It has been about a month since the last earnings report for Rogers Communication, Inc. (NYSE:RCI) . Shares have lost about 1.5% in that time frame, outperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Rogers Communications Q2 Earnings Beat, Revenues Miss

Net Income

Quarterly net income was approximately $394.53 million compared with $292.74 million in the year-ago quarter. Adjusted earnings per share of $0.74 were above the Zacks Consensus Estimate of $0.71. The bottom line grew 19.35% year over year.

Revenue

Quarterly total revenue came in at around $2,670 million, down 0.39% year over year and below the Zacks Consensus Estimate of $2,762.8 million.

Operating Metrics

Adjusted operating profit was $1,047.63 million compared with $1,000.82 million in the year-ago quarter. Quarterly adjusted operating profit margin was 39.3% versus 39.0% from the year-ago quarter.

Cash Flow

During the reported quarter, Rogers Communications generated $611.49 million of cash from operations compared with $832.90 million at the end of Jun 2016. Free cash flow was $465.12 million compared with $367.79 million in the year-ago quarter.

Liquidity

In quarter under review, change in the cash and cash equivalents on Rogers Communications’ balance amounted $18.58 million. Total outstanding long-term debt was approximately $11,454.83 million compared with $11,807.76 million at the end of Dec 2016.

Wireless Segment

Quarterly total revenue came in at around $1,521.66 million, up 6% year over year. Service revenues totaled $1,430.28 million, up 8% from the year-ago quarter. Equipment sales were $91.39 million, down 14% year over year.

Quarterly adjusted operating profit for the segment was $686.53 million, up 9% year over year. Adjusted operating profit margin was 48.0% compared with 47.3% in the year-earlier quarter.

Quarterly blended ARPU (average revenue per user) was $62.13, compared with $60.18 in the year-ago quarter. As of Jun 30, the prepaid subscriber base totaled 1.689 million, with a gain of 77,000 subscribers from the year-ago quarter. Monthly churn rate was 3.96% compared with 3.57% in the prior-year quarter.

As of Jun 30, Rogers Communications’ postpaid wireless subscriber base totaled 8.710 million. In the second quarter, the company added 93,000 postpaid wireless subscribers. Quarterly postpaid ARPA (average revenue per account) was around $124.31 compared with $116.06 in the year-ago quarter. The monthly churn rate was 1.05% versus 1.14% in the prior-year quarter.

Cable Segment

Quarterly total revenue came in at $646.41 million, flat year over year. Service revenues totaled $645.67 million, flat year over year. Internet revenues were $298.69 million, up 7% year over year. Television (Video) revenues were $280.11 million, down 4% year over year. Telephony revenues totaled $66.87 million, down 9% year over year. Equipment sales were $1.51 million, flat year over year.

Quarterly adjusted operating profit for the segment was $318 million, up 3% year over year. Adjusted operating margin was 49.2% compared with 47.7% in the year-ago quarter.

As of Jun 30, the high-speed Internet subscriber count was 2.186 million. Rogers Communications added 11,000 high-speed Internet customers in the quarter. Video subscriber base totaled 1.771 million, after a loss of 25,000 users. Telephony subscriber count was 1.098 million. The company lost 2,000 telephony subscribers in the reported quarter.

Media Segment

Quarterly total revenue came in at $473.29 million, up 4% year over year. Quarterly operating expenses rose 9% year over year to $426.48 million. Adjusted operating profit margin came in at 9.9% versus 14.6% with the year-ago quarter.

Business Solutions Segment

Quarterly total revenue came in at $71.33 million, down 1% year over year. Of the total, next-generation revenues were $58.69 million, up 1%. Legacy revenues were $11.14 million, down 12%. Service revenues were $69.84 million, down 1%. Equipment revenues were $1.49 million, flat year over year. Quarterly adjusted operating profit was $23.78 million, up 3% year over year. Adjusted operating margin was 33.3% compared with 32.0% in the year-ago quarter.

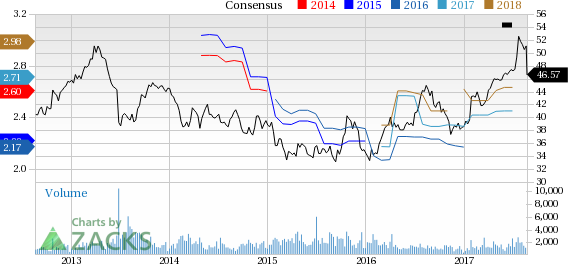

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Rogers Communication's stock has an average Growth Score of C, though it is lagging a lot on the momentum front with an F. Charting a somewhat similar path, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable for growth and value based on our styles scores.

Outlook

The stock has a Zacks Rank #2 (Buy). We are expecting an above average return from the stock in the next few months.

Rogers Communication, Inc. (RCI): Free Stock Analysis Report

Original post

Zacks Investment Research