About a month has gone by since the last earnings report for Franklin Resources, Inc. (NYSE:BEN) . Shares have lost about 5.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Franklin Posts In-Line Earnings in Q3, Costs Flare Up

Franklin reported third-quarter fiscal 2017 earnings of $ 0.73 per share, in line with the Zacks Consensus Estimate. Moreover, results compared unfavorably with the prior-year quarter earnings of $0.77 per share.

Lower revenues and elevated operating expenses were recorded. Net outflows were also an undermining factor. However, growth in AUM was witnessed.

Net income was $410.6 million in the quarter compared with $446.4 million in the prior-year quarter.

Lower Revenues Recorded, Costs Escalate

Total operating revenue edged down 1%, year over year, to $1.61 billion in the quarter, mainly due to lower sales and distribution and shareholder servicing fees, along with other fees. Further, revenues lagged the Zacks Consensus Estimate of $1.63 billion.

Investment management fees inched up slightly year over year to $1.1 billion, while sales and distribution fees were down 4% year over year to $433.3 million. In addition, shareholder servicing fees descended 8%, on a year-over-year basis, to $56.7 million; while other net revenue declined 8% year over year to $26.9 million.

Total operating expenses were up 1% year over year to $1.05 billion. The rise resulted mainly from elevated compensation and benefits, general, administrative, and information systems and technology expenses. These increases were partially offset by lower sales, distribution and marketing, along with occupancy expenses.

As of Jun 30, 2017, total AUM came in at $742.8 billion, up 1% from $732.1 billion as of Jun 30, 2016. Notably, the quarter recorded net new outflows of $7.3 billion. Simple monthly average AUM of $742.1 billion increased slightly on a year-over-year basis.

Stable Capital Position

As of Jun 30, 2017, cash and cash equivalents, along with investments were $10.0 billion, compared with $10.7 billion as of Sep 30, 2016. Furthermore, total stockholders' equity was $12.7 billion compared with $12.5 billion as of Sep 30, 2016.

During the reported quarter, Franklin repurchased 4.1 million shares of its common stock at a total cost of $174.6 million.

How Have Estimates Been Moving Since Then?

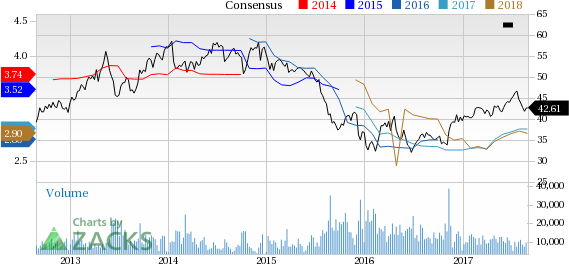

Following the release, investors have witnessed an upward trend in fresh estimates. There has been one revision higher for the current quarter.

VGM Scores

At this time, Franklin Resources' stock has a poor Growth Score of F, however its Momentum is doing a lot better with a C. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregte VGM score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than momentum investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We are looking for an inline return from the stock in the next few months.

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

Original post

Zacks Investment Research