It has been about a month since the last earnings report for PPG Industries, Inc. (NYSE:PPG) . Shares have lost about 3.8% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

PPG Industries Tops Q2 Earnings, Sales Miss Estimates

PPG Industries reported adjusted earnings of $1.83 per share for the second quarter of 2017, up 5.8% from the year-ago earnings of $1.73. The result beat the Zacks Consensus Estimate of $1.81.

Adjusted earnings in the reported quarter exclude one-time items including an after-tax gain from the sale of the Mexican Plaka wallboard business of $24 million, or $0.09 per share; a gain from a legal settlement of $11 million, or $0.04 per share; and after-tax transaction-related costs of $3 million, or a penny per share.

Net sales in the quarter edged up 1% year over year to $3,806 million. Sales missed the Zacks Consensus Estimate of $3,898.6 million.

Unfavorable currency translation affected sales by around 2%. The company witnessed flat sales volume year-over-year.

Segment Review

Performance Coatings: The segment recorded $2.3 billion in sales and income of $413 million in the reported quarter. Sales fell by less than 2% year over year. Unfavorable currency translation reduced segment sales by about $40 million or 2%. Acquisition-related sales provided benefits of $20 million.

Segment income fell 4% year over year owing to unfavorable foreign currency translation of about $10 million primarily due to the Mexican peso, British pound and euro. Architectural coatings – America and Asia Pacific sales volumes fell by a low single-digit clip. Marine coatings sales volumes declined by low-double-digit clip which was partly offset by gains in global protective coatings.

Industrial Coatings: Sales for the segment were $1.51 billion, up roughly 4% from the prior-year period. Total sales volume rose by around 3%.

Net income for the segment was $264 million, down 10% year over year. Higher sales volumes, strong cost management, including the benefits from business restructuring actions, and acquisition-related income and related synergies were more than offset by increased raw material costs and lower selling prices. Unfavorable currency impact reduced segment income by $5 million.

Financial Position

PPG Industries ended the quarter with a cash and cash equivalents of $1,569 million, down 2.2% year over year. Long-term debt fell 9.3% year over year to $3,998 million.

Outlook

PPG Industries expects modest overall global economic growth. Also, the company anticipates a higher level of earnings-accretive cash deployment in the second half of 2017 including acquisitions and share repurchases.

The company announced that it will resume share repurchases from the third quarter. PPG Industries plans to deploy $2.5 billion to $3.5 billion of cash on acquisitions and share repurchases in 2017 and 2018 combined and is now targeting the top end of that range at a minimum.

How Have Estimates Been Moving Since Then?

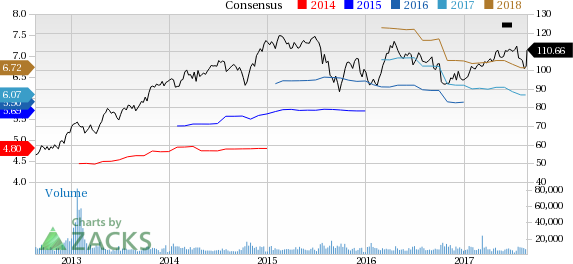

Following the release, investors have witnessed a downward trend in fresh estimates. There have been four revisions lower for the current quarter.

VGM Scores

At this time, PPG Industries's stock has a poor Growth Score of F, a grade with the same score on the momentum front. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Interestingly, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Original post