A month has gone by since the last earnings report for PetMed Express, Inc. (NASDAQ:PETS) . Shares have added about 16.6% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

PetMed Express announced earnings per share (EPS) of $0.45 for the first quarter of fiscal 2018, up 40.6% from the year-ago quarter’s $0.32. Also, earnings surpassed the Zacks Consensus Estimate by 12.5%.

The year-over-year rise in earnings was driven by an increase in sales and improved margins.

Net sales in the reported quarter rose 9.9% year over year to $79.7 million, outpacing the Zacks Consensus Estimate by 0.9%.

According to the company, the upside in sales was a result of increased new orders and reorders during the quarter.

In the reported quarter, reorder sales increased 9% to $64.5 million on a year-over-year basis, while new order sales rose 14% to $15.2 million.

Average order value was approximately $87 in the quarter, compared with $82 in the year-ago quarter. We note that the variation in average order value is mainly driven by shift of sales to higher priced items.

According to the company, the seasonality in its business is mainly because of the proportion of flea, tick and heartworm medications in the product mix. Spring and summer are considered peak seasons while fall and winter represent off-seasons.

During the quarter under review, PetMed acquired 169,000 new customers, up from 169,000 a year ago. Roughly 84% of all orders was generated from its website (versus 82% in the prior-year quarter).

Gross margin expanded 351 basis points (bps) year over year to 34.5% in the reported quarter. General and administrative expenses were up 2.1% year over year to $6.2 million. Also, advertising expenses rose 9.2% to $6.3 million. This led to a 5.6% increase in adjusted operating expenses (without depreciation expense), which amounted to $12.5 million. Adjusted operating margin in the quarter rose 415 bps to 18.8% from the year-ago quarter.

PetMed exited the fiscal first quarter with cash and cash equivalents of $68.5 million, compared with $58.7 million at the end of fiscal 2017. The company also declared a quarterly dividend of $0.20 per share, payable to shareholders on record as of Aug 7, 2017.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

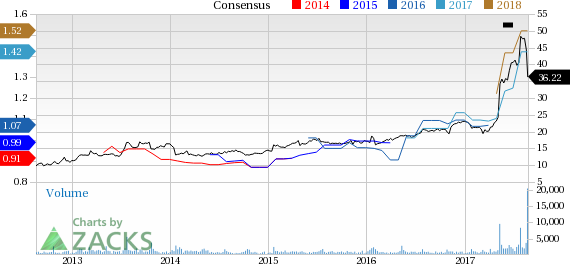

PetMed Express, Inc. Price and Consensus

VGM Scores

At this time, PetMed's stock has a great Growth Score of A, though it is lagging a bit on the momentum front with a B. The stock was allocated a grade of F on the value side, putting it in the lowest quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

The stock has a Zacks Rank #2 (Buy). We expect an above average return from the stock in the next few months

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Original post

Zacks Investment Research