- To taper or not to taper?

- Increased Japanese QE coming soon

- Impact on the rest of the world

- Lower short-term interest rates towards zero.

- Implement QE, involving the purchase of longer term bonds.

- Suppress bond yields and thereby interest rates (check).

- Buying the bonds from banks and other institutions who can use that money to lend out and therefore stimulate the economy (hasn't happened).

- The printed money also helping banks to repair their balance sheets, devastated by 2008 (check, at least in the U.S.)

- Keeping short-term rates near zero means pitiful bank deposit rates and tempting depositors into higher yielding but higher risk investments (check).

- Rising asset prices inducing the wealth effect, where people feel wealthier and start to spend again (minimal success, but let's wait and see).

- Keeping interest rates below GDP rates, thereby reducing the developed world's large debt to GDP ratios (slow progress given sluggish GDP).

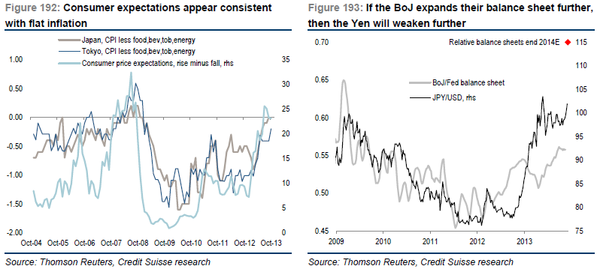

- To reach a targeted 2% annual inflation rate requires the yen to depreciate by around 15% per year. That translates into a +115 yen/dollar rate by the end of next year.

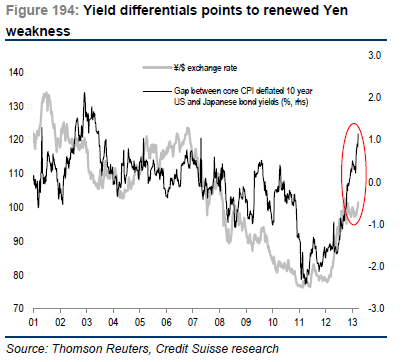

- If U.S. tapering occurs, that will widen the yield differentials between U.S. and Japanese bonds even further. Those yield differentials currently point to fair value of 115-120 yen/dollar rate.

- More QE should result in more money heading offshore and a subsequent weakening of the yen.

- Japan will export even more deflation to the world when it least needs it. By this I mean that a lower yen allows Japanese exporters to price their products more competitively vis-vis other exporters. This would raise already heightened global deflationary risks.

- It'll put other exporting powerhouses, such as Germany, China and South Korea, in a less competitive position, increasing the odds of a backlash via currency war. The yen at 115 or 120/dollar would change the ballgame and increase the risks of this occurring.

- Any currency war risks a trade war. Historically, trade wars reduce global trade, sometimes significantly.

- Putting China in a weakened exporting position will possibly increase tensions in the South China Sea. Tensions are already high and a lower yen won't help the cause.

- You don't have to have a wild imagination to see that if Japan's experiment doesn't help lift inflation and the economy, a desperate, nationalist Prime Minister may just be more inclined to take the fight up to China.

The traditionally quiet period for markets in December is turning out to be not-so-quiet, thanks to a key meeting of the U.S. Federal Reserve starting December 17. The meeting will decide on whether a reduction in quantitative easing (QE) is necessary. Consequently, every economic data point up to the meeting is being analysed and over-analysed. But it does appear that the Fed seems committed to so-called tapering at some point soon and the odds are 50:50 that it'll pull the trigger in December.

A few weeks ago, I was asked for my 2014 global outlook by a large precious metals website and I told the editor that while tapering will be a key theme, Japan is likely to prove equally important if not more so. The editor was taken aback by this and I can understand why. But let me explain...

The Fed has been flagging tapering for some time and markets appear to have gotten used to the fact that it'll happen soon. In May, when Bernanke first hinted of tapering, markets freaked out as they assumed a rise in interest rates would come simultaneously. Since then, the Fed has been at pains to say that interest rates will stay low for several years to come while a wind down in QE occurs. Markets appear to have bought this line. They may continue to buy the line through 2014 and even 2015.

While the U.S. cuts back on stimulus, Japan is likely to move in the opposite direction, increasing its own stimulus very soon. That'll be on top of Japan's existing QE which is the equivalent of 3x that of the U.S. when compared to GDP. The reason for even more QE is that the grand experiment known as Abenomics, almost one year old, has been a failure. It hasn't lifted key components such as core inflation, wages or business spending.

