About a month has gone by since the last earnings report for Sonic Automotive, Inc. (NYSE:SAH) . Shares have lost about 14.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Sonic Automotive’s Q2 Earnings & Revenues Miss Estimates

Sonic Automotive registered adjusted earnings per share of 40 cents in second-quarter 2017 compared with 50 cents in the year-ago quarter. Earnings missed the Zacks Consensus Estimate of 48 cents per share.

Total revenue in the reported quarter increased 1% to $2.41 billion. The figure, however, missed the Zacks Consensus Estimate of $2.44 billion.

Revenues from total new vehicles declined 0.9% year over year to $1.28 billion, while that from used vehicles increased 3.2% to $641.9 million in the quarter. Wholesale vehicle revenues rose 46.6% to $40.8 million. Revenues from parts, service and collision repair increased 2.8% to $361.1 million, while finance, insurance and other revenues grew 3.4% to $86.9 million.

Gross profit increased to $360.6 million in the reported quarter from $353.3 million a year ago. Selling, general and administrative expenses increased to $293.9 million from $277.2 million in the year-ago quarter. The company reported operating income of $42.2 million compared with $57 million in the year-ago quarter.

Dividend Update

The board of directors at Sonic Automotive announced a quarterly dividend of 5 cents per share. The dividend will be paid on Oct 13, 2017, to shareholders on record as of Sep15.

Business Update

During the quarter, the company’s EchoPark stores retailed 2,049 units, up over 80% year over year. Also, the company has plans of accelerated expansion of another 15 EchoPark stores.

During second-quarter 2017, the company opened a new Audi store in Pensacola, Florida and the sixth EchoPark store in Colorado.

2017 Outlook

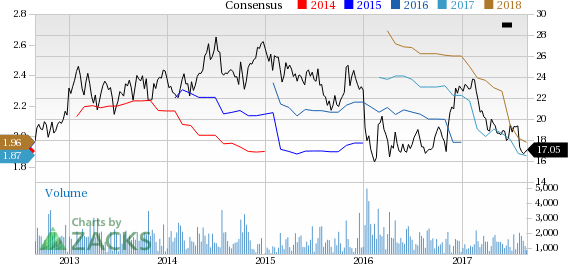

Sonic Automotive expects adjusted earnings per share in 2017 in the band of $1.85–$1.95 per share.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Sonic Automotive's stock has a poor Growth Score of F, however its Momentum is doing a lot better with a A. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than value investors.

Outlook

The stock has a Zacks Rank #5 (Strong Sell). We are expecting a below average return from the stock in the next few months.

Sonic Automotive, Inc. (SAH): Free Stock Analysis Report

Original post

Zacks Investment Research