- Can Microsoft maintain the top spot as the world's most valuable company?

- Microsoft's diversified growth strategy, including AI, cloud computing, and cybersecurity, sets it apart from competitors.

- Analysts forecast strong earnings for Microsoft, and with diversified revenue streams, the stock could ride the AI wave to further gains.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

Microsoft (NASDAQ:MSFT) soared to new all-time highs, closing at $456.73 and reclaiming its position as the world's most valuable company with a market cap surpassing $3.4 trillion.

Meanwhile, Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA), remain in close pursuit with market caps of $3.3 trillion and $3 trillion respectively, keeping the race for AI supremacy intensely competitive.

But beyond the headline battle, a deeper dive reveals contrasting fortunes for these tech titans. AI remains the undisputed battleground, yet Microsoft appears to be carving out a path to leadership in the AI space going forward.

Microsoft: Diversification Fuels Growth

Microsoft's strength lies in its multi-pronged approach. While AI development is a core focus, the company strategically invests in other promising areas, mitigating risk and offering investors a more comprehensive value proposition.

This strategy is evident in several key moves:

- Early AI Adoption: Microsoft's partnership with OpenAI, an industry leader, positioned it ahead of the curve. Integrating ChatGPT features into Office products significantly boosted revenue streams.

- Cloud Computing Innovation: Microsoft successfully leveraged AI in its Azure cloud services, offering an attractive alternative to traditional storage investments for businesses. This innovation continues to fuel Azure's growth.

- Cybersecurity Focus: Microsoft's ongoing investments in cybersecurity represent a potential future growth engine, further diversifying its revenue streams.

This multi-faceted approach keeps investors bullish, with demand for MSFT shares remaining strong.

How Are the Competitors Faring So Far?

While Apple has finally jumped on the AI bandwagon with its "Apple Intelligence" project, its impact remains unclear. Potential revenue seems limited to potential integration with newer iPhone models, and its success is far from guaranteed.

Nvidia's explosive growth since 2023 is undeniable. Riding the AI wave, it's become the undisputed leader in high-speed computing power. However, its dependence on a single segment raises concerns. If the demand for AI plateaus or GPU demand declines, Nvidia could face a significant financial blow. Additionally, established chip manufacturers pose a competitive threat with their technological advancements.

Microsoft's Edge

Compared to Apple and Nvidia, Microsoft's diversified revenue streams offer a critical advantage. This diversification could sway investors seeking stability and long-term growth, potentially solidifying MSFT's position as a top stock pick.

