Goldman Sachs Group, Inc. | Financials - Capital Markets | July 17 BMO

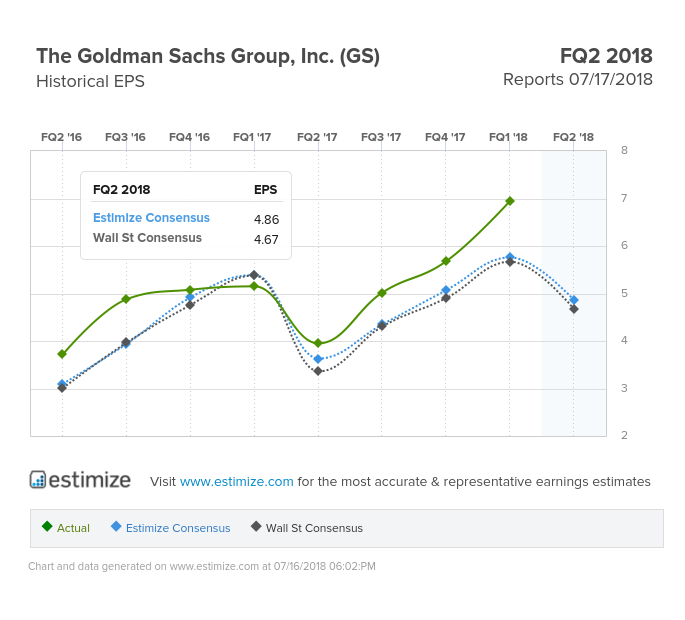

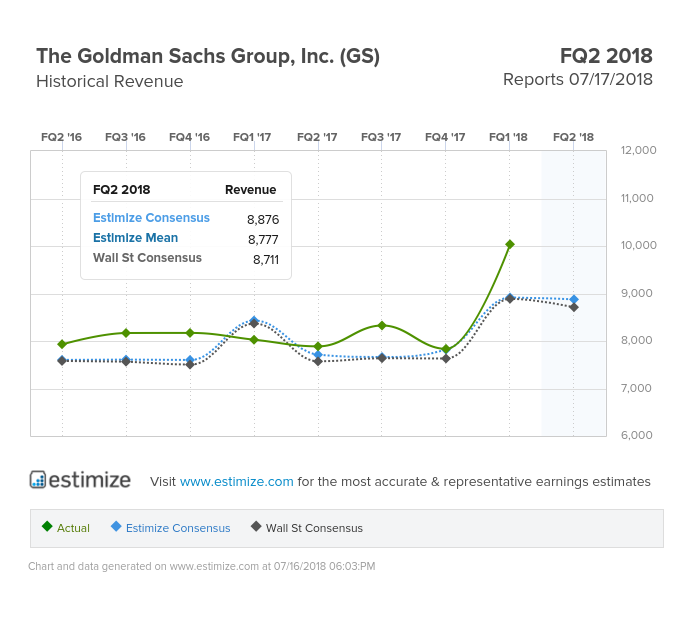

The Goldman Sachs Group (NYSE:GS) is set to release its FQ2’18 earnings Tuesday, amidst the many financial institutions reporting this week. The Estimize consensus projects an EPS of $4.87, which is more bullish than Wall Street’s estimate of $4.67. The Estimize Consensus predicts a year-over-year growth rate for earnings per share (EPS) to be 18%. Goldman Sachs has displayed a tendency to beat estimates, and therefore can be expected to beat projections for the upcoming quarter. Estimize predicts a quarterly revenue of $8.881B in comparison to Wall Street’s estimate of $8.711B. Furthermore, the Estimize Consensus has projected an Investment Banking Revenue to come in at $1.887B, which would show a 9% year-over-year growth rate.

Goldman Sachs will name its current president, David Solomon, as CEO on Tuesday. He will replace current CEO, Lloyd Blankfein, who has been with Goldman for many years. In recent years, Goldman has shifted away from trading, and more toward investment banking and asset management. GS believes that this change in leadership will accelerate this shift and boost the company in a positive direction.

What do you expect from GS?