It has been about a month since the last earnings report for CONMED Corporation (NASDAQ:CNMD) . Shares have lost about 2.9% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

CONMED Earnings Meet, Revenues Beat Estimates in Q2

Headquartered in Utica, NY, leading medical technology player CONMED reported second-quarter 2017 adjusted earnings of $0.41 per share, in line with the Zacks Consensus Estimate. Also, earnings deteriorated 12.8% on a year-over-year basis due to the unfavorable impact of foreign exchange rates, partially offset by higher sales.

Revenues rose 3% to approximately $197.2 million, ahead of the Zacks Consensus Estimate of $195 million. Revenues also increased 3% on a constant currency basis (cc).

Revenue Details

In terms of product line, orthopedic surgery revenues increased 0.9% on a year-over-year basis at cc. Revenues at this segment totaled $105.6 million. The general surgery segment saw a solid quarter, registering a 5.5% increase in revenues at cc. General surgery organic revenues increased to $91.6 million from $87.6 million in the year-ago quarter.

In terms of product category, revenues from single-use products increased 4.6% at cc to $159.5 million. Coming to the capital products, revenues declined 3.3% at cc to $37.7 million.

On the basis of geographies, CONMED witnessed a 1.3% uptick in domestic revenues to $100 million. CONMED saw 4.7% growth in international revenues to $97.2 million.

Balance Sheet

CONMED had a cash balance of $40.1 million at the end of the second quarter, compared with $34.7 million at the end of first-quarter 2017. Also, long-term debt was $484.0 million in the second quarter as compared with $487.0 million in first-quarter 2017. The inventory balance was $136.5 million at the end of the quarter under review.

Guidance

For the full year, CONMED revised the lower end of the sales growth guidance from the band of 1% to 3% to 2% to 3% at cc. The company reaffirmed the adjusted earnings per share at the range of $1.85 to $1.95.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

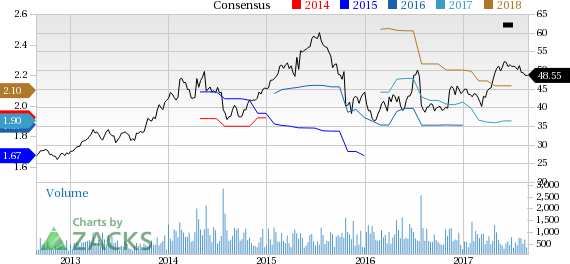

CONMED Corporation Price and Consensus

VGM Scores

At this time, CONMED's stock has an average Growth Score of C, however its Momentum is doing a bit better with a B. The stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for momentum investors than growth investors.

Outlook

The stock has a Zacks Rank #5 (Strong Sell). We expect below average returns from the stock in the next few months.

CONMED Corporation (CNMD): Free Stock Analysis Report

Original post

Zacks Investment Research