It has been about a month since the last earnings report for MGIC Investment Corporation (NYSE:MTG) . Shares have lost about 2.6% in that frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

MGIC Investment Q2 Earnings Beat Estimates, Up Y/Y

MGIC Investment reported second-quarter 2017 operating net income per share of $0.31 that surpassed the Zacks Consensus Estimate by 24%. The bottom line also improved 19.2% year over year.

Owing to higher new insurance written in this quarter, there was a fair rise in the insurance in force. However, claims declined year over year. Meanwhile, the expense ratio remained low.

MGIC Investment recorded total operating revenue of $263.3 million, down about 0.1% year over year on lower premiums earned. Net investment income however improved 9.2% year over year to $29.7 million.

New insurance written was $12.9 billion in the reported quarter, up 2.4% from $12.6 billion in the year-ago quarter on higher insurance written in the quarter.

As of Jun 30, 2017, the company’s primary insurance in force was $187.3 billion, up 5.5% year over year.

Persistency, or the percentage of insurance remaining in force from the preceding year, was 77.8% as of Jun 30, 2017. The company had recorded persistency of 79.9% as of Jun 30, 2017.

Percentage of delinquent loans, including bulk loans, was 4.11% as of Jun 30, 2017, compared with 5.30% as of Jun 30, 2016.

Primary delinquent inventory declined nearly 21.4% year over year to $41.3 billion worth of loans.

Net underwriting and other expenses totaled $41.1 million, up 9% year over year.

Losses incurred in the quarter narrowed to $27.3 million from $46.6 million in the year-ago quarter. The $52-million reduction in losses was due to the positive development on the company’s primary loss reserve. This apart, the company witnessed a lesser number of new delinquent notices and a lower claim rate.

Total loss and expenses contracted 16% year over year to $82.6 million due to lower losses.

Financial Update

Book value per share, a measure of net worth, jumped nearly 9.6% year over year to $8.08 as of Jun 30, 2017.

As of Jun 30, 2017, MGIC Investment had $127 million in cash and investments, down 58% year over year.

Risk-to-capital ratio was 11:3:1 as of Jun 30, 2017, compared with 13:2:1 as of Jun 30, 2016.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

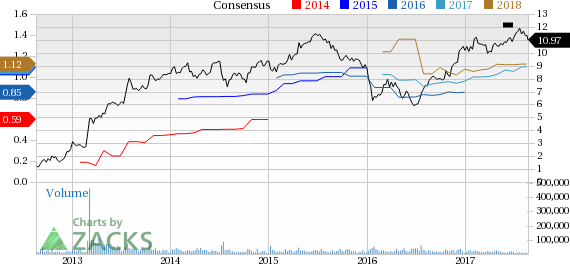

MGIC Investment Corporation Price and Consensus

VGM Scores

At this time, MGIC Investment's stock has a nice Growth Score of B, though it lags a bit on the momentum front with a C. The stock was allocated also a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for value and growth investors.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

MGIC Investment Corporation (MTG): Free Stock Analysis Report

Original post

Zacks Investment Research