A month has gone by since the last earnings report for ManpowerGroup (NYSE:MAN) . Shares have lost about 10.3% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

ManpowerGroup Beats Q2 Earnings on Higher Revenues

ManpowerGroup reported strong second-quarter 2017 results with healthy improvement in the labor market.

Quarter in Details

GAAP earnings came in at $1.72 per share, up 7.5% year over year. The company reported net income of $117 million compared with $115.4 million in the year-ago quarter.

Adjusted earnings for the reported quarter were $1.82 per share, which comfortably beat the Zacks Consensus Estimate of $1.73.

Revenues

The company reported revenues of $5.17 billion, up 3% from the prior-year period. The top line exceeded the Zacks Consensus Estimate of $5.03 billion. The company reported strong business performance from a number of its markets including France, Italy, Mexico and Poland.

Segmental Performance

ManpowerGroup reports revenues in terms of five segments, primarily classified on a geographic basis.

Sales from Southern Europe comprised 41% of consolidated revenue in the second quarter. Sales from Southern Europe came in at $2.1 billion, up 13% year over year. Asia Pacific & Middle Eastern sales increased 5.2% year over year to $643.4 million during the quarter. Northern Europe revenues during the quarter were $1,281.7 million, up 2% year over year.

However, second-quarter 2017 revenues from Americas came in at $1,056.9 million, down 1.5% year over year. Also, Right Management sales decreased 19.8% year over year and came in at $57.1 million, due to the slowdown of career outplacement activity.

Margins

Gross profit margin during the quarter was 16.7%, down 40 basis points (bps) year over year. The staffing gross margin had an adverse impact on overall gross margin by 30 bps.

Balance Sheet and Cash Flow

Cash and cash equivalents were $573.1 million as of Jun 30, 2017 with long-term debt of $454.8 million.

Cash from operating activities was $148 million for the first half of 2017 compared with $262.1 million recorded in the year-ago period. Capital expenditure during the first six months of the year was $25.5 million compared with $30.8 million recorded in the prior-year period.

Outlook

ManpowerGroup anticipates that its European business would strengthen in the quarters ahead. The company is poised to grow on the back of productive workforce and sound restructuring initiatives.

The company anticipates earnings within the range of $1.90–$1.98 per share in third-quarter 2017 which includes a favorable impact from foreign currency of $0.02 per share.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been three revisions higher for the current quarter compared to one lower.

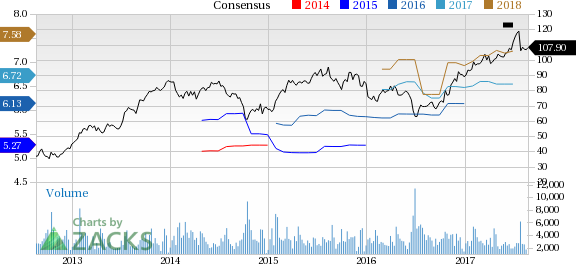

ManpowerGroup Price and Consensus

VGM Scores

At this time, ManpowerGroup's stock has an average Growth Score of C, though it is lagging a bit on the momentum front with a D. The stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. It comes with little surprise that the stock has a Zacks Rank #2 (Buy).

ManpowerGroup (MAN): Free Stock Analysis Report

Original post

Zacks Investment Research