More than a month has gone by since the last earnings report for FormFactor, Inc. (NASDAQ:FORM) . Shares have added about 16.4% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

FormFactor Beats Earnings & Revenue Estimates in Q2

FormFactor reported better-than-expected second-quarter 2017 results.

Non-GAAP earnings of 40 cents beat the Zacks Consensus Estimate by 12 cents while revenues of $144 million beat the same by $10 million.

Revenues in Detail

Revenues were up 11.8% sequentially and 73.3% year over year and came well above the company’s guidance of $130–$138 million. The improvement was driven by continued strength in the FormFactor core probe card business as well as growing probe card and engineering systems businesses from Cascade Microtech.

Revenues by Geography

The U.S. contributed 35.1% of second-quarter revenues (up 26.9% sequentially and 59.8% year over year); Taiwan accounted for 20.7% (up 52% sequentially and 131% year over year); South Korea brought in 15.8% (up 21.4% sequentially and 29% year over year); Japan accounted for 7.4% (down 30.3% sequentially but up 135.6% year on year); Europe contributed 6.5% (up 6.8% sequentially but down 22.3% year over year) and the rest of the world contributed 0.4% (down 14.3% sequentially).

Revenues by Market Segments

Foundry & Logic revenues (62% of the total first-quarter revenue) were $88.7 million, reflecting an increase of 19.4% from the prior quarter and 53.2% from the year-ago quarter. The strength was driven by strong advanced packaging demand and continued strength in data center, mobile, and automotive applications. Reported revenues for DRAM products were $31.5 million, reflecting an increase of 8.6% sequentially and 30.2% year over year and driven by continuous strong demand. Flash revenues were $1.4 million, reflecting a decline of 56.3% from the previous quarter but an increase of 10% from the year-ago period. Systems revenues were $22.4 million, up slightly sequentially driven by increased 300 mm platform shipments.

Margins

Non-GAAP gross profit was $61.8 million, up from $47.6 million in the previous quarter and $27.5 million in the year-ago quarter. Gross margin of 42.9% was up 598 basis points (bps) sequentially and 975 bps year over year. The increase was attributed to higher revenues and a favorable product mix. Adjusted operating expenses were $30 million, reflecting an increase of 9.3% sequentially and 58.6% year over year. Operating margin of 21.8% was up 645 bps sequentially and 3 bps year over year. Pro forma net income was $29.2 million in the second quarter compared with $8 million in the year-ago quarter.

Balance Sheet

FormFactor exited the quarter with cash (comprising cash and cash equivalent, and marketable securities) of $130 million compared with $121.9 million reported in the prior quarter. Cash from operations was $24.5 million in the second quarter compared with $17.8 million in the prior quarter. Free cash flow was $21.2 million in the second quarter.

Guidance

Management expects third-quarter 2017 revenues in the range of $136 million–$144 million. The Zacks Consensus Estimate is pegged at $133.4 million. On a GAAP basis, the company projects gross margin of 38–41% and fully diluted income per share of 12–18 cents. On a non-GAAP basis, gross margin is expected in the range of 43–46% and earnings per share are projected in the range of 29-35 cents. The Zacks Consensus estimate is pegged at 24 cents.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

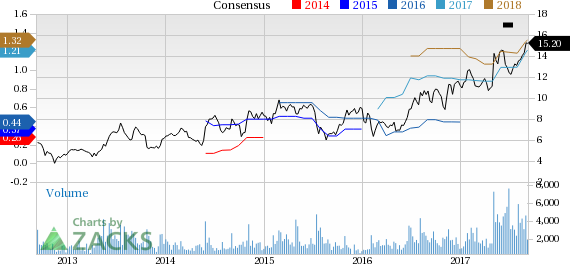

FormFactor, Inc. Price and Consensus

VGM Scores

At this time, FormFactor's stock has a great Growth Score of A, a grade with the same score on the momentum front. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is primarily suitable for growth and momentum investors.

Outlook

Notably, the stock has a Zacks Rank #1 (Strong Buy). We are looking for an above average return from the stock in the next few months

FormFactor, Inc. (FORM): Free Stock Analysis Report

Original post

Zacks Investment Research