A month has gone by since the last earnings report for SUPERVALU (NYSE:SVU) . Shares have lost about 5.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

SUPERVALU Q1 Earnings Miss; Sales Top Estimates

SUPERVALU posted better-than-expected sales in first-quarter fiscal 2018. This marked second straight quarter of sales surprise after missing the consensus for seven quarters. However, earnings missed the Zacks Consensus Estimate.

Quarter in Detail

SUPERVALU posted adjusted earnings per share of $0.09 per share that marginally lagged the Zacks Consensus Estimate of $0.10 by 10.0%. However, earnings grew 12.5% from the prior-year quarter, backed by higher sales in the wholesale business, offset by higher tax rate.

Net sales rose 6.3% year over year to $4.0 billion. Also, the top line came ahead of the Zacks Consensus Estimate of 3.9 billion by 0.6%. This upside was backed by increased sales witnessed at the Wholesale segment, but were hurt by the decline in Retail net sales. The company also lost some volumes as Marsh Supermarkets, one of the company’s large affiliations from fiscal 2017, filed for bankruptcy protection in May.

Gross profit was almost flat from the prior-year quarter at $551 million. However, margin contracted 80 basis points to 13.8%, due to the change in business segment mix, with Wholesale representing a larger portion of total sales and gross profit. Adjusted operating earnings also plummeted 24.7% due to higher selling and administrative costs.

Segment Details

Wholesale: Net sales at Wholesale business grew 12.4% year over year to $2.6 billion, mainly driven by sales to new customers, coupled with greater sales from new outlets operated by existing customers. These were partly compensated by stores from the previous year that are no longer supplied by the company. Lower military sales also dented sales growth. Also, the segment’s operating income came in at $71 million, up from $64 million recorded in the year-ago quarter. Operating margin however remained flat at 2.8%.

Retail: Net sales at Retail slipped 2.7% to $1.4 billion. This decrease represents store closures and unfavorable identical store sales of 4.9%, partly mitigated by sales from acquired and new outlets. Moreover, customer counts decreased 5.0%, while average basket size slightly increased in the quarter. Also, deflation remained flat in the quarter.

In fact, we note that this leading grocery dealer is witnessing sluggish sales in the retail business due to tough competitive pressure, lower store traffic and deflationary environment in the food industry. This is the ninth consecutive quarter of comp sales decline of the retail segment.

Further, the segment reposted operating loss of $4 million, down from $8 million of operating earnings in the year-ago quarter, due to lower sales and higher employee costs, partially due to acquired and new stores.

Corporate: During the fiscal first quarter, fees earned under services agreements were down 6.8% to $55 million. Further, the segment reported adjusted operating earnings of $13 million, down 7.1% as against operating income of $14 million delivered in the year-ago quarter.

Other Developments

At the end of the first quarter, SUPERVALU closed its deal to buy grocery distributor Unified Grocers for $375 million. This deal is in line with the company’s Wholesale segment’s three-pronged strategy, which focuses on maintaining its existing customers; discovering more business with the existing customers and adding new wholesale customers. Hence, the acquisition will boost Supervalu’s wholesale business and will also complement its customer base.

Financial Update

SUPERVALU’s cash and cash equivalents totaled $252 million as of Jun 17, 2017, compared with $332 million as of Feb 25, 2017. Long-term debt was $1.28 billion and total stockholders’ equity came in at $397 million as of Jun 17, 2017, compared with long-term debt of $1.26 billion and stockholders’ equity of $383 million in the preceding quarter.

Further, net cash from operating activities of continuing operations came in at $47 million in the quarter.

Outlook

For fiscal 2018, management expects adjusted EBITDA, including Unified Grocers, of $475 to $495 million.

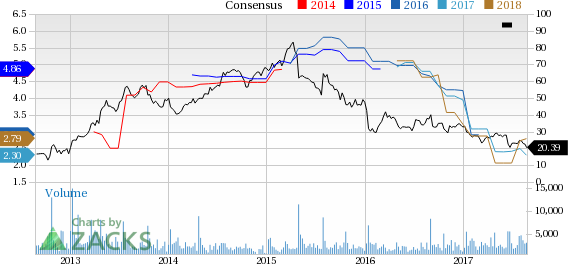

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend infresh estimates. There have been three revisions higher for the current quarter compared to one lower.

VGM Scores

At this time, SuperValu's stock has a poor Growth Score of F, however its Momentum is doing a lot better with a B. However, the stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than momentum investors.

Outlook

While estimates have been broadly trending upward for the stock, the magnitude of these revisions indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

SuperValu Inc. (SVU): Free Stock Analysis Report

Original post

Zacks Investment Research