The crypto market continues to show unchanged price dynamic: the total capitalization of cryptocurrencies has frozen around $220 billion, and if earlier this process mostly was associated with “stagnation”, now we can hear the word “stability” more often. The community remembered the times when Microsoft (NASDAQ:MSFT) and Steam accepted Bitcoin and cryptocurrencies in general carried a similar meaning to fiat currencies.

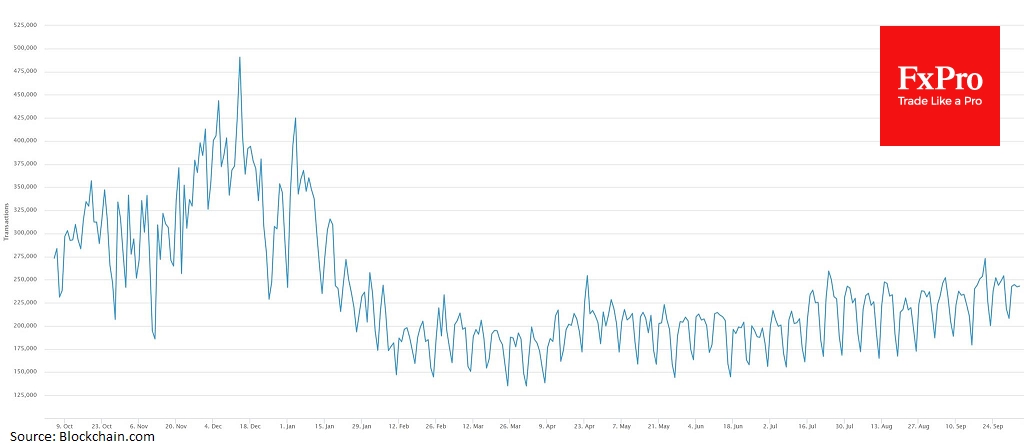

Bitcoin and altcoins are traded at about 0%, indicating a lack of speculative demand. Nevertheless, the average number of confirmed transactions per day has recently become a more significant indicator. Bitcoin shows a confident 244,000 transactions per day compare with 120-200k from February to July.

Amid growing uncertainty about the global economy, including protectionism, sanctions policy, erroneous monetary policies and especially the US-Chinese trade war, we can expect more frequent usage of cryptocurrencies for buying goods and services in developing economies. For example, 150 crypto ATMs are planned to be installed in Argentine at the background of expected inflation growth above 40% by the end of the year. Inflation is doing its job: citizens of countries whose national currencies are rapidly depreciating tend to find more stable assets, and stabilization of cryptocurrency rates makes this desire even stronger.

It can also be assumed that, against the background of the US-launched trade war against China, Beijing, that effectively banned the entire cryptocurrency industry in the country, may replace it with its own version if the Washington's protectionist policy will affect Chinese external payments system. In anticipation of clear regulation the largest US investment banks – Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS) and Citigroup (NYSE:C) – are ready to offer a range of products to the market.

Smaller companies also tend to be ready for the emergence of transparent regulation expecting the huge demand for new technologies in the financial sector. In the case of a positive regulators position, the cryptocurrency market can expect a new, even larger scale rally, as well as the subsequent rollback, and unfortunately, this process will again have negative impact on the cryptocurrencies as the payment method.

Alexander Kuptsikevich, the FxPro analyst