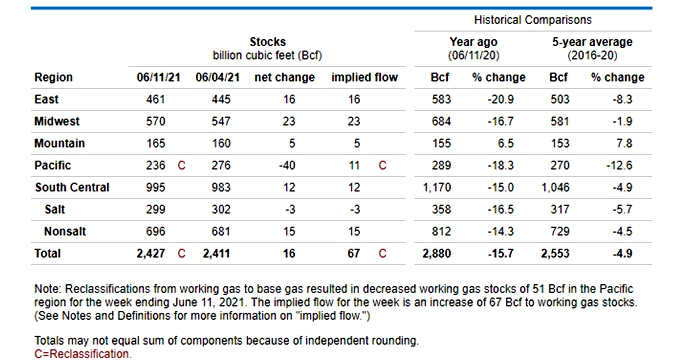

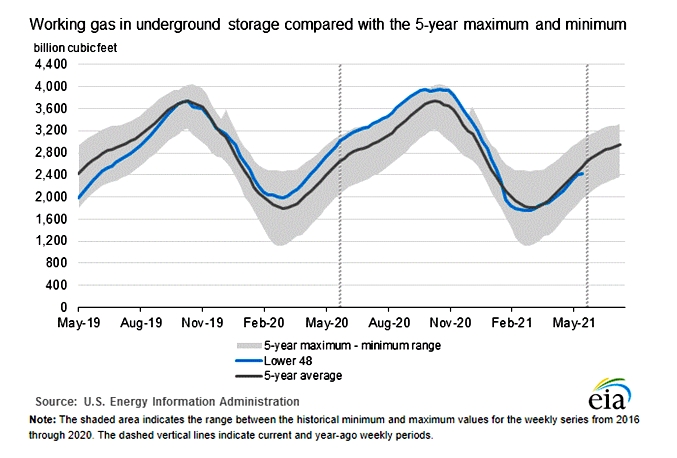

- A steep fall in weekly injection level during the last four weeks is clearly visible.

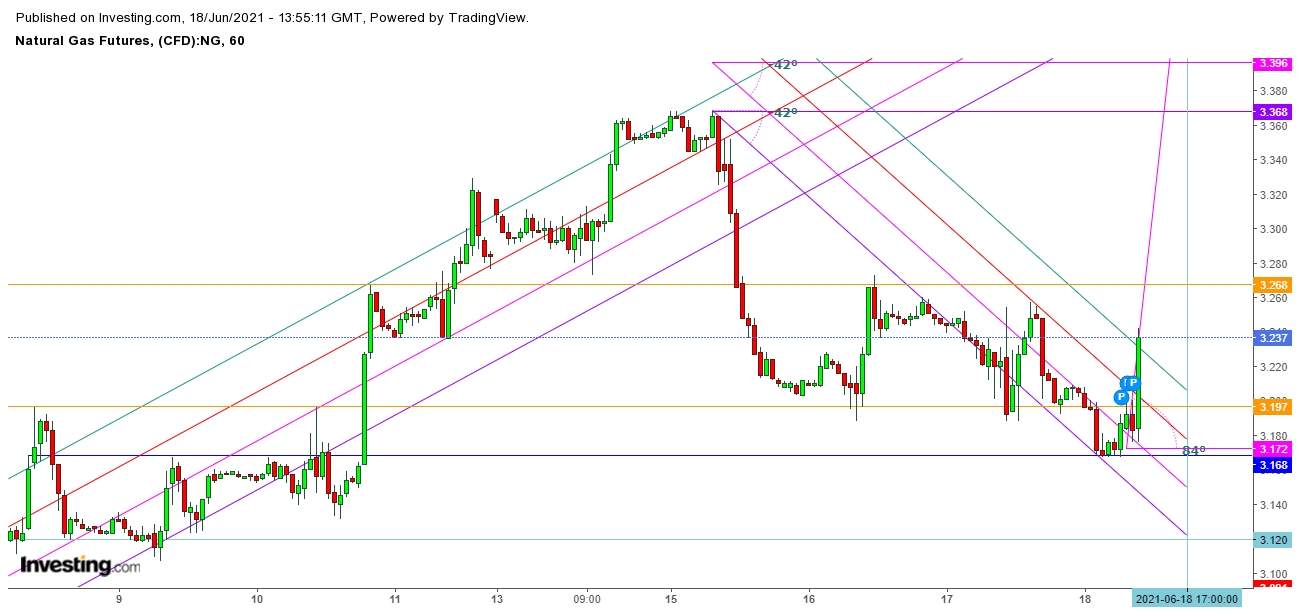

- Natural gas futures have formed a launching pad at $3.188.

- Psychological resistance at $3 has turned into psychological support.

- Commodity hedge funds returned back in 2021 which remained absent during 2020.

- Natural gas futures could test a seasonal peak in November 2021 above $4.5

While analyzing the movements of natural gas futures after the announcement of inventory levels on June 18, 2021, I find that the increase in natural gas is less than expected, it implies greater demand and is bullish for natural gas prices.

Working gas in storage was 2,427 Bcf as of Friday, June 11, 2021, according to EIA estimates. This represents a net increase of 16 Bcf from the previous week. Stocks were 453 Bcf less than last year at this time and 126 Bcf below the five-year average of 2,553 Bcf. At 2,427 Bcf, the total working gas is within the five-year historical range.

Power and natural gas prices in Texas and California spiked this week to their highest levels in months as homes and businesses cranked up air conditioners to escape brutal heat waves. I find that this could help natural gas bulls to remain active during the upcoming weeks.

The hurricane season for 2021starts from June 1 and will end on Nov. 30, 2021. According to the NOAA Climate Prediction Center, there's a 60 percent chance that the 2021 hurricane season in the Atlantic will likely have 13-20 named storms. Six to 10 of those could become hurricanes, and up to five could potentially become major hurricanes.

Natural gas futures have been consistently maintaining an upward trend since June 1, 2021 which indicates a breakout move shortly. I find that on June 17, 2021 natural gas futures have formed a double bottom at $3.188 that could result in a steep reversal up to $3.448. Undoubtedly, a sustainable move above $3.417 could result in a breakout move during the next week.

Undoubtedly, come back to commodity hedge funds has resulted in high volatility in the commodity market. Natural gas is a favorite commodity for hedge funds could continue to find extreme volatile moves amid growing probabilities of a seasonal peak of natural gas futures in November 2021.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.