Increased Japanese QE will mean a lower yen, potentially much lower. If right, that'll have significant consequences. Among other things, it'll increase the risks of exporting rivals fighting back by depreciating their own currencies and embracing a currency/trade war. Second, it's likely to raise the ire of exporting competitor, China, and raise already high tensions in the South China Sea. If more stimulus fails to lift the Japanese economy, Abe will be desperate to maintain his credibility and a fight with China could just suit his ends. Hence why Japan matters. Perhaps more than tapering.

To taper or not to taper?

It may be the time when the Fed stops with all the flirting and finally starts to cut bond purchases. Bond whiz, Bill Gross of Pimco, suggests there's a 50:50 chance, or even greater, of tapering this month. And he's probably right given the many hints from the Fed that it's ready to go down that path. If tapering does occur, markets will be assessing the potential time frame for a full wind-down of QE and the economic targets set by the Fed for that to happen.

To understand the potential consequences of tapering, let's do a quick recap of what QE is and what it's been trying to achieve. The Fed has put in place two key policies since the financial crisis:

The Fed and other central banks have done this to achieve several ends:

The Fed is now contemplating tapering as it sees a recovering economy and is worried about QE's stimulatory effects on asset prices. Tapering involves cutting back on the purchase of long-term bonds while keeping short-term interest rates near zero.

In essence, the Fed is saying: "Look everyone, we're going to keep short-term interest rates near zero for a very long time. We're resolute with this and hoping that cutting back on the buying of long-term bonds won't lead to a spike in long-term bond yields. Please, market, cooperate with us in achieving this aim."

The Fed knows markets largely control the long-term bond. It can't afford to lose control of the bond market as higher long-term bond yields would result in increased mortgage rates and rising government interest expenses. That outcome would be a disaster as consumers and governments simply wouldn't be able to cope with even a small spike in rates. And any hoped-for economic recovery would be over.

Key risks to the tapering strategy include a stronger-than-expected economic recovery or higher future inflation expectations, and the Fed moving too late to raise short-term rates. Alternatively, an economic recovery doesn't take place and more QE is needed to maintain current growth. Here, the Fed would lose immense credibility and may eventually lose control of the bond market as investors start to demand higher yields on government debt.

But these risks may not be short-term story if investors believe that tapering and rising rates don't go hand-in-hand.

Increased Japanese QE coming soon

On December 16 last year, Shinzo Abe came to power and promised the most audacious economic reforms in Japan since the 1930s in order to arrest a 23-year deflationary slump. Almost a year on, the reforms now known as Abenomics can be judged a failure. This failure may soon result in policies which could have a greater impact on markets in 2014 than the much talked about taper.

Initially Abenomics involved a strategy with the so-called three arrows. The first arrow was a dramatic expansion in the central bank's balance sheet to lift inflation to a 2% target rate. The second arrow involved a temporary fiscal support program. While the third was structural reform to the economy.

The first arrow came with much fanfare and resulted in a large depreciation of the yen. Yen devaluation wasn't a stated aim but was certainly a target given a lower currency is needed to lift inflation. The big problem is that inflation has risen for the wrong reasons via higher import costs. Core inflation is flat as wages have barely moved

The second arrow was implemented while the third arrow largely hasn't been fired. The market has been disappointed with the latter as it knows economic reform is needed for stronger and sustainable growth. Abe has resisted change on this front given the entrenched interests against reform.

A fourth arrow has been fired, though, in the form of an increased consumption tax. The tax will increase from 5% to 8% in April next year. This is necessary to raise government revenues given Japan's unsustainable budgetary position where government debt is 20x government revenues. The problem is that the tax will depress spending and cut GDP growth by an estimated 2% next year. To partially compensate for this, Abe has promised corporate tax relief and infrastructure spending of 5 trillion yen, equivalent to 1% of GDP. In other words, more stimulus to partially offset the impact from rising taxes.

Given the failure of Abenomics to lift core inflation or wages, you can soon expect even more stimulus on top of the 290 trillion yen already planned between now and end-2014. And this is likely to result in a much weaker yen, for the following reasons:

Impact on the rest of the world

If a much lower yen is on the cards, it'll have the following consequences:

The above analysis could well turn out to be incorrect. Perhaps Japan holds off on stimulus. Or it increases QE but combines it with meaningful structural reform.

Maybe. Whichever way Asia Confidential looks at it though, a substantially lower yen would seem to be something you can almost take to the bank. And the implications of that being the case are worth thinking about as we head into 2014.

That's all from us for this week.