About a month has gone by since the last earnings report for Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD) . Shares have lost about 4.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Ironwood Second Quarter Loss Wider than Expected, Sales Miss

Ironwood reported second-quarter 2017 adjusted loss of 28 cents per share, wider than both the Zacks Consensus Estimate of a loss of 23 cents and the year-ago loss of 16 cents.

Total revenue (collaborative revenue) in the quarter amounted to $65.1 million, up 19.7% from the year-ago period but below the Zacks Consensus Estimate of $68.5 million.

The Quarter in Detail

Linzess generated U.S. net sales of $167.8 million, as reported by partner Allergan (NYSE:AGN), up 11.5% year over year.

Ironwood and Allergan equally share brand collaboration profits or losses. Ironwood's share of the net profits from the sales of Linzess in the U.S. (included in collaborative revenues) was $43.8 million in the second quarter, up 11% year over year but down 13% sequentially.

Lower inventory hurt sales of Linzess in the quarter. Management is uncertain whether this trend will persist through the rest of the year.

However, Linzess witnessed continued strong demand growth year over year. According to data provided by IMS Health, Linzess prescriptions filled during the quarter crossed 750,000, up 15% from the year-ago period. Total Linzess volume growth included a 19% increase in capsules due to an increase in the number of prescriptions for the 90-count bottle.

Zurampic raked in sales of $0.5 million in the quarter. Zurampic prescriptions filled during the quarter were 1500, higher than 900 prescriptions filled in the previous quarter. The uptake of the drug has been slow and management expects sales to be nominal in 2017 as it works on educating physicians and patients as well as secure payer access.

During the reported quarter, selling and administrative (SG&A) expenses increased 56.5% to $57.8 million primarily due to investments to support the launch of Zurampic.

Research and development (R&D) expenses were $37.3 million, up 17.9% from the year-ago period due to costs associated with pipeline development.

2017 Guidance Maintained

The company now expects to use less than $100 million for operations in 2017, much higher than 2016 levels, given a full-year of commercial expenses related to the launch of Zurampic and to support the launch of Duzallo and pipeline advancement.

R&D expenses and SG&A expenses are expected in a range of $145–$160 million and $235–$250 million, respectively.

Total marketing and sales expenses for Linzess are still expected to be around $250–$280 million.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 20.5% due to these changes.

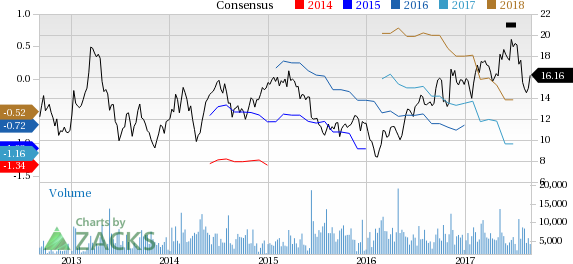

Ironwood Pharmaceuticals, Inc. Price and Consensus

VGM Scores

At this time, Ironwood's stock has a subpar Growth Score of D, though it is lagging a bit on the momentum front with an F. Following the exact same course, the stock was allocated a grade of F on the value side, putting it in the bottom 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate investors will probably be better served looking elsewhere.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. It's no surprise that the stock has a Zacks Rank #4 (Sell). We expect below average returns from the stock in the next few months.

Ironwood Pharmaceuticals, Inc. (IRWD): Free Stock Analysis Report

Original post

Zacks Investment Research