A month has gone by since the last earnings report for VMware, Inc. (NYSE:VMW) . Shares have lost about 10.6% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

VMware Beats on Q1 Earnings & Revenues, Guides Up

VMware reported first-quarter fiscal 2018 non-GAAP earnings (excluding stock-based compensation) of $0.99 per share, increasing 15.1% from the year-ago quarter. Including stock-based compensation, earnings were $0.72 per share, which beat the Zacks Consensus Estimate by $0.07.

The year-over-year growth in earnings was driven by strong top-line and stringent cost control which aided in expanding margins.

Revenues of $1.74 billion also topped the consensus mark of $1.71 billion and increased 9.3% on a year-over-year basis. At the end of the quarter, unearned revenue was $5.2 billion.

The strong top-line growth can be attributed to robust performance from its product offerings like NSX, AirWatch, vSphere, and vSAN. During the quarter, VMware completed the divestiture of vCloud Air Network to OVH Group, a global hyper-scale cloud provider.

Moreover, VMware recently completed the acquisition of Wavefront, an ultra high performance metrics monitoring service for cloud and modern application environments.

Hybrid Cloud & SaaS, License Bookings Shines

Services revenues (64.9% of total revenue) increased 10.7% to $1.13 billion, driven by 9.3% and 20.6% growth in Software Maintenance and Professional Services revenues, respectively.

License revenues increased 6.6% year over year to $610 million. NSX licensed bookings grew over 50% on a year-over-year basis driven by strong demand for micro segmentation security solution. Moreover, customer count increased to over 2600.

vSAN licensed bookings surged more than 150%, with customer count reaching 8000. Further, EUC license bookings were up over 20%, on the back of healthy growth in both mobile and desktop businesses.

Region wise, U.S. revenues (49.5% of total revenue) increased 7.5%, while International (50.5%) grew 11% from the year-ago quarter.

VMware’s hybrid cloud and SaaS offerings now represents more than 9% of revenues. This product segment grew 30% from the year-ago quarter. The growth was driven by continued strong adoption of vCloud Air Network, which surged 40% on a year-over-year basis.

Total Cloud management bookings were up in the mid-single digits. However, cloud management licensed bookings were down in the low teens on a year-over-year basis.

Partnerships, Large Deals Key Catalysts

VMware has inked number of partnerships, which includes the likes of Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL), Alphabet’s Google (NASDAQ:GOOGL) division and Pivotal. The company also extended its partnership with IBM (NYSE:IBM).

The company won six large deals equal to or greater than $10 million in the quarter versus one large deal in the year-ago quarter.

VMware also launched some key products during the quarter including a new release of vSAN, vCloud NFV 2.0, and Pulse IoT Center, a secure, enterprise grade Internet of Things (IoT) Infrastructure management solution.

The company also announced IoT based partnerships with HARMAN, Samsung (KS:005930) and Fujitsu.

Lower Costs Boost Margins

Gross margin (including stock-based compensation) contracted 90 basis points (bps) to 85%, primarily due to unfavorable product mix. Services gross margin contracted 140 bps, which was partially offset by 50 bps expansion in license gross margin.

Under operating expense line, research & development (R&D) as percentage of revenues increased 170 bps, fully neutralize by 170 bps and 140 bps expansion in Selling & Marketing and General & Administrative expenses, respectively.

As a result, operating margin (including stock-based compensation) expanded 60 bps to 19% in the reported quarter.

Aggressive Share Repurchase to Support Bottom-Line

VMware completed the remaining $125 million in stock repurchase from its previous authorization of $500 million. Additionally, the company repurchased $300 million of stock in the quarter from Dell Technologies. Of this 2.7 million were delivered in the reported quarter and the remaining 0.7 million will be delivered in the second quarter.

VMware currently have $900 million remaining under its $1.2 billion repurchase authorization which extends through the end of fiscal 2018.

Guidance

For second-quarter fiscal 2018, revenues are expected to be in the range of $1.840–$1.890 billion (Midpoint of $1.865 billion). License revenues are expected to be $695–$725 million (Midpoint of $710 million).

Non-GAAP operating margin is anticipated to be 30.5%. Non-GAAP earnings are expected to be in the range of $1.11–$1.14 per share (Midpoint of $1.125).

For fiscal 2018, revenues are expected to be $7.610 billion, slightly better than previous guidance of $7.57 billion. License revenues are expected to be $2.975 billion, slightly better than previous guidance of $2.97 billion.

Non-GAAP operating margin is expected to be 32.5% better than prior guidance of 32.3%. Non-GAAP earnings are expected to be $4.91 per share, up 4 cents from the previous guidance.

Capital Expenditure is expected to be $260 million. Operating cash flow and free cash flow for the fiscal are expected to be $2.70 billion (up from $2.65 billion) and $2.44 billion (up from $2.39 billion), respectively.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been six revisions higher for the current quarter

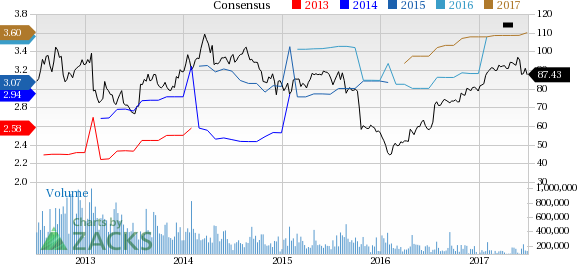

VMware, Inc. Price and Consensus

VGM Scores

At this time, VMware's stock has a strong Growth Score of 'A', though it is lagging a bit on the momentum front with a 'B'. The stock was allocated a grade of 'C' on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of 'A'. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is primarily suitable for growth investors while also being suitable for those looking for momentum and to a lesser degree value.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Vmware, Inc. (VMW): Free Stock Analysis Report

Original post

Zacks Investment Research