About a month has gone by since the last earnings report for Loews Corporation (NYSE:L) . Shares have lost about 4.2% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Loews Q2 Earnings Meet Estimates, Revenues Improve Y/Y

Loews reported second-quarter 2017 operating earnings of $0.76 per share, which met the Zacks Consensus Estimate. Earnings surged 27% year over year.

The quarter witnessed a better performance by CNA Financial, Diamond Offshore and Loews Hotels and improved results from the parent company’s investment portfolio. However, lower earnings at Boardwalk Pipeline and soft results from the parent company investment portfolio were partial dampeners.

Including asset impairment charges at Diamond Offshore Drilling Inc (NYSE:DO) , the company reported net income of $0.69, thereby rebounding from the year-ago quarter’s loss of $0.19.

Revenues

Operating revenue of $3.3 billion increased 3% year over year. Rise in insurance premiums, contract drilling revenues and other revenues aided this improvement.

Behind the Headlines

Total expenses declined 16.7% year over year to $3 billion, mainly due to lower contract drilling expenses and other operating costs as well as a decrease in insurance claims & policyholders' benefits.

CNA Financial’s revenues increased 4.3% from the prior-year quarter to $2.4 billion. It reported net income attributable to Loews Corp. is $244 million, up 29% from the year-ago quarter. This improvement may be attributed to current accident year underwriting results from its core P&C business and higher realized investment gains. However, lower net investment income limited the upside.

Boardwalk Pipeline’s revenues inched up 3.2% year over year to $318 million. Net income attributable to Loews, plunged 65% year over year to $7 million, due to loss on the sale of a processing facility.

Loews Hotels’ revenues declined 4.2 % year over year to $181 million. Income attributable to Loews jumped to $10 million from $1 million in the year-ago quarter. Earnings improved on higher equity income from Universal Orlando joint-venture properties.

Diamond Offshore’s revenues improved 5.6% year over year to $399 million. Net income attributable to Loews was $7 million, comparing favorably with ($294 million) in the year-ago quarter. Higher fleet utilization and lower depreciation expense resulted mainly from the asset impairment charges taken in 2016.

Book value as of Jun 30, 2017 was $56.01 per share, up about 2.5% from $54.62 as of Dec 31, 2016.

How Have Estimates Been Moving Since Then?

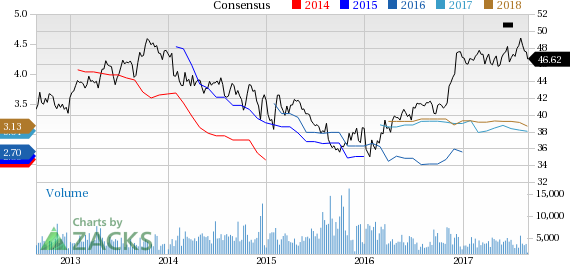

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter.

VGM Scores

At this time, the stock has an average Growth Score of C, a grade with the same score on the momentum front. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for value investors than those looking for growth and momentum.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Loews Corporation (L): Free Stock Analysis Report

Original post

Zacks Investment Research