More than a month has gone by since the last earnings report for Prudential Financial, Inc. (NYSE:PRU) . Shares have lost about 13.8% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Prudential Financial Q2 Earnings Miss, Revenues Rise

Prudential Financial’s second-quarter 2017 operating income of $2.09 per share missed the Zacks Consensus Estimate of $2.70 by 22.6%. Earnings also improved about 13.6% year over year.

Including the impact of one-time items, net income was $1.12 per share, down 45% year over year.

Behind the Headlines

Total revenue climbed 10.2% year over year to $13.0 billion on the back of 23% growth in premiums, 8% increase in net investment income and a 4% rise in asset management fees, commissions and other income.

Total benefits and expenses of $11.8 billion increased 9.7% year over year in the quarter. This rise in expenses is mainly attributable to higher insurance and annuity benefits, interest credited to policyholders’ account balances, amortization of acquisition costs and general and administrative expenses.

As of Jun 30, 2017, Prudential Financial’s assets under management increased 5.5% to $1.334 trillion from $1.264 trillion as of Dec 31, 2016. Adjusted book value, a measure of the company’s net worth, was $80.62 per share as of Jun 30, 2017, up 5.3% year over year.

Operating return on average equity was 10.5% versus 9.8% in the year-ago quarter.

Debt balance totaled $19.4 billion as of Jun 30, 2017, down from $19.7 billion as of Jun 30, 2016.

Quarterly Segment Update

U.S. Retirement Solutions and Investment Management reported adjusted operating income of $1.138 billion, up 30.8% year over year. The upside was driven by higher contribution from Individual Annuities, Retirement and Asset Management businesses.

U.S. Individual Life and Group Insurance incurred adjusted operating loss of $421 million, wider than $201 million incurred in the prior-year quarter, attributable to higher losses at Individual Life.

International Insurance reported adjusted operating income of $823 million, up 2.5% year over year. This improvement was due to higher contribution from Life Planner operations.

Corporate and Other Operations reported adjusted operating loss of $312 million, narrower than a loss of $415 million in the year-ago quarter.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

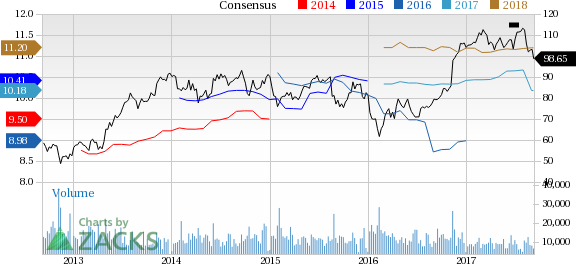

Prudential Financial, Inc. Price and Consensus

VGM Scores

At this time, Prudential Financial's stock has a poor Growth Score of F, however it is doing a bit better on the momentum front with a D. The stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value investors based on our style scores.

Outlook

The stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Prudential Financial, Inc. (PRU): Free Stock Analysis Report

Original post

Zacks Investment Research