In 2001, an economist coined an acronym that typified investing in the initial decade of this century. Indeed, “BRIC” became part and parcel of our vocabulary.

BRIC regards four of the largest economic powerhouses in the emerging world — Brazil, Russia, India and China. And for investors, it became a must-know concept for success in the 2002-2007 global bull market.

A variety of BRIC ETFs were introduced in that time, including Guggenheim BNY BRIC (EEB), iShares MSCI BRIC (BKF) and SPDR S&P BRIC 40 (BIK). We even watched combo vehicles make their way to the table such as First Trust Chindia (FNI).

Investors quickly bought into the notion that — with 40% of the world’s population residing in these 4 countries alone — the global growth potential would translate into remarkable investing gains. And for the better part of 2002-2007, the theory held true.

By the same token, lumping the “Big 4″ into a single entity ignored unique circumstances within the individual countries. Countries like Russia were dependent on oil exports, while Brazil became one Of China’s largest raw materials suppliers. Meanwhile, many overestimated the rate at which export-driven economies would transition into middle class consumption-oriented economies. And few BRIC advocates had anticipated the ways in which different cultures would respond differently to global shocks.

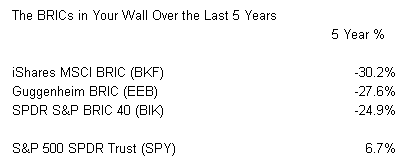

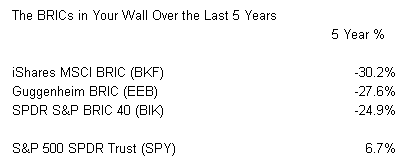

It follows that the 10/07-3/09 bear decimated portfolios with large BRIC exposure. Moreover, BRICs have severely underperformed in the 2009-2012 period.

The consequence of greed… of earning more through BRIC-heavy portfolios… has been significant underperformance over the last 5 years. What’s more, the ETFs themselves have been less successful in terms of investor interest via waning assets under management.

The fact that these ETFs have been bleeding assets is primarily due to a shift from greed-based investing to fear-based investing. Whether that is rational, emotional or a combination of both, it’s clear that fund providers recognize that a new BRIC ETF would have virtually no chance of succeeding right now. (Note: It’s also clear that investors with well-defined exit strategies haven’t experienced the depth of BRIC under-performance over the last 5 years.)

What concept is succeeding? Low volatility funds. Why? For one thing, the 2009-2012 bull market has been noticeably kind to non-cyclical sectors like health care and staples — segments that tend to be safer haven equity choices. In addition, whether the media is talking about the fiscal cliff or Europe’s ceaseless sovereign debt drama, investors are still fearful.

Indeed, fund providers have been quick to capitalize on the idea that you can invest for better than 0% in a savings account without the stress associated with the Dow falling 1000 points in a week. And low volatility funds have experienced reasonably solid results in 2012.

While it is intriguing to see “Low Volatility ETFs” garner a chunk of the upside of broad market benchmarks, it is critical to understand where we are in a fear-greed cycle. Specifically, the events of 2008 as well as the subsequent crises (e.g., European debt, “Taxmageddon, etc.) lead money managers as well as individuals toward less risky watering holes. And that’s fine… for now.

On the other hand, one would be wise to recognize that yield-oriented ETFs and low volatility ETFs are not “buy-n-forget-about-them” solutions. Rising interest rates could hurt the former, as well as the latter, to the extent the latter is heavily exposed to utility stocks. Most importantly, where the investment community sits on the fear-greed continuum will affect both the types of concepts that ETF marketers may hype as well as the performance of those ETFs themselves.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

BRIC regards four of the largest economic powerhouses in the emerging world — Brazil, Russia, India and China. And for investors, it became a must-know concept for success in the 2002-2007 global bull market.

A variety of BRIC ETFs were introduced in that time, including Guggenheim BNY BRIC (EEB), iShares MSCI BRIC (BKF) and SPDR S&P BRIC 40 (BIK). We even watched combo vehicles make their way to the table such as First Trust Chindia (FNI).

Investors quickly bought into the notion that — with 40% of the world’s population residing in these 4 countries alone — the global growth potential would translate into remarkable investing gains. And for the better part of 2002-2007, the theory held true.

By the same token, lumping the “Big 4″ into a single entity ignored unique circumstances within the individual countries. Countries like Russia were dependent on oil exports, while Brazil became one Of China’s largest raw materials suppliers. Meanwhile, many overestimated the rate at which export-driven economies would transition into middle class consumption-oriented economies. And few BRIC advocates had anticipated the ways in which different cultures would respond differently to global shocks.

It follows that the 10/07-3/09 bear decimated portfolios with large BRIC exposure. Moreover, BRICs have severely underperformed in the 2009-2012 period.

The consequence of greed… of earning more through BRIC-heavy portfolios… has been significant underperformance over the last 5 years. What’s more, the ETFs themselves have been less successful in terms of investor interest via waning assets under management.

The fact that these ETFs have been bleeding assets is primarily due to a shift from greed-based investing to fear-based investing. Whether that is rational, emotional or a combination of both, it’s clear that fund providers recognize that a new BRIC ETF would have virtually no chance of succeeding right now. (Note: It’s also clear that investors with well-defined exit strategies haven’t experienced the depth of BRIC under-performance over the last 5 years.)

What concept is succeeding? Low volatility funds. Why? For one thing, the 2009-2012 bull market has been noticeably kind to non-cyclical sectors like health care and staples — segments that tend to be safer haven equity choices. In addition, whether the media is talking about the fiscal cliff or Europe’s ceaseless sovereign debt drama, investors are still fearful.

Indeed, fund providers have been quick to capitalize on the idea that you can invest for better than 0% in a savings account without the stress associated with the Dow falling 1000 points in a week. And low volatility funds have experienced reasonably solid results in 2012.

While it is intriguing to see “Low Volatility ETFs” garner a chunk of the upside of broad market benchmarks, it is critical to understand where we are in a fear-greed cycle. Specifically, the events of 2008 as well as the subsequent crises (e.g., European debt, “Taxmageddon, etc.) lead money managers as well as individuals toward less risky watering holes. And that’s fine… for now.

On the other hand, one would be wise to recognize that yield-oriented ETFs and low volatility ETFs are not “buy-n-forget-about-them” solutions. Rising interest rates could hurt the former, as well as the latter, to the extent the latter is heavily exposed to utility stocks. Most importantly, where the investment community sits on the fear-greed continuum will affect both the types of concepts that ETF marketers may hype as well as the performance of those ETFs themselves.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.