There are two reasons why we often see great buys in November and December, at least for the short to intermediate term.

First, individual investors owning what they believe (or believed!) to be quality companies have looked on hungrily as they see other companies’ share prices move forward rapidly. They look at their own holdings and, if they don’t see the same “action” often sell their shares to take what is often greater risk at a higher valuation, buying the momentum darlings that are moving up instead of stagnating or moving down.

Second, in a great year like 2017 has been, lots of investors have taken significant capital gains already or are planning to. When they talk to their accountant or plug this into their tax software, they suddenly realize they just pushed themselves into a higher bracket. Unless they are convinced that their now-sunk holdings are their best bet to reap further gains, it makes eminent sense for them to take whatever capital losses they must in order to return to a lower bracket.

Finally, the big mutual fund companies, managers of your pension fund, money managers, etc. do not want to look like idiots even though they may be. If you as a holder in some mutual fund, for instance, look at the year-end “Portfolio Holdings” page and see nothing but stocks that have under-performed, these managers recognize you might pull your funds and place them elsewhere. So they “window dress.”

They sell stocks not in the public eye that may represent the best long-term value and instead buy stocks that are in the news. Tesla (NASDAQ:TSLA) is a lot sexier to own than Ford (NYSE:F) and has performed reliably better in 2017 as well.

However, even if these neglected stocks that have declined were all dogs – and they are not! – “every dog shall have its day.” Market history shows that many fickle money managers, at or near the beginning of the next year, are salivating to find the Fallen Angels that will afford the best rebound probability. (This trend has moved forward in many years as more mutual funds and other institutions have moved their reporting forward for year-end.)

Here are some of my best ideas for which Fallen Angels might do best in the coming weeks and months.

Health Care:

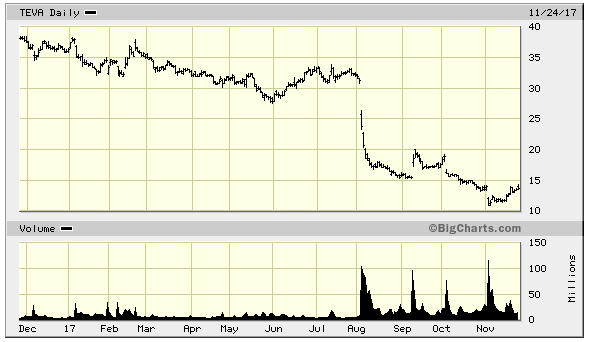

Can Teva Pharmaceutical (NYSE:TEVA) make any more dumb mistakes than they already have? At first, the declines in this mega-cap generic and ethical pharmaceutical company were the result of a whole series of self-induced wounds by self-aggrandizing executives looking to secure their legacy, but now? Now it has less to do with fundamentals and more to do with the three factors stated above; having lost two-thirds of its value, now it’s just investors piling on. Could it get worse before it gets better? Any stock could. But there are patents here, and market share, that are enticing enough to make it worth your due diligence.

Celgene (NASDAQ:CELG) has a much clearer runway to good growth than TEVA but it, too, disappointed investors, not with its Q3 numbers—its top line grew 10% year-on-year, less than the analyst community expected, but actually beat on earnings. Come end of year, anything less than an earnings surprise on the upside (financially engineered or not) will do for this pack. They had the temerity to suggest their full-year revenues would be just $13 billion, not the $13.2 million they were previously expecting. I don’t expect fireworks here but I imagine a fall in stock price from $140 to $105 might be just a tad overdone. I see CELG as a growth company for years to come.

Technology:

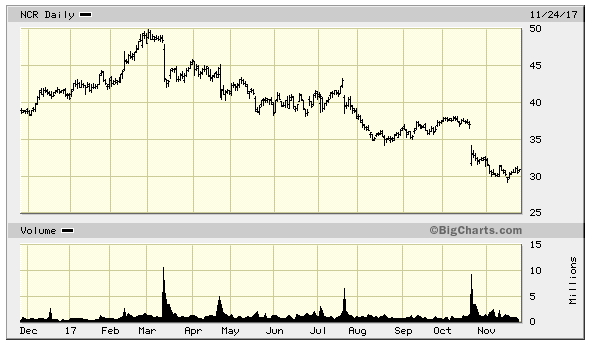

There are those who might quibble with my choice here, noting that the old National Cash Register Company, now just NCR Corp (NYSE:NCR) is hardly a tech company. Why, they just make cash registers or ATM machines or something equally boring, right? Well, maybe so – to us in the USA. But what many don’t know is that NCR is a true multinational, deriving most of its earnings overseas. Or that they also make point-of-sale terminals and self-service check-out systems for grocery and other retail stores, and self-check-in kiosks for airlines and hotels. Or that they are the biggest factor in ATMs globally, especially in India. NCR is somewhat of an indirect play on India where retail banking is being established in the countryside; the company has installed some 25,000 ATMs in India over the last couple of years. Then there is the servicing of all this and the software that keeps NCR a jump ahead in point-of-sales and all that. No they aren’t Amazon (NASDAQ:AMZN). On the other hand, if NCR just recovers half of what they lost this year and goes to 40, that would be a 25% move. Not bad for any year.

Retail:

Speaking of Amazon, it seems to be an article of faith among some that in the future we’ll never need to go anywhere since Amazon will deliver our food, clothing, games, programming and soma direct to our doorstep. Somehow I just don’t see it. I think people will still want the occasional bit of fresh air, socializing with others and actually touching some of the things they buy. Bed Bath & Beyond (NASDAQ:BBBY) might just benefit from meandering shoppers in their retail stores. (Or AMZN will buy them in order to have a central place shoppers can touch the product and still have it delivered in bulk.) We need to remember that BBY isn’t just one store; they also own Cost Plus World Market, Christmas Tree Shops, buy buy Baby, Linen Holdings, Chef Central and a whole bunch of online specialty stores themselves. The stock is down 55% this year based on the fact that they are brick-and-mortar. Sorry, Charlie, brick-and-mortar doesn’t mean peel-and-fade. It just means you have to have great products, low debt, a strong balance sheet and an innovative approach to marketing. Oh, by the way, BBBY has a current Price/ Earnings Ratio of 5.3.

Will all of these companies rise, Phoenix-like, from the ash heap onto which they have been thrown? Of course not. But I’ll wager most have seen or within the next week or two will see their bottoming area and are unlikely to plunge further. And if only one or, dare to dream, two recover anywhere near their high of this year…

Disclosure: Please do your own due diligence on these or any other company. You may contact me at joe@stanforwealth.com for other similar ideas.