It has been about a month since the last earnings report for General Motors Company (NYSE:GM) . Shares have lost about 3.9% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

General Motors Beats on Q2 Earnings, Revenues Miss

General Motors delivered adjusted earnings of $1.89 per share in second-quarter 2017, surpassing the Zacks Consensus Estimate of $1.72. Earnings increased 5.6% from $1.79 per share in the second quarter of 2016.

Revenues in the reported quarter came in at $37 billion, 1.1% lower than the year-ago quarter. Also, revenues missed the Zacks Consensus Estimate of $40.25 billion.

Total wholesale unit sales declined to 1.21 million vehicles from 1.31 million vehicles in the second quarter of 2016. Worldwide retail unit sales decreased to 2.34 million vehicles from 2.39 million vehicles in the year-ago quarter. The automaker’s global market share was 10.2% during the reported quarter, reflecting a marginal decline from 10.3% in the year-ago quarter.

Segment Results

GM North America (GMNA) generated net sales and revenues of $28.4 billion during the second quarter of 2017, reflecting a decline from $30.2 billion in second-quarter 2016.

GM International Operations’ (GMIO) net sales and revenues came in at $3.2 billion, declining from $3.3 billion in the year-ago quarter.

GM South America (GMSA) generated net sales and revenues of $2.3 billion, increasing from $1.6 billion in the year-ago quarter.

GM Financial generated net sales and revenues of $3 billion during the quarter, increasing from $2.1 billion in the year-ago quarter.

Financial Position

General Motors had cash and cash equivalents of $16.6 billion as of Jun 30, 2017 compared with $12.57 billion as of Dec 31, 2016.

Automotive operating cash flow during the quarter came in at $5.1 billion, reflecting an increase of $0.3 billion from that of second-quarter 2016.

2017 Outlook

General Motors continues to expect 2017 adjusted earnings per share in the range of $6.00–$6.50. The automaker also expects adjusted EBIT and adjusted EBIT margin to remain stable or improve, while revenues are projected to increase from the 2016 level. Further, the automaker is expected to generate around $7 billion in adjusted automotive free cash flow. The company aims at returning capital of up to $7 billion to shareholders in 2017.

How Have Estimates Been Moving Since Then?

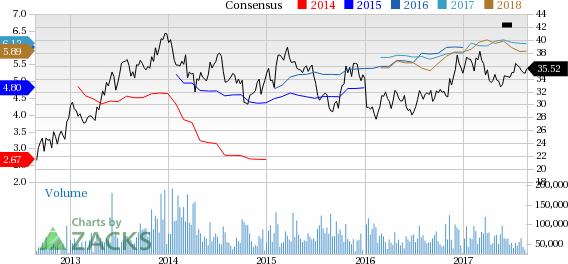

Following the release and in the last month, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 12.9% due to these changes.

VGM Scores

At this time, General Motors' stock has a nice Growth Score of B, though it is lagging a lot on the momentum front with a F. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

General Motors Company (GM): Free Stock Analysis Report

Original post

Zacks Investment Research