A month has gone by since the last earnings report for Waters Corporation (NYSE:WAT) . Shares have lost about 2.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Waters Q2 Earnings Beat on Broad-Based Sales Growth

Waters Corp. has a brilliant earnings beat streak, spanning 11 quarters of positive earnings surprises, which the company broke just once as it reported in-line earnings once last year.In second-quarter 2017, Waters Corp. continued its impressive streak, as the company’s adjusted earnings of $1.76 per share trumped the Zacks Consensus Estimate of $1.72 by 2.3%.

The bottom-line figure fared even better in year-over-year comparison, reflecting striking growth of 11.4% from the prior-year quarter tally of $1.58. Remarkable broad-based top-line expansion, along with spectacular growth in Asia, aided the earnings beat.

Solid operational execution backed by the company’s efficient business model also lent strength to the results. Further, a decline in interest expenses aided quarterly profits.

Inside the Headlines

In the reported quarter, Waters Corp.’s net sales grew 4% year over year to $558 million and also came ahead of the Zacks Consensus Estimate of $552.9 million.

The upside in the top line came on the back of robust performance in the industrial end markets (up 7% on a constant currency basis) and the bio/pharmaceutical end market (up 4% on a constant currency basis). The momentum was further aided by growth of 5% (on a constant currency basis) in the government and academic markets.

Also, impressive contribution from sale of key products across major geographies supplemented quarterly sales growth. In addition, Water Corp.’s recurring revenues and instrument system sales grew 5% and 3%, respectively, driving top-line growth.

In terms of geographies, Waters Corp. witnessed strong sales in Asia and Europe, which posted 14% and 5% growth, respectively, at constant currency. However, sales in the Americas continued to reflect weakness and declined 3% year over year.

Total selling and administrative expenses in the quarter came in at $130.2 million, up from $129.6 million incurred in second-quarter 2016. Research and development outlay for the quarter was $32.9 million compared with $32.6 million incurred a year ago.

Despite the rise in these expenses, operating income in the quarter climbed 1.4% year over year to $118.9 million.

Liquidity

Waters Corp.’s cash, cash equivalents and investments at the quarter end amounted to just over $3 billion, higher than the $2.81 billion recorded as on Dec 31, 2016. The company’s total liabilities at quarter end increased to about $2.48 billion from $2.36 billion as on Dec 31, 2016.

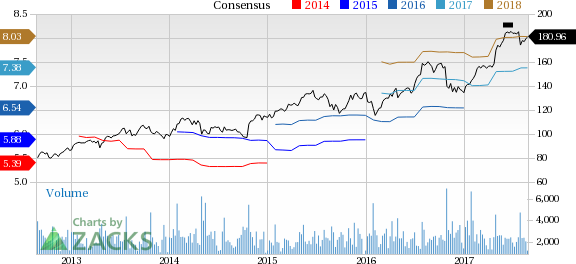

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates have trended upward during the past month. There have been three revisions higher for the current quarter compared to one lower. While looking back an additional 30 days, we can see even more upward momentum. There have been seven moves higher compared to two lower two months ago.

VGM Scores

At this time, Waters' stock has an average Growth Score of C, though it is doing a bit better on the momentum front with a B. The stock was allocated also a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is more suitable momentum than for growth based on our styles scores.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Waters Corporation (WAT): Free Stock Analysis Report

Original post

Zacks Investment Research