It has been about a month since the last earnings report for CNA Financial Corporation (NYSE:CNA) . Shares have lost about 5.4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

CNA Financial Q2 Earnings Beat Estimates, Grow Y/Y

CNA Financial Corporation reported second-quarter 2017 operating income of 88 cents per share, beating the Zacks Consensus Estimate by 17.3%. Also, the bottom line improved 18.9% from the prior-year quarter.

The quarter witnessed a better performance by Specialty, Commercial, International as well as Life and Group Non-Core segments. However, the company displayed lower net investment income in the reported quarter. Nonetheless, the company experienced improvement in both its underlying loss as well as expense ratios, thus marking the period as one of the best underwriting quarters in the past decade.

Including net realized investment gains, net income of $1.00 per share jumped 29.9% year over year.

Behind Second-Quarter Headlines

Net investment income declined about 10% year over year to $276 million due to decrease in limited partnership returns in the quarter.

Net written premiums at Property & Casualty Operations improved 4.7% year over year to $1.7 billion. Net operating income increased about 14% year over year to $261 million owing to improved current accident year underwriting results. However, lower net investment income partially offset the upside. Combined ratio improved 390 basis points (bps) on a year-over-year basis to 93.5%.

As of Jun 30, 2017, book value (excluding AOCI) was $44.26 per share, down 1.4% from Dec 31, 2016.

Segment Results

Specialty net written premiums rose 3.6% year over year to $716 million. A modest increase in new business resulted in the upside. Retention was 88% in the reported quarter. Average rate for policies grew 1% year over year. Combined ratio deteriorated 450 bps to 89.9%.

Commercial net written premiums increased 3.6% year over year to $767 million, driven by higher new business within Middle Markets. Retention declined to 82% in the quarter under review. Average rate for the policies was remained flat year over year. Combined ratio improved 840 bps to 95.1%.

International net written premiums climbed 12.9% year over year to $219 million. The company achieved retention of 78% in the second quarter. Average rate on policies remained flat year over year. Combined ratio improved 1850 bps to 100.1%.

Life & Group Non-Core operating revenues inched up 0.9% year over year to $330 million. Net operating income of $5 million compared favorably with the year-ago loss of $4 million.

Corporate & Other Non-Core net operating loss of $27 million was considerably wider than a loss of $24 million in the year-ago quarter.

Dividend Update

The board of directors of CNA Financial announced a quarterly dividend of 30 cents per share during the reported quarter.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower. While looking back an additional 30 days, we can see even upward momentum. There have been two moves higher in the last two months.

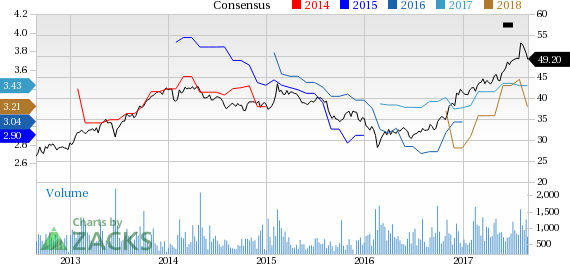

CNA Financial Corporation Price and Consensus

VGM Scores

At this time, CNA Financial's stock has a poor Growth Score of F. However, its Momentum is doing a lot better with a B. Following the exact same course, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and momentum investors.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

CNA Financial Corporation (CNA): Free Stock Analysis Report

Original post

Zacks Investment Research