A month has gone by since the last earnings report for Plexus Corp. (NASDAQ:PLXS) . Shares have lost about 8.9% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Plexus Q3 Earnings & Revenues Beat Estimates

Plexus reported better-than-expected third-quarter fiscal 2017 results. Quarterly adjusted earnings of $0.74 per share and revenues of $618.8 million beat the Zacks Consensus Estimate of $0.72 and $610 million, respectively.

However, on a year-over-year basis, earnings fell 2.6% while revenues declined 7.3%.

Revenues from the Communications sector (16% of total revenue) plummeted 36.5% year over year to $99 million.

Healthcare/Life Sciences revenues (34%) were up 1.4% from the year-ago quarter to $210 million.

Industrial/Commercial revenues (32%) were almost unchanged year over year at $201 million.

Defense/Security/Aerospace segment revenues (18%) grew 5.8% on a year-over-year basis to $109 million.

Region-wise, revenues from the Americas decreased 26.2% to $265 million. However, revenues from the Asia Pacific region increased 11.3% to $326 million on a year-over-year basis. Revenues from Europe, the Middle East, and Africa, which totaled $53 million, also grew 29.3% year over year.

Margins

Plexus reported adjusted operating profit of $29.5 million in the quarter, down 9.9% year over year. Adjusted operating margin decreased 10 basis points (bps) year over year to 4.8%.

Balance Sheet & Cash Flow

Plexus exited the fiscal with cash & cash equivalents worth $519.2 million compared with $433 million as of Oct 1, 2016. The company had long-term debt and capital lease obligations of about $26.1 million compared with $184 million as of Oct 1, 2016.

For the quarter, the company generated $16.3 million in cash flow from operations and used $9.8 million for capital expenditures. Free cash flow came in at about $6.5 million. Share repurchases for the quarter amounted to $10 million.

Outlook

For the fourth quarter of fiscal 2017, revenues are projected in the range of $660–$700 million. GAAP earnings are projected within $0.77 and $0.87 per share.

For Health/Life sciences Sector, management expects growth to be in mid single-digits driven by new program ramps.

For Industrial/Commercial sector, revenues will decline in mid single-digits year over year in the fourth quarter due to considerable product refresh cycle of one customer along with many customers now reaching normalized level of productions, stated the mangement. This will offset the strength in end market demand of one large customer.

Communications sector will benefit from end-market strength related to several new program ramps. Revenues will be up 50% in the current quarter.

Defense/Security and Aerospace bolstered by increasing end market demand and new program wins will see revenues up in mid single digits sequentially.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

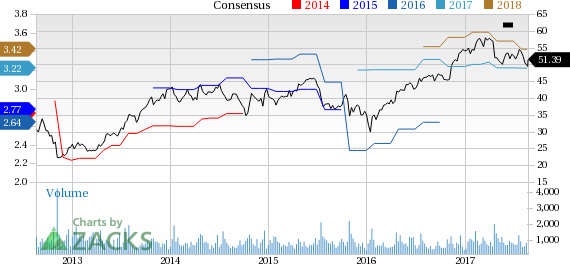

Plexus Corp. Price and Consensus

VGM Scores

At this time, Plexus' stock has an average Growth Score of C, though it lags on the momentum front with a D. The stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for value investors than those looking for growth.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Plexus Corp. (PLXS): Free Stock Analysis Report

Original post

Zacks Investment Research