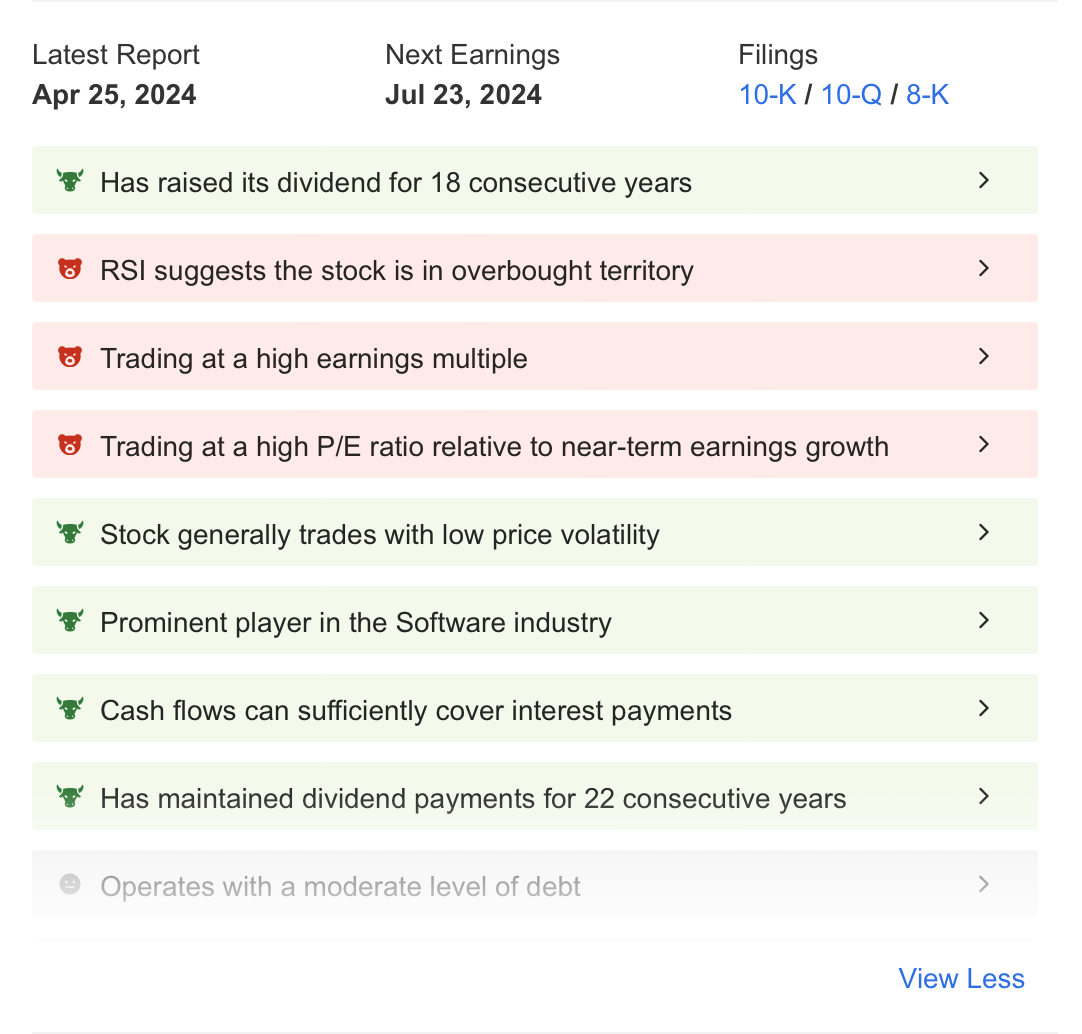

Source: InvestingPro

Let's also examine Microsoft's financials via InvestingPro. According to InvestingPro's ProTips section, Microsoft showcases several strengths:

- The company has consistently paid dividends for many years, even though the payout level is low.

- The stock experiences low price volatility.

- Cash flow sufficiently covers interest expenses.

- The company continues to offer high returns and maintain profitability both in the short and long term.

However, one noted weakness is the increasing price/earnings (P/E) ratio as the share price rises. Despite this, if Microsoft's forward-looking growth expectations hold, these high valuation ratios could remain sustainable.

What Lies Ahead?

