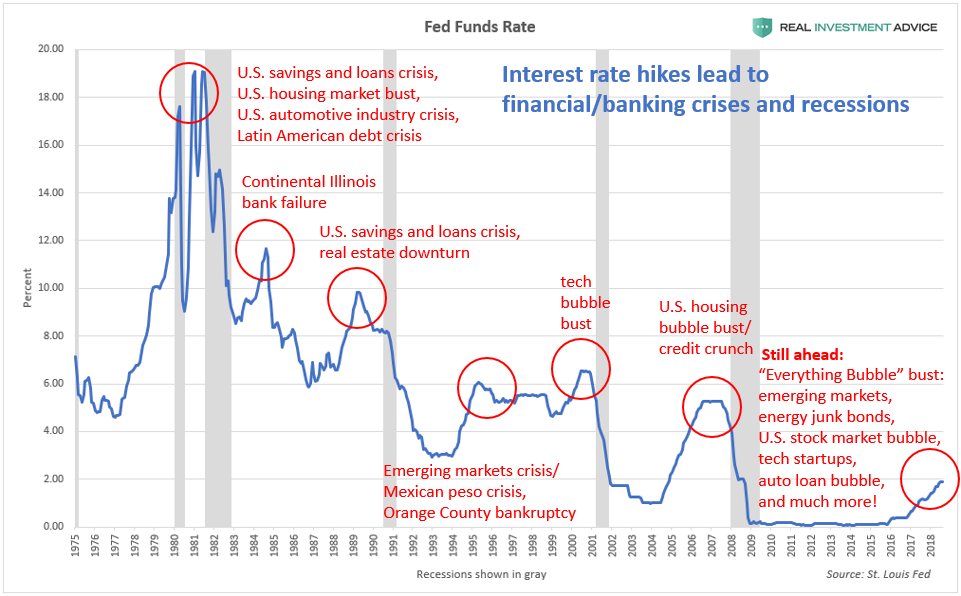

In September, I wrote a popular Forbes piece called “How Interest Rate Hikes Will Trigger The Next Financial Crisis” in which I showed how historic recessions, banking, and financial crises have occurred after interest rate hike cycles (the chart below is from that piece). I believe that dangerous bubbles have formed in emerging markets, U.S. stocks, the shale energy industry/energy junk bonds, tech startups, and other industries and countries after the Great Recession, and that rising interest rates are going to pop those bubbles and cause yet another financial and economic crisis.

I am particularly worried about plunging oil prices because I believe that it is going to pop the shale energy bubble that I have been warning about for years.

Here’s what I wrote in Forbes in 2014:

I am also growing increasingly concerned that the U.S. shale energy boom is actually another post-2009 economic bubble (it would be a part of the commodities bubble). In a zero-percent interest rate environment like we are currently experiencing, any economic boom can devolve into a bubble. Shale energy extraction is a very capital-intensive business that relies heavily on cheap credit to survive. Shale oil wells experience much faster decline rates than conventional oil wells, which means that energy companies must keep drilling at a furious pace just to maintain their production – a very costly proposition that is typically funded by copious amounts of debt.

Here’s what I wrote in Forbes in September 2018, when I summarized the shale energy bubble:

U.S. shale energy boom/energy junk bonds: This boom/bubble is closely related to the corporate debt bubble discussed above. Extracting oil and gas from shale via fracking is extremely capital-intensive and would not be feasible in a normal interest rate environment. Thanks to the artificially low interest rate environment since the Great Recession, the shale energy industry’s net debt surged to $200 billion in 2015 – a 300% increase from 2005. Rising interest rates and the bursting of the corporate debt/junk bond bubble will cause a major bust in the shale energy industry.

The oil price plunge and overall rising interest rate environment is causing high yield or “junk” bonds to sink. The chart below shows that the HYG high yield corporate bond ETF recently broke below a key technical level known as a neckline, which is a signal that further bearish action is likely ahead (which means that junk bond yields will rise). I believe that this is yet another sign that the shale energy bubble is at risk of popping.

Fund manager Jeff Gundlach said that he expected that the Fed would raise rates “until something breaks.” There is a good chance that one of the first things that broke and continues to break is crude oil prices and the shale energy bubble. This has very serious implications because it is one of the most important drivers of economic activity and job creation in the U.S. since the Great Recession. Society is going to be taught the lesson that cheap credit and flooding the economy and financial system with liquidity leads to bubbles rather than sustainable economic booms.