A month has gone by since the last earnings report for Ford Motor Company (NYSE:F) . Shares have lost about 8.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to its next earnings release, or is F due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Ford's Q4 Earnings Fall Short of Estimates, Improve Y/Y

Ford posted adjusted earnings per share of 39 cents in the fourth quarter of 2017. The reported figure was 9 cents higher than the year-ago figure. However, earnings missed the Zacks Consensus Estimate of 42 cents per share.

During the quarter, adjusted pre-tax profit came in at $1.7 billion, reflecting a decrease of $0.4 billion from the year-ago quarter.

Fourth-quarter net income came in at $2.4 billion, reflecting an increase of $3.2 billion from the year-ago quarter.

During the quarter, Ford logged automotive revenues of $41.3 billion. The Zacks Consensuses Estimate for revenues was $37.2 billion.

For full-year 2017, adjusted earnings per share came in at $1.78, increasing 2 cents from 2016. The Zacks Consensuses Estimate for revenues for 2017 was $1.82.

For full-year 2017, revenues came in at $156.8 billion, reflecting an increase of $5 billion from 2016. The Zacks Consensuses Estimate for revenues for 2017 was $147.5 billion.

Ford Automotive

During the quarter, wholesale volumes at the Ford Automotive segment increased 42,000 units to 1.75 million. Pre-tax profit decreased to $1.4 billion from $2 billion in the year-ago quarter.

In North America, during the quarter, revenues increased $1 billion to $24.1 billion. Wholesale volumes increased 36,000 year over year to 739,000 units. Further, pre-tax profit decreased to $1.6 billion from $1.9 billion in fourth-quarter 2016.

In South America, revenues increased $0.3 billion to $1.7 billion. Wholesale volumes rose 17,000 to 107,000 units. Pre-tax loss amounted to $197 million.

In Europe, revenues increased $0.9 billion to $8.1 billion. Wholesale volumes increased 26,000 units year over year to 416,000 units. The region incurred pre-tax profit of $56 million during the quarter.

In the Middle East & Africa segment, revenues declined $0.1 billion year over year to $0.8 billion. Wholesale volumes plunged 6,000 units to 35,000 units. The region incurred pre-tax loss of $70 million.

In the Asia-Pacific region, revenues increased $0.4 billion to $83.8 billion. Wholesale volumes declined 31,000 to 452,000 units. The Asia-Pacific region generated pre-tax profit of $5 million.

Financial Services

Ford Credit generated pre-tax profit of $610 million, up from $398 million in the prior-year quarter.

Financial Position

Ford had cash and cash equivalents of $9.6 billion as of Dec 301, 2017, up from $8.1 billion as of Dec 31, 2016.

2018 Guidance

The company expects 2018 adjusted EPS in the range of $1.45-$1.70 and an effective tax rate of 15%.

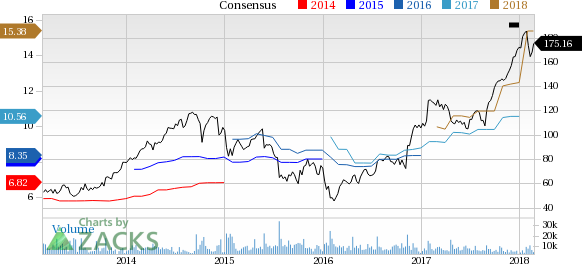

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 9% due to these changes.

VGM Scores

At this time, Ford has a great Growth Score of A, though it is lagging a lot on the momentum front with an F. However, the stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and growth investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Interestingly, F has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Ford Motor Company (F): Free Stock Analysis Report

Original post

Zacks Investment Research