A month has gone by since the last earnings report for The Goodyear Tire & Rubber Company (NASDAQ:GT) . Shares have lost about 7.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Goodyear Q2 Earnings, Revenues Lag Estimates, Fall Y/Y

The Goodyear Tire & Rubber Company reported 39.7% decrease in adjusted earnings per share to $0.70 in second-quarter 2017 from $1.16 recorded a year ago. Also, earnings missed the Zacks Consensus Estimate of $0.72. Adjusted net income declined to $189 million from $195 million in second-quarter 2017.

Revenues in the reported quarter were $3.69 billion, missing the Zacks Consensus Estimate of $3.75 billion. Plus, revenues declined from $3.88 billion recorded a year ago.

Tire unit volumes were 37.4 million, down 10% from 2016. Replacement tire shipments dropped 11% while original equipment unit volume declined by 8% year over year due to lower volume sales in Europe, Middle East and Africa and Americas.

Segment operating income dropped to $361 million in the reported quarter from $531 million a year ago.

Segment Detail

Revenues at the Americas’ segment declined 3% year over year to $2 billion, primarily due to increased competition. Original equipment unit volume went down 12% year over year. Replacement tire shipments were down 8%.

Segment operating income plunged 27% to $213 million due to higher raw material costs and the impact of lower volume, partially offset by an improved price/mix.

Revenues from the Europe, Middle East and Africa segment were $1.1 billion, down 12% year over year. Revenues were primarily hurt by 16% decrease in tires volume. Original equipment unit volume was down 11% while replacement tire shipments declined 18% year over year. Segment operating income slashed 48% to $77 million, primarily due to high competition and a declining volume, partially offset by better price/mix and cost savings.

Revenues from the Asia-Pacific segment nudged up 3% to $543 million, reflecting an improved pricing of products. Original equipment unit volume inched up 2% while replacement tire shipments dipped 3% year over year. Segment operating income down 21% to $71 million, driven by continued high raw material costs, partly offset by improved product mix.

Financial Position

Goodyear had cash and cash equivalents of $903 million as of Jun 30, 2017, down from $1.1 billion as of Dec 31, 2016. Long-term debt and capital leases amounted to $5.4 billion as of Jun 30, 2017, up from $4.8 billion as of Dec 31, 2016.

In the first half of fiscal 2017, the company recorded a total cash flow of ($185) million from operating activities, which widened from ($67) million, recorded in the same period a year-ago. Also, capital expenditure for the same period, increased to $497 million from $466 million, recorded a year-ago.

Capital Deployment

During the reported quarter, Goodyear repurchased 147,000 shares for $5 million under the previously announced $2.1 billion share repurchase program. Also, on Jul 13, the board declared a quarterly dividend of 10 cents payable on Sep 1 to shareholders of record on Aug 1.

Outlook

Goodyear anticipates operating income for 2017 to be within the range of $1.6-1.65 billion compared with the previous projection of $2 billion.

How Have Estimates Been Moving Since Then?

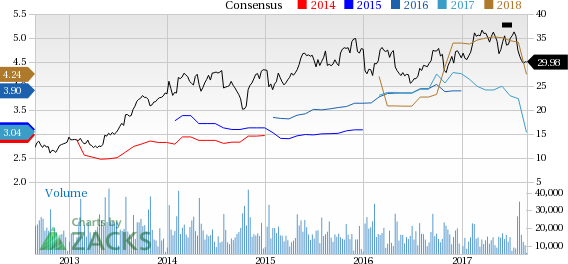

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 39.6% due to these changes.

VGM Scores

At this time, Goodyear's stock has a subpar Growth Score of D, though its momentum is lagging a bit with a F. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is solely suitable for value investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. The stock has a Zacks Rank #4 (Sell). We are expecting a below average return from the stock in the next few months.

The Goodyear Tire & Rubber Company (GT): Free Stock Analysis Report

Original post

Zacks Investment Research