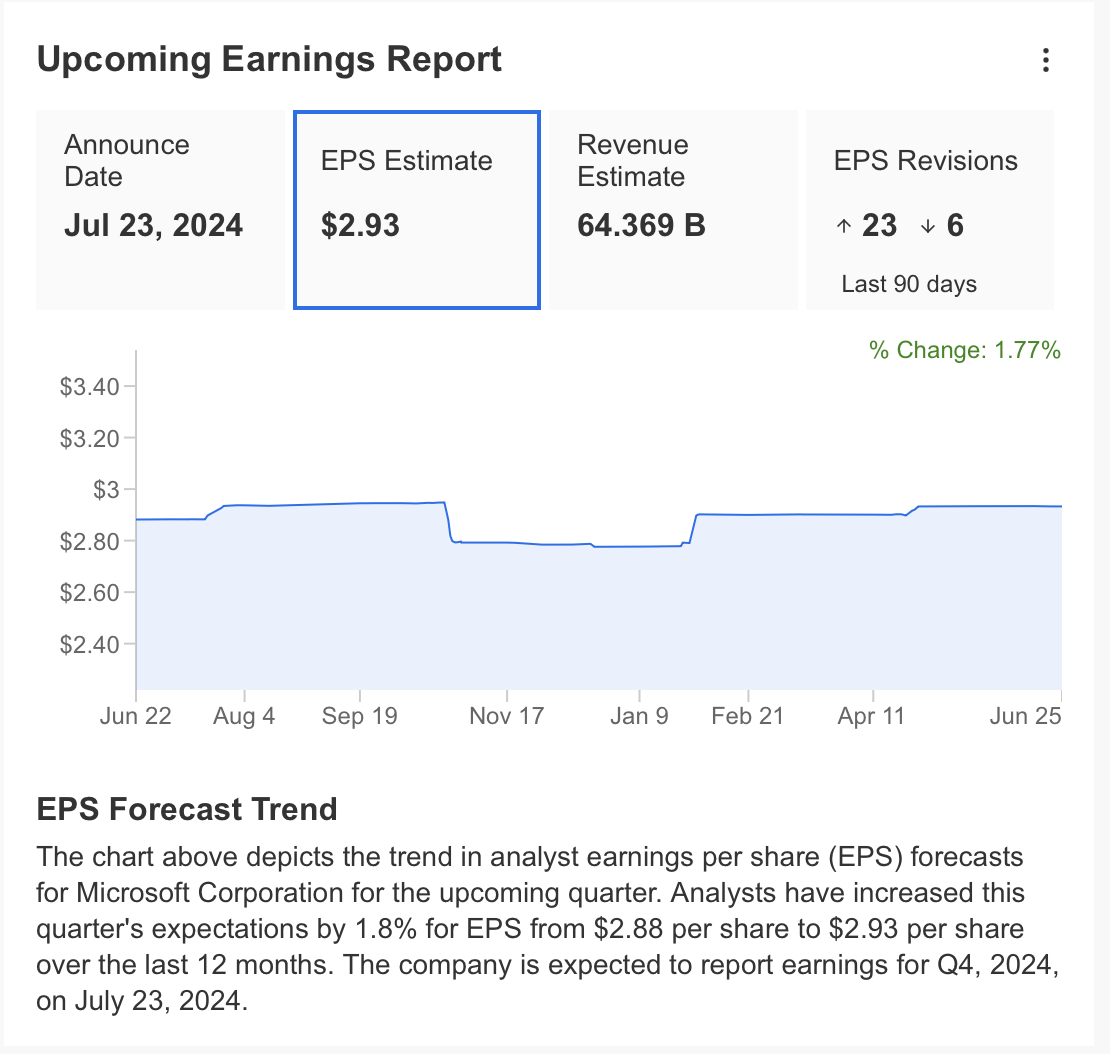

Let's take a closer look at the current forecasts for Microsoft. Analysts estimate the company will announce an EPS of $2.93 and quarterly earnings of $64.36 billion before releasing the upcoming earnings report.

Source: InvestingPro

Notably, 23 analysts have revised their estimates upward for the current period, indicating a positive outlook.

Long-term growth forecasts for Microsoft range between 15% and 20%, with analysts maintaining moderate growth expectations for the company.

