It has been about a month since the last earnings report for Everest Re Group, Ltd. (NYSE:RE) . Shares have lost about 2.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Everest Re Q2 Earnings Beat Estimates, Improve Y/Y

Everest Re Group Ltd reported second-quarter 2017 operating earnings of $5.51 per share that outpaced the Zacks Consensus Estimate of $5.30 by nearly 4%. The bottom line also improved about 74% from the prior-year quarter.

Premiums improved on the back of higher premiums written in both Insurance and well as Reinsurance segments. While expenses increased, combined ratio exhibited improvement. Everest Re Group noted strong momentum across its underwriting operations, with opportunities in both reinsurance and insurance.

Including net realized capital gains of $0.44, net income came in at $5.95 per share, improving 62.1% year over year.

Operational Update

Everest Re Group’s total operating revenue of $1.5 million increased nearly 7% year over year. Revenues beat the Zacks Consensus Estimate of $1.4 million.

Gross written premiums grew 17% year over year to $1.6 billion. The company’s worldwide reinsurance premiums increased 14% primarily due to the new crop reinsurance transaction and growth in financial lines premium. Insurance premiums also improved 25% due to continued growth in new initiatives.

Net investment income came in at $134.5 million in the quarter, up 1% year over year.

Total claims and expenses increased 1% year over year to $1.2 million. Higher incurred losses and loss adjustment expenses, commission, brokerage, taxes and fees, and higher underwriting expenses were responsible for the rise.

Combined ratio improved 460 (basis points) bps. Excluding catastrophe losses from the Australian windstorm, reinstatement premiums, and prior-year loss development, combined ratio deteriorated 60 bps year over year to 86.7%.

Financial Update

Everest Re Group exited the quarter with total assets of $22.5 billion, up about 6% from $21.3 billion at the end of 2016. Shareholder equity at the end of the reported quarter rose 6% to $8.5 billion from the 2016-end level of $8 billion. Total cash balance at the end of the quarter declined 3% to $469.2 million from $481.9 million at the end of 2016. Everest Re Group's cash flow from operations was $252.6 million, down 18% year on year.

Book value per share increased 6% to $209.05 as of Jun 30, 2017 from $197.45 as of Dec 31, 2016. Return on equity was 13% in the quarter.

Dividend Update

The company paid out a dividend of $1.25 per share in the quarter, up a dime year over year.

How Have Estimates Been Moving Since Then?

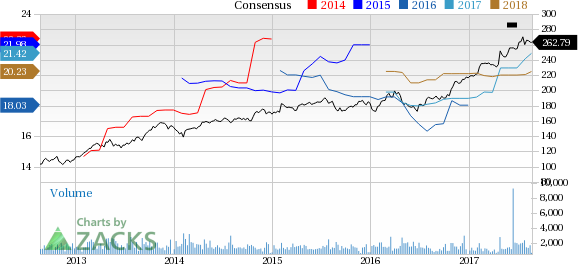

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter.

VGM Scores

At this time, Everest Re's stock has a subpar Growth Score of D, however its Momentum is doing a lot better with a B. Charting a somewhat similar path, the stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than momentum investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Everest Re Group, Ltd. (RE): Free Stock Analysis Report

Original post

Zacks Investment Research