Stocks and Bonds Both Elevated By Low Rates

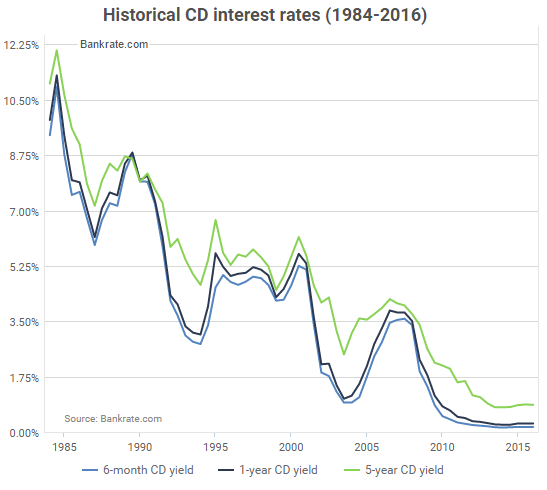

Assume you worked hard your entire life and amassed a nice nest egg, allowing you to retire if you could earn an average of 5.00% annually. That plan would not have required you to take a lot of risk when CD rates were above 5.00% in the 1980s and 1990s (see below).

Search For Higher Returns

However, when CD rates started to fall well below 5.00%, you would have been forced to either lower your income expectations or add higher-yielding investments to your retirement portfolio. The search for yield has created additional demand for riskier assets, including stocks.

Higher Rates Reduce Demand For Stocks

For illustrative purposes, if we assume the Fed raised rates back to 5.00% this month, it is easy to understand how many investors would no longer feel the need to invest a portion of their portfolios in higher-volatility assets, such as stocks. Higher rates reduce demand for riskier assets, which in turn can lead to a decline in stock prices. If we knew stocks and CDs would both produce an annual return of 5.00% over the next decade, most would prefer to own the lower-volatility asset (CDs).

Bonds Have Benefited As Well

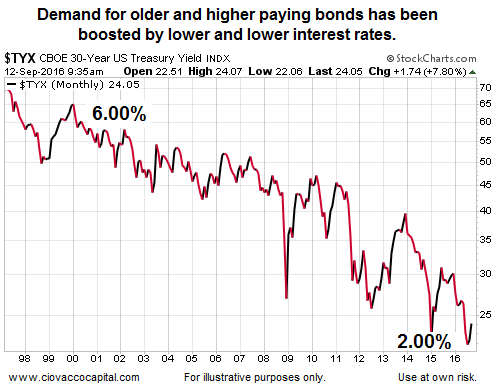

If you invested in a 30-year bond paying over 6.00% in 1999, you would be quite happy with that portion of your portfolio. Fast forward to 2016 when long-term bonds are paying closer to 2.00%. Basic supply and demand tells us most people would rather have a bond paying 6.00% per year than one paying 2.00% per year, which is why bond prices tend to benefit from lower rates. When rates begin to rise, the relative attractiveness of higher paying bonds begins to drop, which is why bond prices tend to fall when the Fed starts to raise rates. The relationship between interest rates and bond prices is based on supply and demand.tyx

Lowering Rates And The Wealth Effect

The wealth effect refers to potential economic benefits created by rising asset prices. When your 401(k) is rising, you feel better about your financial standing. Consumers who feel good about the future tend to spend more, which can be beneficial to the economy. The Fed hopes to stimulate the economy via the wealth effect when they lower interest rates.

Stocks And Bonds Vulnerable To Higher Rates

Rising interest rates can hurt stocks by reducing the demand for riskier assets relative to safer assets. Higher rates can also negatively impact bond prices by reducing the relative attractiveness of higher-yielding bonds that were issued when interest rates were higher. Therefore, stocks and bonds could both sell off if the Fed continues to raise interest rates.

The Wealth Effect Shifts Into Reverse

If higher interest rates put pressure on both stock and bond prices, it stands to reason higher rates can also flip the wealth effect into reverse. When your 401(k) drops, you may not feel as confident to spend and consume as you did when the balance was rising.

Higher Rates Could Spark A Deflationary Spiral In Asset Prices

Last Friday’s plunge in both stocks and bonds provided the Fed with a little reminder of what followed their December 2015 rate hike. The Fed is concerned rate hikes could kick off a difficult to contain deflationary spiral. If asset prices fall, fear increases, causing more investors to hit the sell button…which causes asset prices to fall further and fear to increase…rinse and repeat.

Investors Know Fed Has Juiced Stocks And Bonds

Since central banks have been injecting themselves into the economy and markets with much greater frequency in recent years, investors are well aware of the risks posed by higher interest rates. This knowledge has created a marketplace that has become increasingly skeptical of the Fed’s constant chatter about additional rate hikes. For example, even after numerous Fed speakers talked tough last week on rates, market odds for a September rate hike were still sitting around 24%, meaning the market was saying there was roughly a 76% probability the Fed does not raise rates in September.

How High Are The Risks Of A Bear Market?

In a bear market, stocks tend to make a series of lower highs and lower lows. In a bull market, stocks tend to make a series of higher highs and higher lows. Note in both cases, the stock market pulls back when it makes a low. Therefore, our concerns increase when the odds of a new bear market are escalating. To make sure we are comparing longer-term apples to longer-term apples, this week’s video covers updated charts from longer-term outlooks outlined on August 20 and September 2. The video also reviews historical cases when volatility followed a bullish breakout from a long-term consolidation box, similar to what recently occurred in all three major U.S. stock indexes. Reviewing facts regarding longer-term bullish probabilities relative to longer-term bearish probabilities allows us to assess the odds of an ongoing bull market relative to the odds of a new bear market.

Low Rates And Excessive Debt

When companies and governments can borrow money for next to nothing, it creates additional incentive to issue more debt. As noted above, rising rates can put pressure on debt instruments. The relationship between global debt, the Fed, and interest rates was outlined in detail in Debt’s Impact On Central Banks, Stocks, Bonds, And Gold.