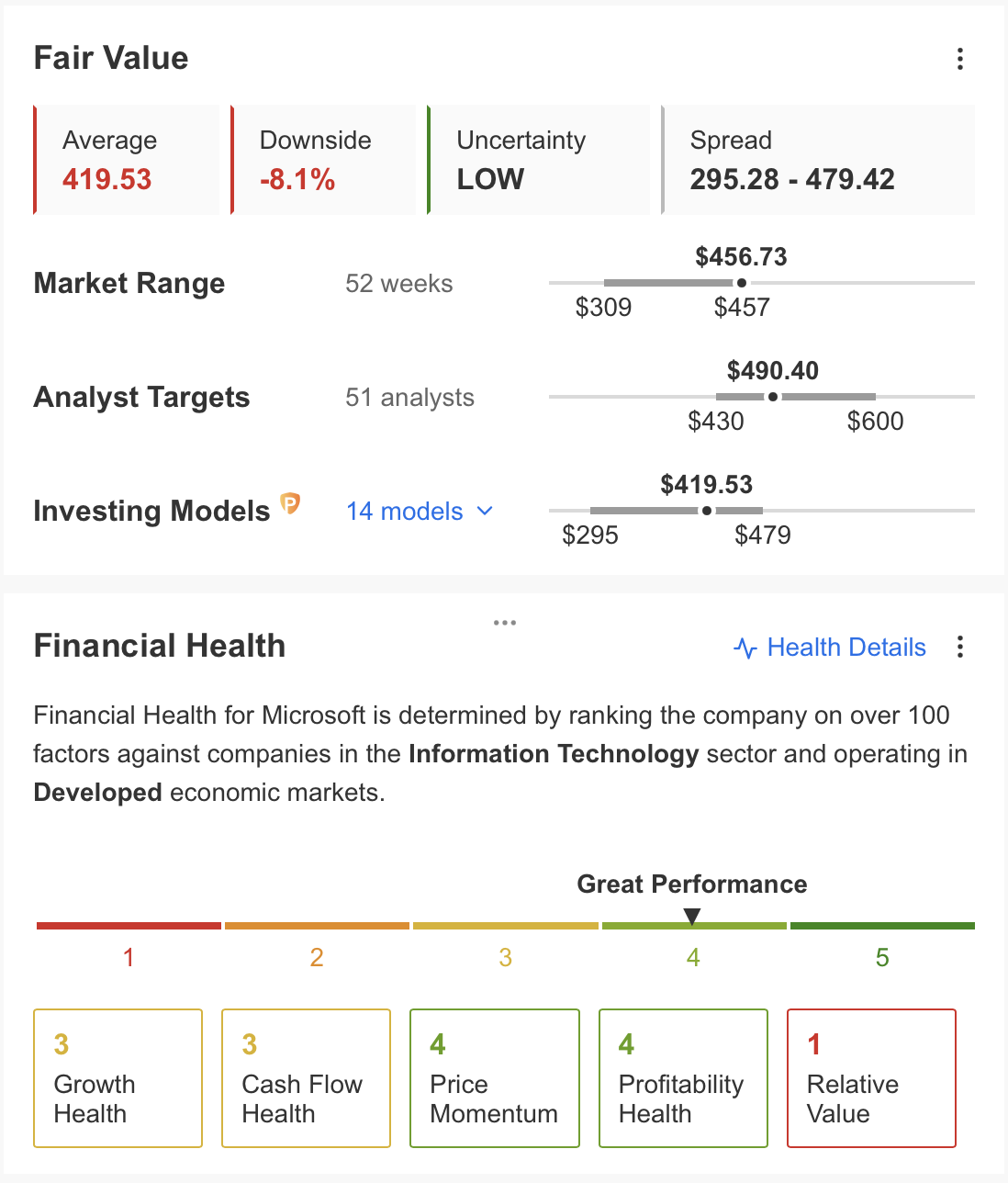

Source: InvestingPro

As a result, InvestingPro calculated the current fair value of MSFT as $419 based on 14 models according to the current financials. Analysts' consensus forecast stands at $490, indicating that the uptrend will continue.

At this point, the price level obtained from fundamental analysis can be considered as a support point for MSFT. It is also worth checking the fair value update according to the company's financials after the last quarter results expected to be announced on July 23.

MSFT Technical View

Microsoft has shown a strong long-term uptrend, especially when analyzing the past three years of stock performance. The 2022 pullback provided valuable data for understanding the current trend.

In the first half of this year, Microsoft encountered resistance around the $419 mark (Fib 1.618). However, last month, the stock achieved a clear weekly close above this resistance level, indicating that $419 has now turned into a support level.

The stock price continues to stay above the rising trend line, with $435 acting as an intermediate support and $419 as a critical support.

While MSFT may test the trend line on a weekly basis, the current trend suggests that as long as there is no weekly close below this trend line, momentum could drive the price towards the $540 range, the next Fibonacci level.

In the event of a downside, breaking below the trend line could push MSFT towards its main support around the $340 region in the medium term.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.