More than a month has gone by since the last earnings report for Watts Water Technologies, Inc. (NYSE:WTS) . Shares have lost about 3.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Watts Water Tops Q2 Earnings, Records In-Line Revenues

Watts Water reported second-quarter 2017 adjusted earnings of $0.83 per share, up 11% year over year, primarily on the back of operational improvement, driven by productivity and restructuring initiatives. Earnings also surpassed the Zacks Consensus Estimate of $0.80.

On a reported basis, including special items, Watts Water’s earnings were $0.79 per share in the quarter, down 5% year over year from $0.83 recorded in the year-ago quarter.

Total revenue was up 2% year over year to $378.5 million in the quarter. It came in line with the Zacks Consensus Estimate of $379 million. Organic sales remained flat year over year.

Regionally, organic sales dipped 1% in the Americas. It was flat in Europe and improved 2% in APMEA. The Americas sales were affected by lower heating and hot water product sales, and headwinds in the retail sector and specialty sectors. In Europe, growth in drains and electronics products was offset by a decline in water and plumbing products. APMEA’s improvement was driven by growth in China.

Cost and Margins

Cost of sales edged down 0.6% year over year to $221.8 million. Gross profit increased 4% to $156.7 million. Gross margin in the reported quarter expanded 80 basis points (bps) to 41.4%. Selling, general and administrative expenses went down to $110.2 million from $110.5 million in the prior-year quarter.

Adjusted operating profit went up 7.3% to $47.3 million in the reported quarter. Adjusted operating margin advanced 60 bps to 12.5%.

Segment Performance

Americas: Net sales climbed 4.6% to $250.5 million in the reported quarter. Adjusted operating profit increased 4.8% to $41.4 million.

Europe: Net sales declined 3% year over year to $110.7 million. The segment reported adjusted operating profit of $13 million compared to $12.8 million recorded in the year-ago quarter.

APMEA: Net sales remained flat year over year at $17.3 million. Adjusted operating profit surged 37.5% to $2.2 million from $1.6 million in the prior-year quarter.

Financial Performance

Watts Water had cash and cash equivalents of $217.5 million at the end of second-quarter 2017 compared with $338.4 million at the end of 2016. The company recorded cash from operations of $9 million for the six-month period ended Jul 2, 2017, compared with $7.8 million recorded in the comparable period last year.

Watts Water repurchased 73,000 shares of Class A common stock for $4.5 million during the quarter.

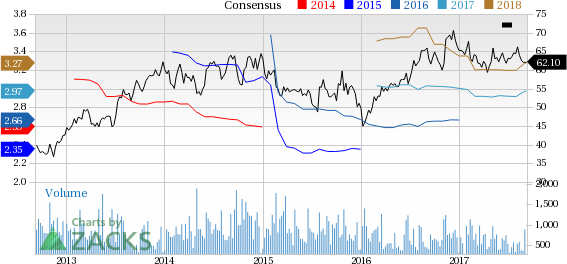

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Watts Water's stock has an average Growth Score of C, however its Momentum is doing a bit better with an B. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for momentum investors than those looking for value and growth.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Watts Water Technologies, Inc. (WTS): Free Stock Analysis Report

Original post