Oil prices rose sharply on Tuesday morning, despite a lack of oil-related news, sending investors and traders scrambling to find answers as to why “black gold’s” bearish streak has apparently ended.

Prior to today, West Texas Intermediate (WTI) crude oil had plunged more than 8% from its highs last Wednesday, as news of Donald Trump’s shocking presidential election victory roiled global markets. WTI was up more than 3.5% this morning, however, and a couple of key theories are circulating as to why.

The first and most obvious explanation for oil’s bounce is renewed OPEC deal hopes. From Reuters:

Reports of a diplomatic push by OPEC to strike a deal are supporting the markets,” said Tamas Varga, oil analyst at London brokerage PVM Oil Associates. “The rally could last a little while but the underlying fundamental picture is still bearish.

IG Group market strategist Jingyi Pan said market sentiment has been buoyed by reports that key producers including Iran and Iraq were thinking about restraining production.

Nothing has really changed on the OPEC front over the past couple of days, however, with the assumption being that the odds of a deal getting done are still 50/50, at best. So perhaps some other technical reasons are to blame instead:

Philips Futures investment analyst Jonathan Chan in Singapore said crude prices were supported by short-covering.

The current active contract (for U.S. crude) is expiring. The last trading day is next Monday, so some oil traders are already starting to close out their positions to roll over, Chan said.

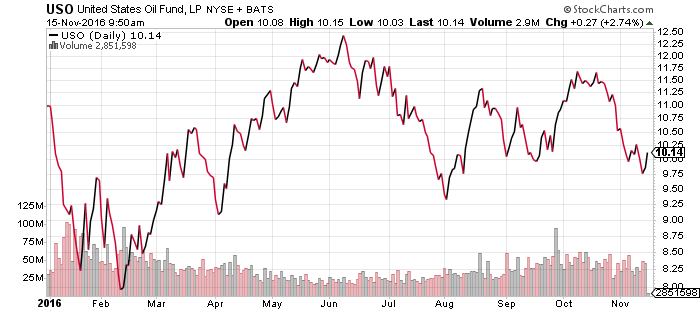

Regardless of the true reasons, the fact remains that oil prices continue to be very volatile. The United States Oil ETF (NYSE:USO) rose $0.26 (+2.63%) to $10.13 per share in Tuesday morning trading. The largest fund tied to WTI crude prices has still fallen 8.09% year-to-date, however, and many experts believe that an OPEC deal won’t be enough to change oil’s underlying bearish fundamentals.