Is Bitcoin in bubble territory? Certainly, the price pattern this year looks like an exponential one, at least locally, but there are also opposing views. In an article on CNBC, we read:

[William] Bernstein is a neurologist who began writing about investing in the 1990s, soon becoming a best-selling author and drawing the admiration of legends such as Vanguard's Jack Bogle for his clear and rational analysis. He is best known for books such as "The Intelligent Asset Allocator" and "The Four Pillars of Investing" that show independent investors how to manage their money for the long term. He is currently retired as a doctor, but co-principal at Efficient Frontier Advisors, a money management firm for the very wealthy.

"Bitcoin is not something I want to waste my time on," Bernstein told CNBC. "Unless [you are] an expert on blockchain technology and bitcoin, stay away. Don't invest in things [you] don't understand."

(...) bitcoin doesn't quite fulfill all four criteria of a bubble, Bernstein said.

First, the digital currency hasn't yet become the primary topic of social gatherings, he told CNBC.

And second, most people aren't quitting well-paying jobs to speculate in bitcoin.

Also, skeptics of bitcoin aren't yet met with anger.

The only sign of bitcoin being in a bubble that Bernstein can see is some "whiffs" of extreme price predictions.

This is a different perspective on the Bitcoin market from what we usually see on mainstream media. The default two modes seem to be either that Bitcoin is an extreme opportunity or that it is a bubble. Actually, these are not mutually exclusive clauses. Bernstein presents a view based on the analysis of past market manias and he seems to be using periods akin to the dot-com bubble as the yardstick. The main takeaway from this should be that while Bitcoin’s rise has been meteoric and the past price action certainly looks like one in a bubble, there’s no telling when the move up stops and, as such, Bitcoin might still have a long way to go.

For now, let’s focus on the charts.

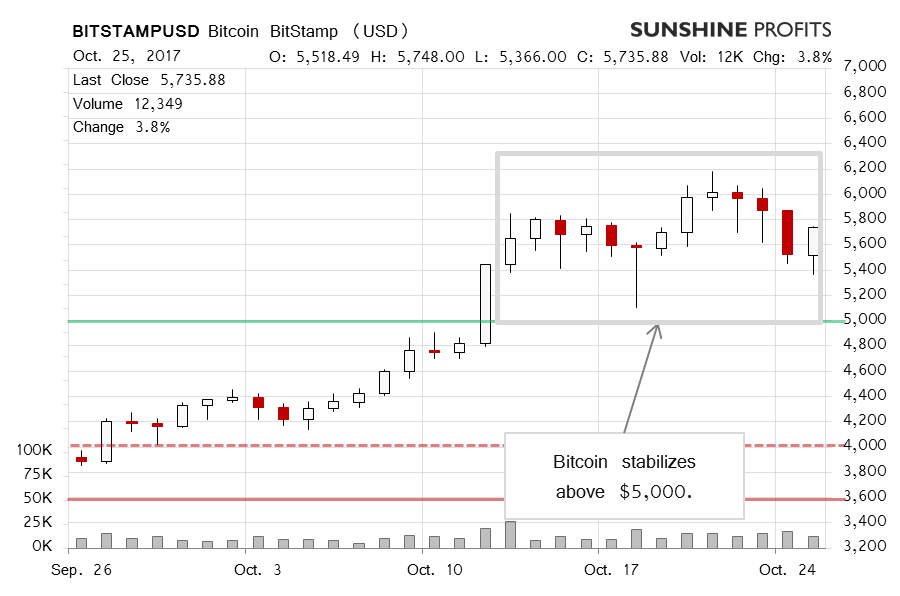

On BitStamp, we see that Bitcoin has stabilized below but not very far from $6,000. Friday, the action was mostly to the upside and as of this writing Bitcoin was back at $6,000. What might this mean for the Bitcoin market? Recall our recent comments:

Quite importantly, we saw a move to $5,000 (actually, a bit above it) but this didn’t result in a breakdown. Quite the contrary, the volume of the move down was relatively subdued and almost all the losses were very quickly reversed. Even though the move down might have seemed like a bearish indication, it doesn’t necessarily have such implications.

What we saw following the release of our previous alert was more appreciation in Bitcoin, without any spectacular moves but the currency was able to reach a new all-time high one way or another. At the moment of writing these words (...), we have seen a move down which has erased some of the recent gains. The situation, however, is more bullish now than it was previously.

What we might get from the current action in the Bitcoin market is that we’re seeing a rebound from the very recent move down. This is yet another bullish sign in a series of bullish hints we’ve been getting recently. The question now is whether this is enough to consider opening hypothetical speculative positions.

On the long-term Bitfinex chart, we see the pullback from the recent all-time high. In our recent commentary, we wrote:

We didn’t see Bitcoin move below $5,000 despite the move to this level. This means that we saw a first bearish attempt after the recent all-time high but it didn’t amount to much. Actually, Bitcoin went down very close to the 23.6% retracement level based on the recent move up ($5,168) but this level stopped the decline. We are now quite close to considering hypothetical long positions. What we would need to see is some more strength or even a lack of decline. (…)

Right now almost all the conditions for considering a long hypothetical position have been met. Additionally, Bitcoin is moving out of the overbought territory as measured by the RSI. If we don’t see an acceleration of the move down that has transpired today (so far), we will most likely be looking at hypothetic long speculative positions. (...)

There has been another bullish hint in the form of the relatively quick pullback from the very recent move down. There is now even more to suggest that a move up is in the cards. The one thing that still needs to get out of the way is the very recent all-time high. If we see this high being taken out, we might get a very bullish reading, at least for the short term. Mind that if we don’t see such a move, we might also get a more bullish reading in the form of the lack of a breakdown.