A month has gone by since the last earnings report for Sallie Mae (NASDAQ:SLM) . Shares have lost about 7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Sallie Mae Q2 Earnings In Line, Costs & Provisions Rise

Sallie Mae reported second-quarter 2017 core earnings of $0.16 per share, in line with the Zacks Consensus Estimate. The bottom line, however, increased 33% from the prior-year quarter.

Earnings growth was supported by an increase in net interest income. The private education loan portfolio and deposits grew considerably. However, these positives were offset by lower non-interest income, higher expenses and rise in provision for loan losses.

Sallie Mae reported core earnings (primarily adjusted for derivatives) of $69 million, up 35% from the year-ago quarter.

Increased Net Interest Income Offsets Higher Expenses

Net interest income for the second quarter was $269.9 million, up 27% year over year. The improvement was mainly driven by an increase in the portfolio size of private education loans. Net interest margin expanded 7 basis points (bps) year over year to 5.91%.

Non-interest income came in at $7 million, reflecting a 55% decrease from the prior-year quarter. The fall was mainly due to loss on derivatives and hedging activities and lower other income.

The company’s total expenses increased 17.2% year over year to $111.4 million. The rise was mainly due to increased compensation and benefits expenses, higher FDIC assessment fees and other expenses.

Efficiency ratio, on a non-GAAP basis, declined to 39.7% in the quarter from 41.8% in the year-ago quarter. A lower ratio indicates improved profitability.

Credit Quality Worsens

Provision for loan losses was $50.2 million, up 20.2% year over year.

Delinquencies as a percentage of private education loans in repayment were 2.2%, reflecting an increase from 2.1% in the year-ago quarter.

Growth in Deposit and Loans

As of Jun 30, 2017, deposits of Sallie Mae Bank were $13.8 billion, up from $11.9 billion as of Jun 30, 2016. Increases in broker deposits along with retail and other deposits contributed to the rise.

As of Jun 30, 2017, the private education loan portfolio was $15.5 billion, up 27.2% year over year. Loan origination climbed 2% year over year to $431 million in the reported quarter. Average yield on the loan portfolio was 8.33%, up 35 bps year over year.

Strong Capital Position

As of Jun 30, 2017, Sallie Mae Bank’s Tier 1 capital to risk-weighted assets and common equity Tier 1 capital were both 12.5%. Capital ratios exceeded the “well capitalized” industry benchmark in regulatory requirements.

2017 Outlook

The company expects core earnings per share in the range of $0.71–$0.72.

Operating efficiency ratio on a non-GAAP basis is expected in the range of 38–39%.

Private education loan originations are projected to be $4.9 billion.

Management expects the total risk-based capital ratio to be 13%.

The company expects charge-off rate to decline in third quarter sequentially.

Allowance for loan losses is expected to be about 1.40%.

How Have Estimates Been Moving Since Then?

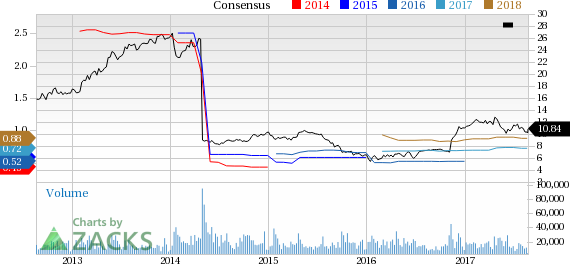

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Sallie Mae's stock has a subpar Growth Score of D, however its Momentum is doing a lot better with a B. The stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for momentum investors based on our styles scores.

Outlook

The stock has a Zacks Rank #4 (Sell). We expect below average returns from the stock in the next few months.

SLM Corporation (SLM): Free Stock Analysis Report

Original post

Zacks Investment Research